Article

23 May 2019 - The National Investor Relations Institute (NIRI), the largest professional investor relations association in the world, earlier this month announced the inaugural class of its “40 Under 40” recognition program. The 40 Under 40 Program recognizes those who “have made noticeable contributions to their companies, communities, the IR profession, and to NIRI”. Included in the list of talented young IR professionals is FCLTGlobal’s Ariel Fromer Babcock, a Research Director whose work has identified investor relations strategies that can promote long-term value creation for both companies and the shareholders who invest...

Risk and Resilience | Article

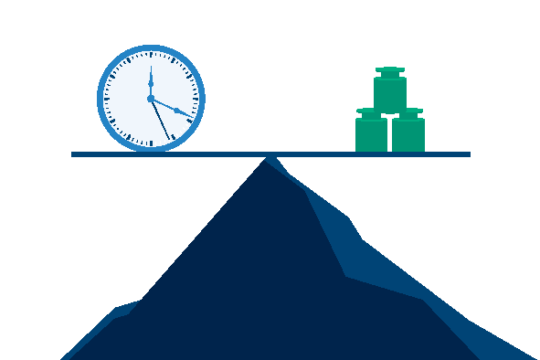

10 May 2019 - Boards and executives of long-term funds, such as pension plans, sovereign wealth funds, and endowments, need to manage portfolios to meet their long-term purpose, which may be decades or more into the future. In Balancing Act: Managing Risk Across Multiple Time Horizons, FCLTGlobal describes how laying out the goals and parameters of a fund can lead to a deeper understanding of the fund’s needs and provide greater conviction to maintain a long-term outlook in the face of market stress. Denmark’s largest pension and social security provider, ATP, takes as its...

In the News

12 April 2019 - To explore the most important factors influencing long-termism in the current environment, Toppan Merrill commissioned Mergermarket to speak with four leading experts for their insights. Topics of discussion include: • What effect, if any, has the push for ESG investing had on efforts to move toward long-termism? • Do you think recent interest in passive investment strategies makes it easier for companies to focus on the long term? • Are there particular regulatory changes you think would be effective at encouraging longer-term thinking at companies?

Investor-Corporate Engagement | Article

11 April 2019 - When considering going public, private companies often express concern about the perceived short-term fixation of public markets. In response, some choose to stay out of the public markets – to the detriment of our overall economic health. But other companies address this concern by issuing multiple classes of shares, each with different voting rights. Common practice is to assign more voting rights to one class of stock than the other, with the superior voting rights going to founders or other insiders. Issuing companies say that they take...

In the News

8 April 2019 - Sarah Williamson, chief executive, Focusing Capital on the Long Term, a US-based non-profit consortium of asset owner and managers dedicated to encouraging long-term behaviour, urged investors to refine and sharpen their beliefs. “At many funds, if you ask different members of the board what their beliefs are, you get different answers,” she said. Engrained beliefs are particularly important during market bumps when “ownership” of long-term strategies tends to fall away. She urged investors to hone their “purpose” and be clear about the things they find...

Earnings Guidance, Policy and Geopolitics | Article

5 April 2019 - Research has consistently found that the vast majority of corporate executives think that short-term pressure is changing their business decisions and harming long-term value. Recent work from FCLTGlobal has shown that an effective way to combat this phenomenon is by moving away from quarterly guidance. After calls from the White House and American business leaders in the latter half of 2018 to reexamine the standards for corporate guidance and reporting in American business, the U.S. Securities and Exchange Commission has requested public comment on how to enhance the investor protection attributes of periodic disclosures...

Policy and Geopolitics, Stakeholder Capitalism | Article

3 April 2019 - The global focus on responsible business practices has blossomed over the past decade. With that growth has come a greater awareness of concepts such as corporate governance, ESG integration, financial transparency, and fiduciary duty. Stewardship codes have become a tool to formalize the roles and obligations of corporations and investors alike. Administered by a variety of governmental agencies or independent regulators, stewardship codes now exist in over 20 countries worldwide, as well as in international associations like the OECD and ICGN. The United Kingdom was the...

Governance | Press Release

2 April 2019 - Boston, MA, April 2, 2019 — FCLTGlobal, a not-for-profit organization that advocates for a longer-term focus in business and investment decision-making, is releasing a new whitepaper; Long-term Habits of a Highly Successful Corporate Board,which identifies proven steps corporate directors can take if they aim to be long-term leaders of corporate success. This includes: A heavier focus on strategic counsel, relative to other issues Purchasing and holding company stock through and beyond their tenure. Increased direct communication with the company’s long-term shareholder base. Ensuring the board is comprised of a diverse group of directors, with...

Risk and Resilience | Article

1 April 2019 - Long-term funds need to manage their portfolios to meet their long- and near-term expectations simultaneously. This challenge demands assessing risks and opportunities across multiple time horizons. However, board members and staff often use different language to communicate, especially when it comes to investment risk. This disconnect can often lead to a lack of understanding of the most important risk issues facing a fund. Purposeful questions can bridge this divide, and focusing on the right strategic points can spur constructive conversations between the fund’s board and its...

Governance | Report

29 March 2019 - A well-functioning corporate board of directors wields the power to meaningfully influence the purpose, culture, and direction of an organization. This is often among a company’s greatest untapped strategic assets.

Governance | Toolkit

29 March 2019 - A well-functioning corporate board of directors wields the power to meaningfully influence the purpose, culture, and direction of an organization. Is your board taking the steps necessary to help companies maximize their long-term potential?