Resources

We conduct original research on the causes of short-term business decisions and work to find practical solutions.

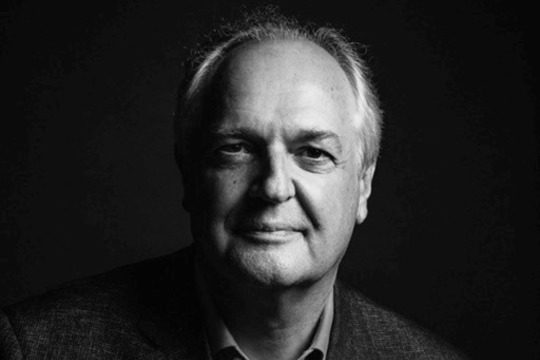

Investor-Corporate Engagement | Podcast

5 October 2020 - Amid today's evolving global business environment, corporate-level long-term thinking is more important than ever. Paul Polman, Co-Founder and Chair of IMAGINE and former CEO of Unilever, discusses the need for long-term perspectives in many professional capacities.

Governance | Report

1 October 2020 - Although the advantages of maintaining a long-term orientation are clear, the practical aspects of managing for long-term performance are less well understood. FCLTGlobal and McKinsey have published joint studies revealing a few things that long-term companies don’t do, such as invest modestly in R&D and use accounting methods to lift reported earnings. In this report, we build on that analysis to identify the behaviors that long-term companies consistently exhibit. We also propose actions that boards and executives can take to promote these behaviors.

Article

25 September 2020 - Globally, companies have increasingly favored buybacks over the past two decades, so much so that they have nearly surpassed dividends as the most utilized means for companies to return capital to their shareholders.

Investor-Corporate Engagement | Article

23 September 2020 - The U.S. Securities and Exchange Commission has proposed a change in the reporting threshold for institutional investment managers. Read FCLTGlobal's full comment letter below, which asserts that there are alternative ways to modernize 13F reporting, and small investors and a transparent relationship with companies must not be forgotten.

Risk and Resilience | Video

9 September 2020 - For many investors, asset allocation begins with an estimate of volatility, producing the most stable portfolio of assets that still can earn the target return. An assumption underpins this process – that volatility has a mathematically-certain relationship with time. That assumption is empirically false, and the ramifications for diversification and strategic asset allocation are enormous. Learn more from experts at State Street Associates about how the choice of risk timeframe influences a portfolio’s long-term success.

Risk and Resilience | Video

9 September 2020 - For many investors, asset allocation begins with an estimate of volatility, producing the most stable portfolio of assets that still can earn the target return. An assumption underpins this process – that volatility has a mathematically-certain relationship with time. That assumption is empirically false, and the ramifications for diversification and strategic asset allocation are enormous. Learn more from experts at State Street Associates about how the choice of risk timeframe influences a portfolio’s long-term success.

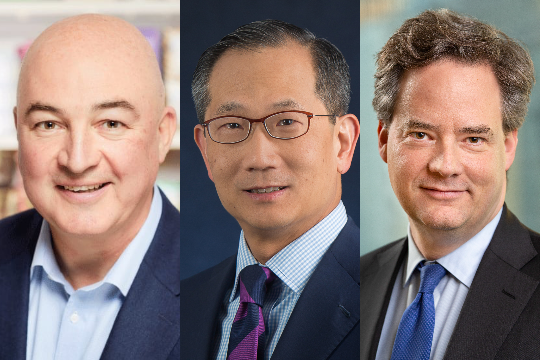

Press Release

4 September 2020 - Alan Jope is the Chief Executive Officer at Unilever and has been with the company for over 35 years. Unilever has been a FCLTGlobal Member since the start in 2016 and has been actively engaged with its work and programming since. Earlier this year, Mr. Jope was a panelist at FCLTSummit 2020, speaking in our Funding the Future: Investments in Innovation session. Kewsong Lee currently serves as Co-Chief Executive Officer of Carlyle and will assume the role of Chief Executive Officer effective September 30, 2020. Carlyle...

Policy and Geopolitics | In the News

27 August 2020 - FCLTGlobal CEO Sarah Williamson argues that the short-term ESG investing mindset in the U.S. will hinder growth in a new op-ed.

Incentive Alignment | Article

27 August 2020 - Some long-term investors are ready for companies to depart from the pay-for-performance status quo, but the jury is still out on the method that many of them are considering as a replacement.

Risk and Resilience | Toolkit

26 August 2020 - FCLTGLOBAL has developed this guide as an extension of the Risk Conversation Guide published in Balancing Act: Managing Risk Across Multiple Time Horizons.

In the News

25 August 2020 - Speaking at a FCLTGlobal discussion on resilience, CPP Investments’ head of Asia Pacific, Suyi Kim said that long-term investors like CPP expect companies and leaders to prepare for the pandemic’s effects on their businesses.