Earnings Guidance, Policy and Geopolitics | Article

5 April 2019 - Research has consistently found that the vast majority of corporate executives think that short-term pressure is changing their business decisions and harming long-term value. Recent work from FCLTGlobal has shown that an effective way to combat this phenomenon is by moving away from quarterly guidance. After calls from the White House and American business leaders in the latter half of 2018 to reexamine the standards for corporate guidance and reporting in American business, the U.S. Securities and Exchange Commission has requested public comment on how to enhance the investor protection attributes of periodic disclosures...

Policy and Geopolitics, Stakeholder Capitalism | Article

3 April 2019 - The global focus on responsible business practices has blossomed over the past decade. With that growth has come a greater awareness of concepts such as corporate governance, ESG integration, financial transparency, and fiduciary duty. Stewardship codes have become a tool to formalize the roles and obligations of corporations and investors alike. Administered by a variety of governmental agencies or independent regulators, stewardship codes now exist in over 20 countries worldwide, as well as in international associations like the OECD and ICGN. The United Kingdom was the...

Risk and Resilience | Article

1 April 2019 - Long-term funds need to manage their portfolios to meet their long- and near-term expectations simultaneously. This challenge demands assessing risks and opportunities across multiple time horizons. However, board members and staff often use different language to communicate, especially when it comes to investment risk. This disconnect can often lead to a lack of understanding of the most important risk issues facing a fund. Purposeful questions can bridge this divide, and focusing on the right strategic points can spur constructive conversations between the fund’s board and its...

Governance | Article

19 March 2019 - A chapter in the upcoming new edition of The Handbook on Board Governance focuses on the strategic benefits of long-term oriented boards, co-authored by FCLTGlobal’s Ariel Babcock and Sarah K. Williamson, and Dr. Robert Eccles (Said Business School). A well-functioning corporate board of directors wields the power to meaningfully influence the purpose, culture, and direction of an organization. This is often among a company’s greatest untapped strategic assets. While many boards of directors may display sound corporate governance principles, the most effective boards at leading companies for long-term value creation...

Article

4 February 2019 - The debate no longer concerns why organizations should be longer-term, but rather how they can accomplish it.

Article

21 December 2018 - In the run-up to the much anticipated G20 Summit in Buenos Aires, amidst chatter of tariffs and tête-à-têtes among world leaders, the World Bank Group and the Argentine government hosted the Investor Forum. The conference is a first-of-its-kind event uniquely positioned to bring together global investors and policy makers to identify steps for increasing long-term, sustainable investments that promote economic growth. The forum leaned heavily toward action, with people in the room capable of it on a global scale – in attendance were political leaders including...

Risk and Resilience | Article

18 October 2018 - FCLTGlobal, with its Members, is developing practical tools to address the issue of balancing long- and short-term risks. Part of the process includes interviews with experts in the area of assessing, managing, and planning for investment risk. Below is the next in this series with Emily Haisley, Behavioural Finance Director at BlackRock. FCLTGlobal: We appreciate the chance to speak with you today. To begin, I’d like to know if you think that there are any commonly overlooked aspects of risk that long-term investment organizations need to measure...

Investor-Corporate Engagement, Earnings Guidance | Article

9 October 2018 - A version of this post was first published on Harvard Law School Forum for Corporate Governance and Financial Regulation. Thank you to our Member organizations who contributed to the writing of this article. By now, most business-watchers have seen the president’s tweet asking the Securities and Exchange Commission (SEC) to study the requirement that US public companies release earnings quarterly. With this message, President Trump has focused attention on the short-term mentality that too often characterizes American business. The tweet, which followed his discussion with Pepsi CEO Indra Nooyi about...

Risk and Resilience | Article

9 October 2018 - FCLTGlobal, with its Members, is developing practical tools to address the issue of balancing long- and short-term risks. Part of the process includes interviews with experts in the area of assessing, managing, and planning for investment risk. Below is the next in this series with Will Kinlaw and David Turkington, Senior Managing Director and Senior Vice President at State Street Associates, respectively. As State Street’s academic affiliate, State Street Associates is a unique partnership that bridges the worlds of financial theory and practice. SSA develops risk, investor behavior...

Innovation, Climate | Article

5 October 2018 - The fifth annual Milken Institute Asia Summit, held from 12-14 September in Singapore, gathered global leaders to address the trends, innovations, and disruptions transforming the Asia-Pacific region, and provided actionable steps to effectively prepare for the inevitable transition. The Milken Institute hosts annual events that bring together the top minds from every industry and sector to find collaborative solutions to common problems. FCLTGlobal and many of our Member companies were fortunate enough to take part in the annual Asian gathering, including in an off-the-record roundtable on...

Risk and Resilience | Article

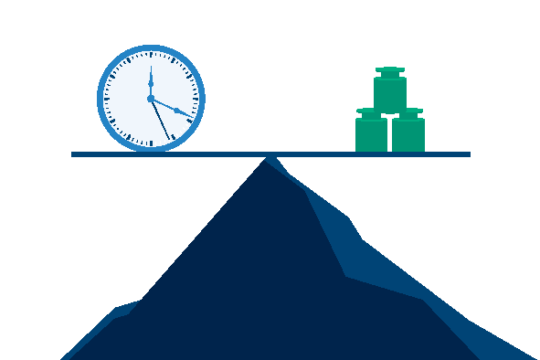

25 September 2018 - Investors often face a challenge of meeting long-term obligations and maintaining the support of their constituents along the way. In particular, they need investment strategies to meet their long-term obligations, but current risk communications, behaviors, and measurements can interfere. FCLTGlobal, with its Members, is developing practical tools to address the issue of balancing long- and short-term risks. Part of the process includes interviews with experts in the area of assessing, managing, and planning for investment risk. Below is the first in a series of discussions, featuring...

Risk and Resilience | Article

10 September 2018 - FCLTGlobal’s research is designed to find practical solutions that encourage farsighted decision making within the investment industry. The work we do is primarily intended to explore how every actor on the investment value chain – corporations, asset owners, and asset managers – can put theory into action and reorient themselves and their counterparts toward the long-term. In order to arrive at the “how”, however, we must also explore why investors continue to make short-term decisions that sacrifice long-term value. A team of researchers at the University...