Long-term investors like pension funds, insurance companies, and sovereign wealth funds invest significant amounts of capital in world equity and debt markets, where reaction to tariffs prompted significant volatility, to levels not seen since the pandemic and global financial crisis of 2008.

It’s easy to get swept up in the panic, but that’s just it: panic and an immediate short-term reaction could lead to bad investment decision-making. Now, more than ever, focusing on the long-term implications of tariffs and the greater geopolitical context is needed to navigate the storm. Resilient portfolios are able to cope with extreme events, and it buys time to develop the strategy and organizational readiness to survive through a crisis. Ensuring resilience in portfolios and organizations is crucial.

That makes it all the more important for investors to focus on the longer-term geopolitical trends, where tariffs and trade wars are just one facet of a world in transition. Even if announced tariffs are reduced or canceled, or a trade war fizzles, risks will persist. Trade reshuffling is but one aspect of a structural rewiring of globalization, with likely second- and third order effects, and far-reaching implications for inflation, growth, and financial stability. Looking back, we have been through periods of significant trade barriers before (Exhibit 1). Trade openness, a measure of imports and exports as a percent of GDP, is one way to look at globalization over time. The indicator grew substantially in the 60 years ending around 2008 but has been flat since, and could shrink further given isolationist policies.

Exhibit 1: World Trade as a Share of Global GDP, 1870–Present

What investors can do to confront geopolitical risk

Last year, FCLTGlobal published Storm Clouds and Silver Linings: Long-term Investing in an Age of Geopolitical Uncertainty, which provides research and analysis on the shifting geopolitical landscape and how investors can be proactive to build resilient portfolios and organizations. We focused on three key elements in this work, which are particularly relevant for today’s environment, where investors can take actions now.

Navigating geostrategic spheres

The recent wave of protectionist moves from the U.S. administration are just the latest in an ongoing shift toward a more balkanized global economy. Much attention is placed on trade right now, but investors need to also reflect on how a reshuffling of trade may affect capital flows and investment, especially as policies favor national economic or security objectives, which may or may not align with fiduciary interest or responsibilities.

In the report, we offer a framework (Exhibit 2) for analyzing portfolio investments and how they meet specific objectives. This is especially timely as investors revisit the benefits of diversification in a scenario of global trade reshuffling. The newly imposed tariffs have further driven a wedge between major global markets (case in point the breakdown in U.S.-E.U. relations and tariff escalation between the U.S. and China), which could impact risk and return profiles in the capital markets. This creates tension between the policy objectives of governments, and investment objectives.

Exhibit 2 maps out dimensions of national interest against fiduciary risk-adjusted returns. How could investors anticipate and develop scenarios for the capital markets based on what is happening with tariffs? “Destinations” offer relative safety from policy risk, and present attractive investment opportunities. “Deadweight” is unattractive on both dimensions. “Diversions” do not contribute to investment return objectives meaningfully but do align with national interest regulations or responsibilities. It may be a diversion from where capital would have been deployed absent national interest. “Diversifiers” offer attractive investment opportunities while presenting reversal or reputation risks due to misalignment with national interest.

Investors can use this matrix to map out portfolio exposures to regions and markets to analyze how their portfolio may or may not align with trade reshuffling given different scenarios.

Exhibit 2: “The Four Ds”: Mapping a Grid of Alignment and Return Objectives

Confronting geopolitics through governance

Proactive organizations build a culture of readiness for the future, putting strategy at the center of resilient portfolios and organizations. Investment committees and boards must also ensure appropriate committee structures and oversight responsibility are assigned for geopolitical risks and opportunities. The message is clear that we should no longer run from event to event, but manage geopolitical risk as a structural risk factor even if we do not know what the next event will be.

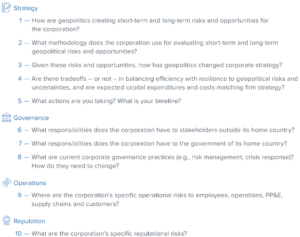

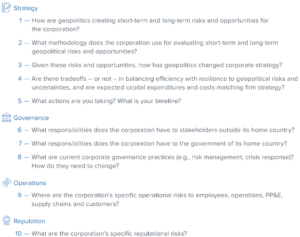

The 2024 report presented a set of critical questions designed to help investment committees and boards better manage geopolitical risks. This framework enables organizations to build resilient portfolios through strategic planning and oversight, focusing on key areas, no matter the geopolitical event. These questions can be applied to the current situation on tariffs, including scanning portfolios and organizations according to:

- Cross-border return premiums

- Strategic importance of various countries

- Mean reversion versus options mindsets

- Reputational risks

- Portfolio concentration risks

- Unique organizational insights or disadvantages

- Governance processes

- Crisis response planning

By addressing these questions, investment committees can optimize resource allocation and adapt to unpredictable geopolitical turbulence, like what is happening today, and maintain open lines of communication with government officials and stakeholders during critical events.

Assessing portfolio companies’ geopolitical resilience

Knowing exposures to an escalating trade war requires an in-depth assessment of how individual companies and investments are responding to geopolitical risks. This toolkit focuses on key questions grouped by strategy, governance, operations, and reputation, that investors can use to reevaluate the investment thesis of a company or asset given a scenario of trade reshuffling:

These tools were designed for investors to evaluate geopolitical risks in recognition of longer-term trends affecting investment, such as global conflict, trade, de-globalization, and capital controls. The current shock of tariffs affecting markets is but one facet of complex changes impacting the international financial system, which is likely to be a significant theme for investment going forward. These changes are also structural, secular, and systemic in nature, which highlights the need for investors to evaluate risks over the long term.