The panel of experts demonstrated, through their diversity, that investors can manage risk in a long-term way irrespective of their geography, their position on the investment value chain, or their liquidity demands. Our panel of experts included:

- Claude Bergeron, Caisse de dépôt et placement du Québec

- Mark Blair, Ontario Teachers’ Pension Plan

- Kevin Bong, GIC

- Will Kinlaw, State Street Associates

- Jacques Longerstaey, Nuveen

- Deirdre Ypma, Neuberger Berman

Opening the event, FCLTGlobal CEO Sarah Williamson said, “This call presents a unique opportunity for some of the foremost risk practitioners to compare experiences about how to focus on the long term in the midst of this historic crisis. We’re very excited to have this important conversation and think about how to collaborate on best practices amid this new landscape.”

For investors, strong performance over the long term requires taking calculated and deliberate risks, especially during times of crisis. Our panelists discussed strategies that fellow risk professionals can employ to optimize their portfolios for the impact of the global pandemic, rather than “battening down the hatches” and withholding action until after the fact. In Balancing Act: Managing Risk Across Multiple Time Horizons, Members emphasized that long-term investors would take the risks needed to fulfill their purpose and work from there to maintain sufficient performance along the way.

Of the many recommendations suggested over the course of the call, several key points and insights emerged from the discussion.

- Preparedness exceeds predictions – Most participants agreed that while their scenario planning did not precisely predict the parameters of the current crisis, their long-term planning had provided the tools to prepare and respond appropriately.

- The role of government and municipal credit in a portfolio is being re-evaluated – The pandemic has transformed the role of various asset classes in a portfolio – the safe-haven treatment of municipal bonds is in question and low yields for Treasuries and other national credit instruments makes them seem more like hedging instruments than contributors to an income portfolio – with implications for risk management that may cause permeant shifts in how those asset classes are treated going forward.

- Operational risk may be more problematic than investment risk – There was general agreement that the longer employees are working from home, the more operational risks become front and center, with implications for compliance and data management as well as heightened cybersecurity risk.

While the scale and circumstance of the current situation is unprecedented, participants found that their organizations have continued to operate well, due in large part to prior planning. Following through on scenario plans set in advance, under less stress, facilitated decision-making when faced with choices as a result of COVID-19. In the midst of a crisis, communicating in ways that appropriately frame board and management decisions is critical.

“Anytime you develop a product that takes the emotional or behavioral element out of investment decision-making, that product is helpful,” one participant observed.

The concept of managing for multiple time horizons was a common theme of the discussion. As noted in Balancing Act, the challenge of meeting both long-term obligations and short-term expectations means that even the longest-term investor must manage for both the short- and long-term, which is often at odds with risk processes that have been developed to address one or the other. Our panelists all observed the importance of a multidisciplinary approach.

“Sometimes the long-term arrives sooner than you think,” said one participant, “and reconciling the short- and long-horizon scenarios is harder when it does. Sudden changes or transitions that happen before they are expected to can change the path and need different reactions.”

Participants kicked off the call with a poll on key issues surrounding risk management, which provided several valuable insights:

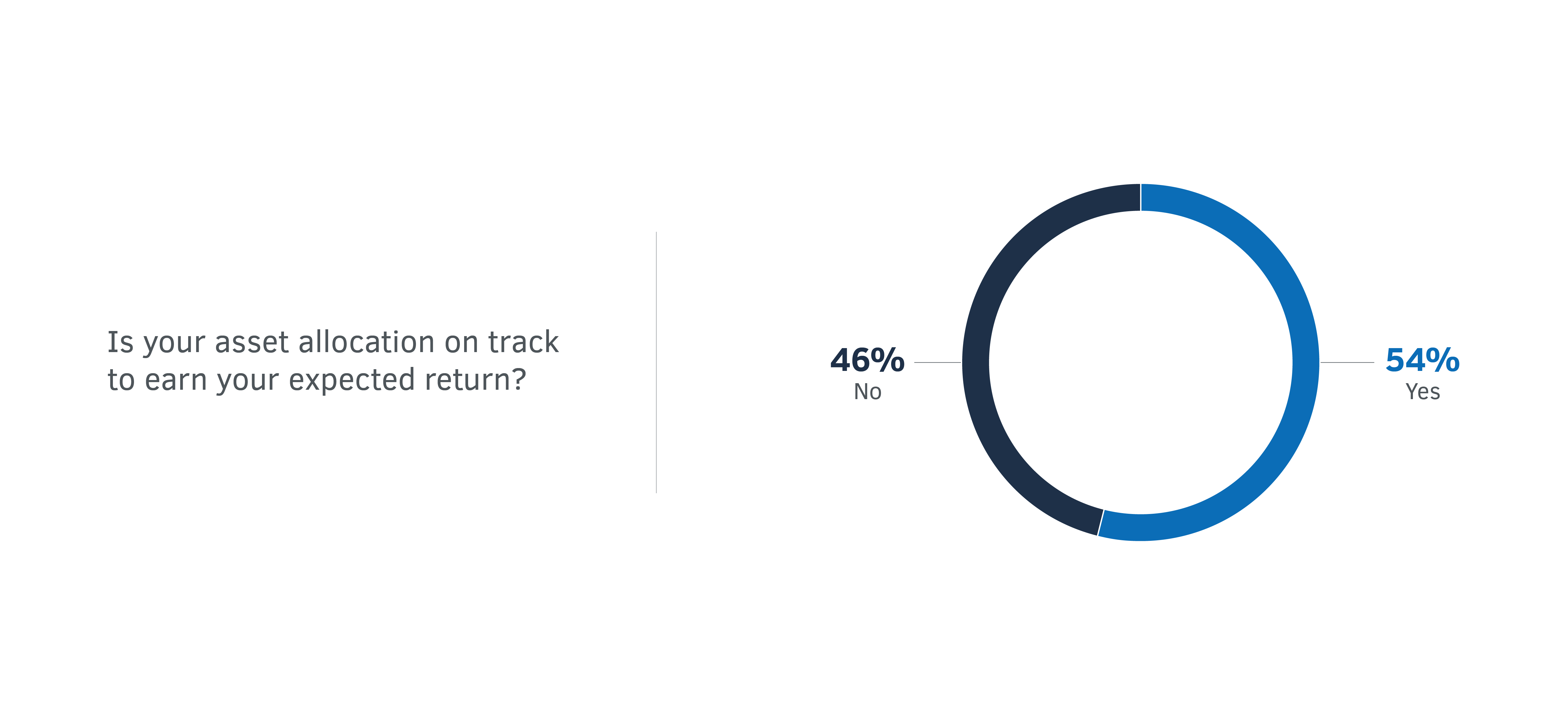

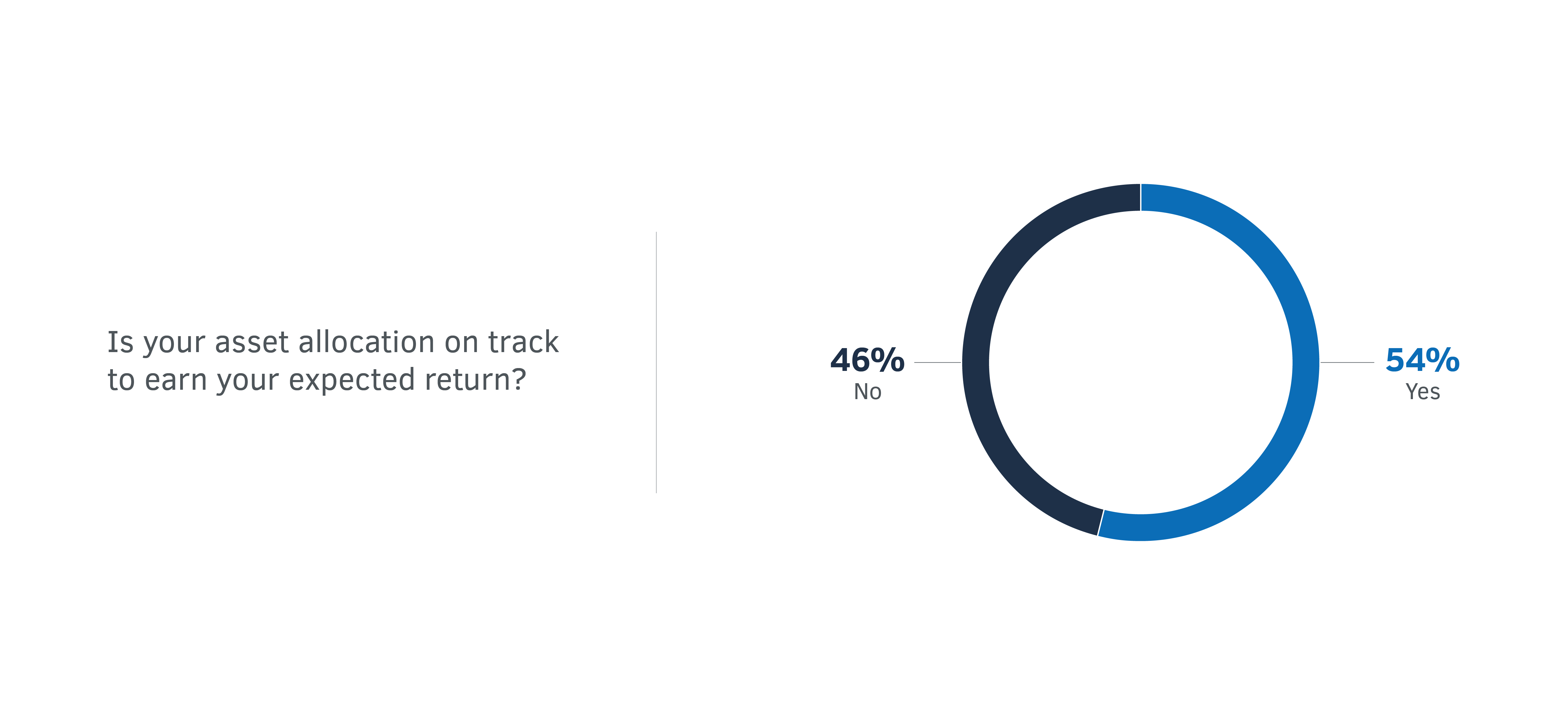

Asset allocations, as of right now, reflect organizations’ expected return with mixed consistency. This could be due in large part to rebalancing (see question 2). If no rebalancing has taken place in response to the pandemic, at least not yet, the organization is less likely to have an asset allocation on track to realize its initial expected return. Additionally, the crisis may have changed risk-adjusted projections for asset-class returns. Still, there is a time dimension to the expected return, and it may be that more organizations are on track for long-term than shorter-term expected return:

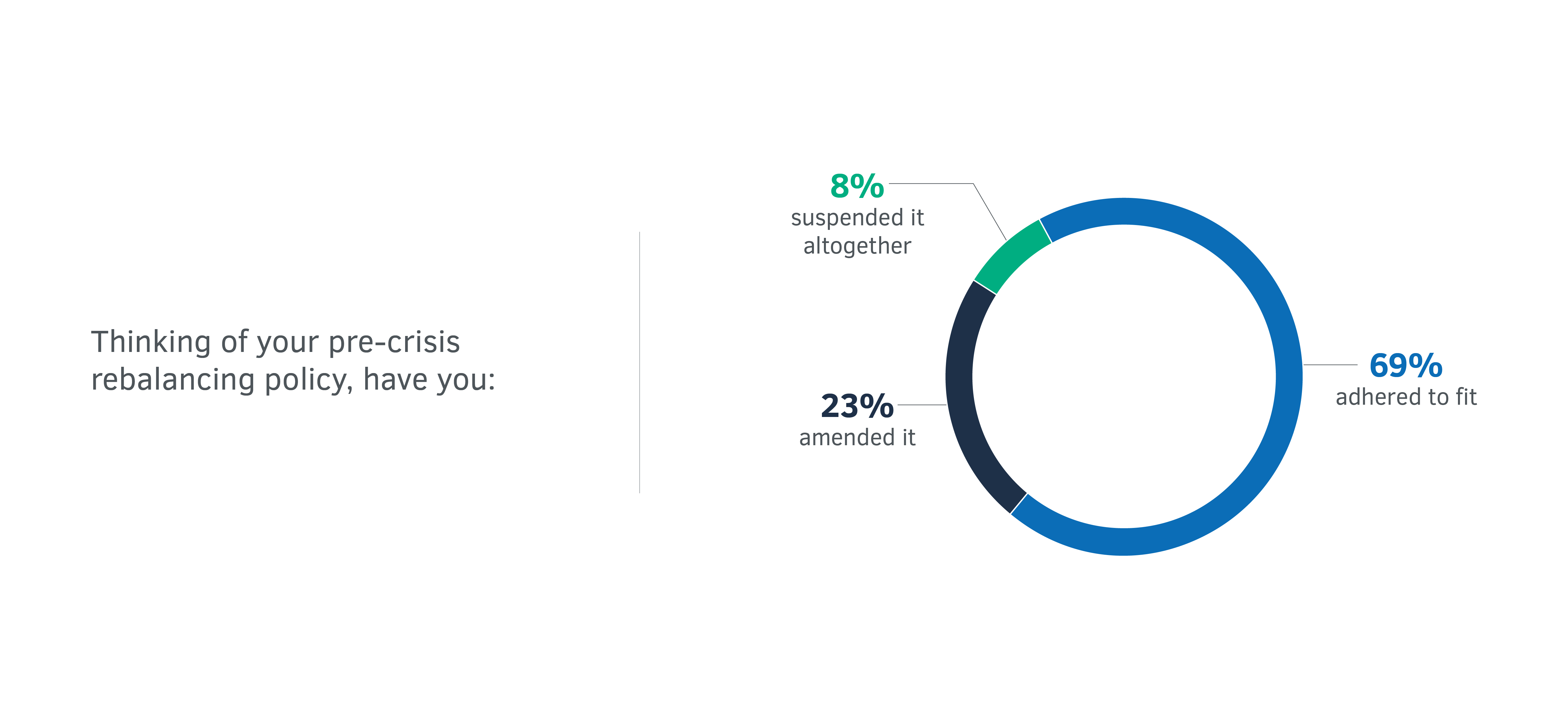

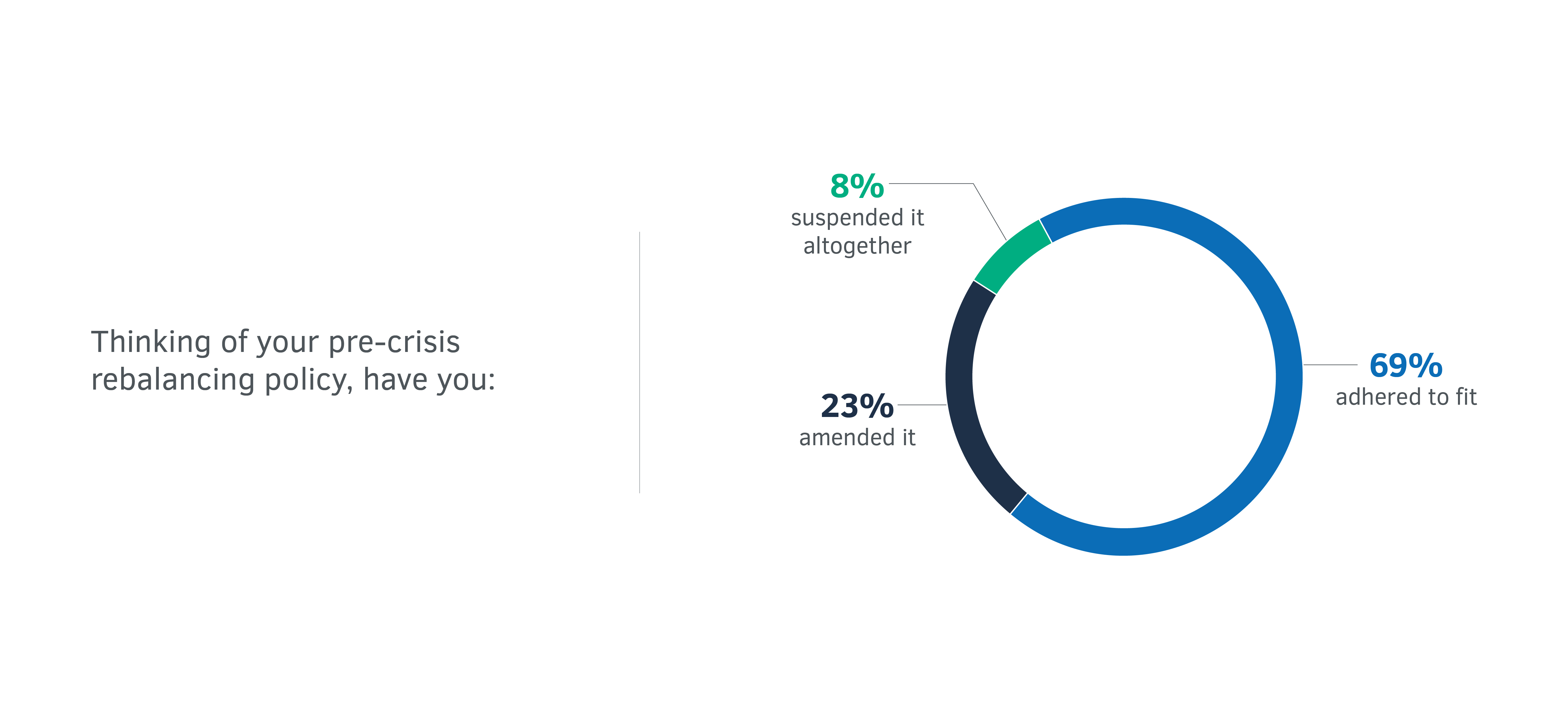

Nearly 70% of respondents adhered to their pre-crisis rebalancing policy. Setting a plan in advance, with greater deliberation and lower stress, is allowing them to now buy fundamentally strong assets at a discount – even though short-term volatility can put resolve to the test:

Nearly 70% of respondents adhered to their pre-crisis rebalancing policy. Setting a plan in advance, with greater deliberation and lower stress, is allowing them to now buy fundamentally strong assets at a discount – even though short-term volatility can put resolve to the test:

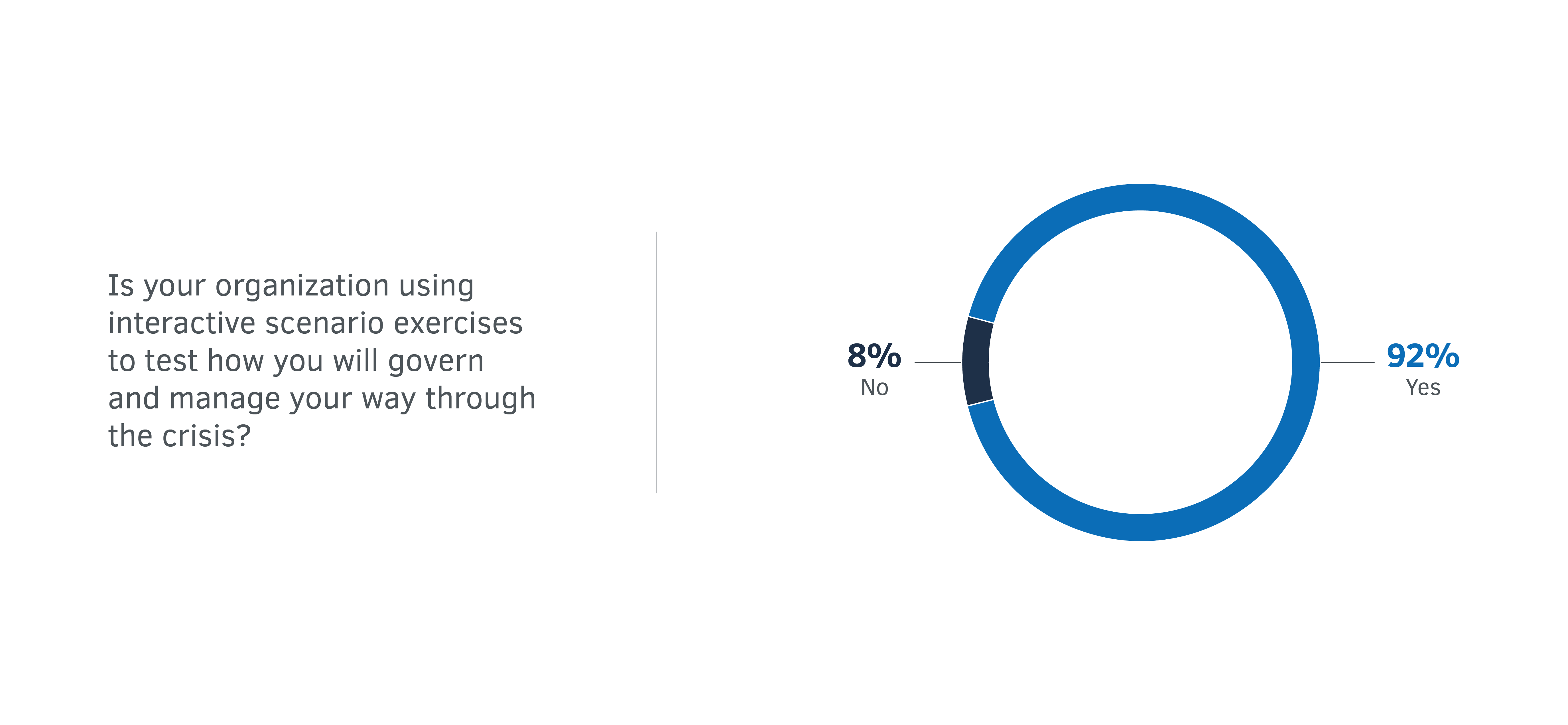

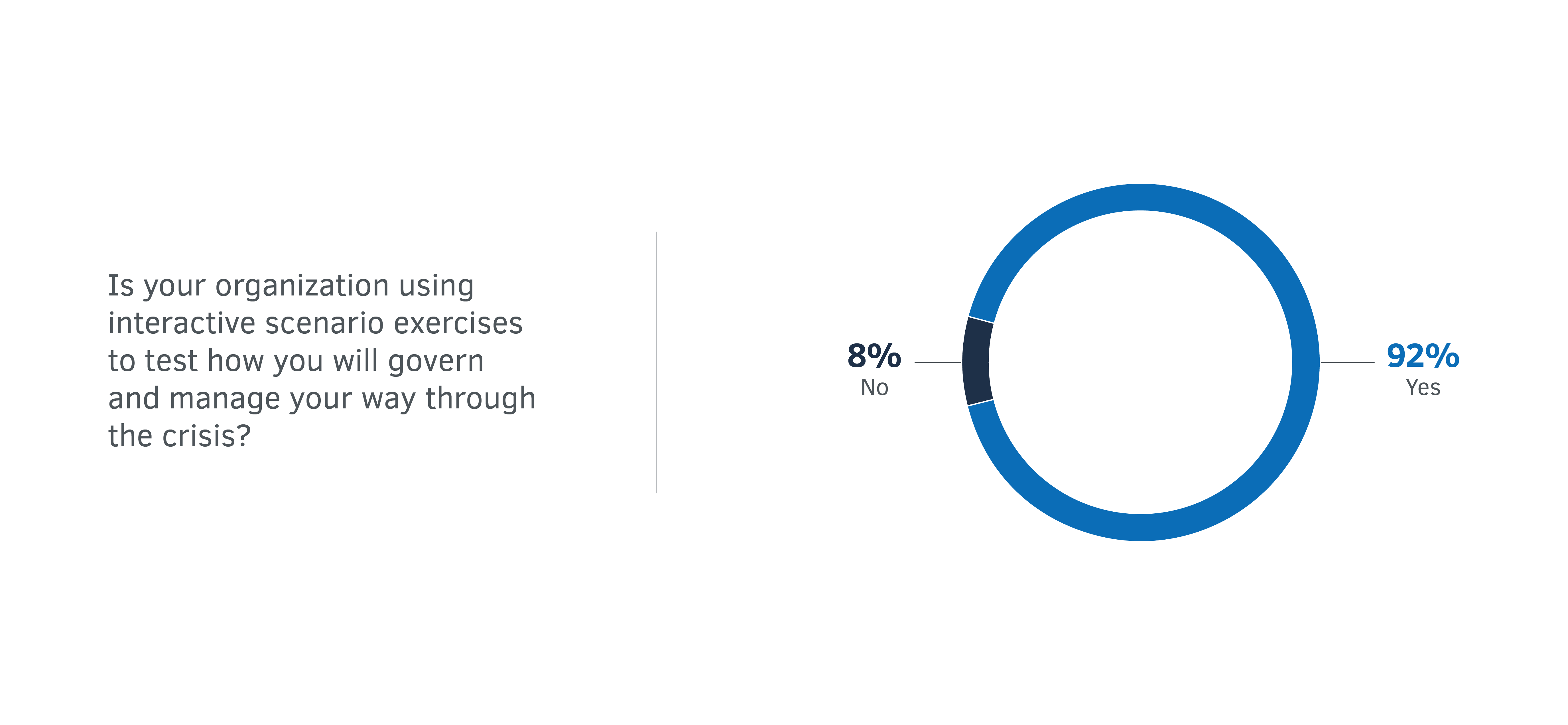

Interactive scenario exercises are key to governing and managing through this crisis, and respondents are overwhelmingly employing them to test their planned response to certain situations. Not only do these exercises help ease decision-making, but they also clarify the mindset of the c-suite and board:

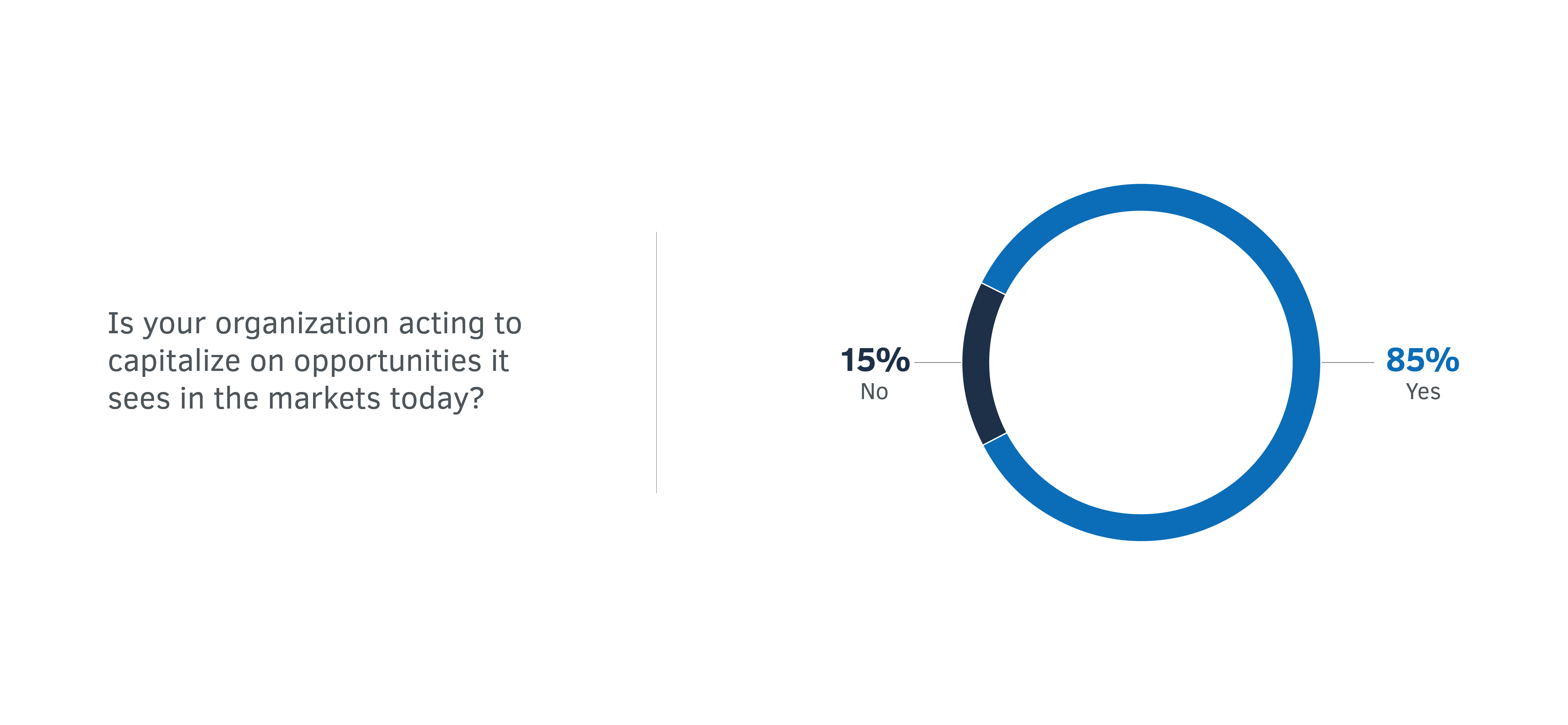

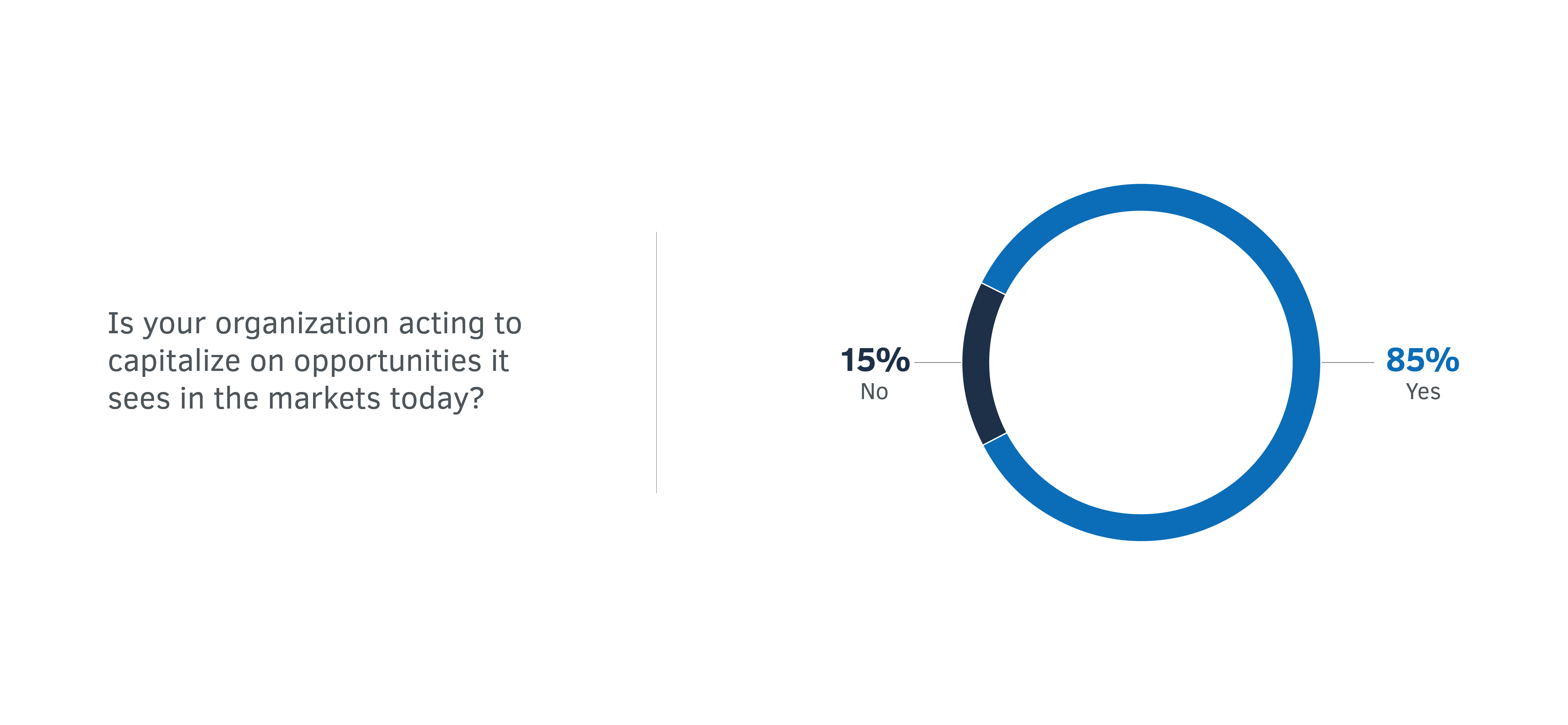

While these organizations remain firmly grounded in the long term, they maintain flexibility in their portfolios to adapt to the constantly changing markets and seize new opportunities as they arise. A large majority of callers reported that their organizations are doing exactly that:

These actions on the part of risk professionals are helping their organizations see their way through the crisis. The choices made are strategic ones, our panelists said, and part of a unified effort. Focusing on the long term entails surviving through the short term, so it is critical not to lose focus on the present while planning for the future. Long-term investors will take the risks needed to fulfill their purpose and work from there to maintain sufficient performance along the way. Achieving this balance involves very deliberate communications, behaviors, and measurements. Tools, like those mentioned above and those discussed on the call, can help investors strike this balance.

Many of FCLTGlobal’s members are leading the way in this regard, and this event served to share these practices with others who are experiencing the same decisions first-hand. Risk professionals who participated can return to their organizations better able to fulfill its purpose and still maintain sufficient performance in the near-term, whatever may come. Thank you to our panelists and all of our participants for joining this fruitful conversation.

For further information, please consult Balancing Act: Managing Risk Across Multiple Time Horizons or reach out to FCLTGlobal’s research staff at [email protected].

Nearly 70% of respondents adhered to their pre-crisis rebalancing policy. Setting a plan in advance, with greater deliberation and lower stress, is allowing them to now buy fundamentally strong assets at a discount – even though short-term volatility can put resolve to the test:

Nearly 70% of respondents adhered to their pre-crisis rebalancing policy. Setting a plan in advance, with greater deliberation and lower stress, is allowing them to now buy fundamentally strong assets at a discount – even though short-term volatility can put resolve to the test: