The way that investment organizations navigate existing responsibilities and new expectations that arise has a considerable impact on their long-term success. When an investment organization fails to fulfill true responsibilities, staff can become distracted from their long-term focus, interrupting the organization’s long-term investment strategy. Consequences also can include turnover in leadership or responses by legal or regulatory authorities that narrow the discretion of leadership. Yet positive cases of investment organizations meeting evolving expectations abound: two examples are Future Fund’s efforts to ensure that external managers steward its reputation appropriately and the New Zealand Super Fund’s participation in the national response to social media firms live streaming the Christchurch atrocity.

Fundamentally, evolving expectations extend beyond what returns investment organizations earn to how they earn those returns.

Determining which expectations to accept as responsibilities is based on the long-term purpose of the organization, its constituents, and the tradeoffs that accepting a particular responsibility would entail. Some—but not all—of these evolving expectations become true responsibilities, and investment organizations must make such determinations on a case-by-case basis. Making these judgments and managing responsibilities is a complex challenge.

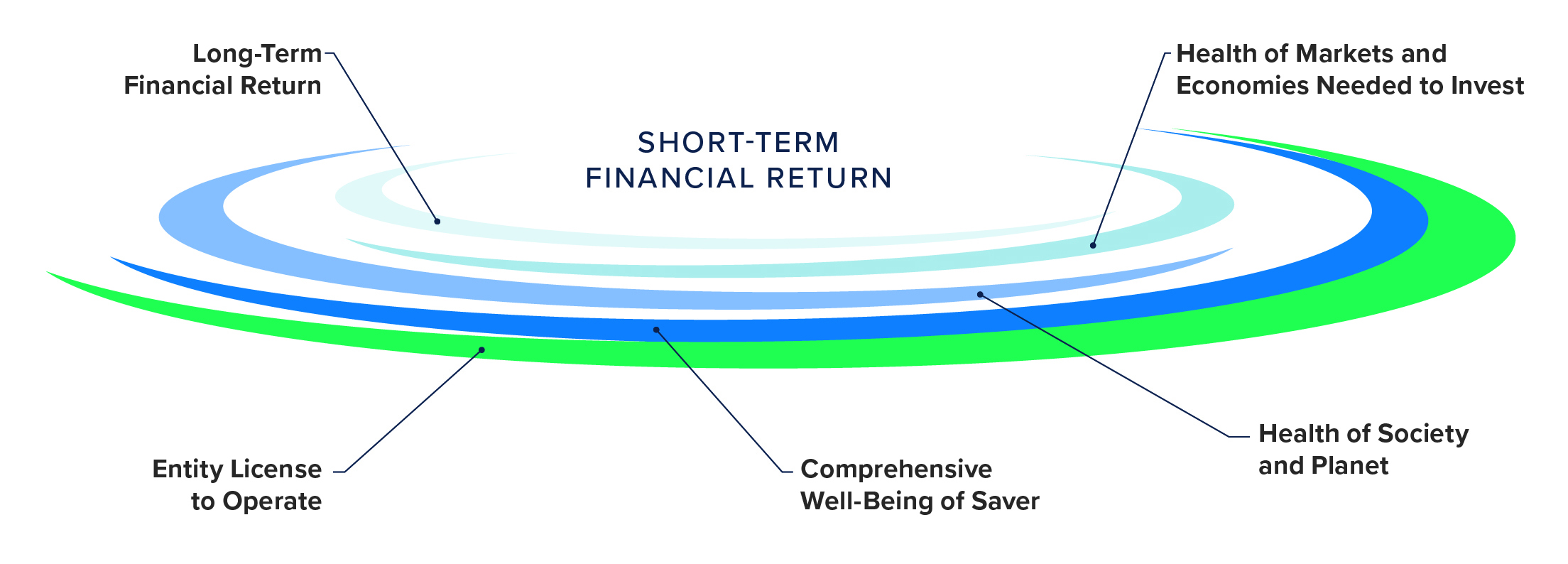

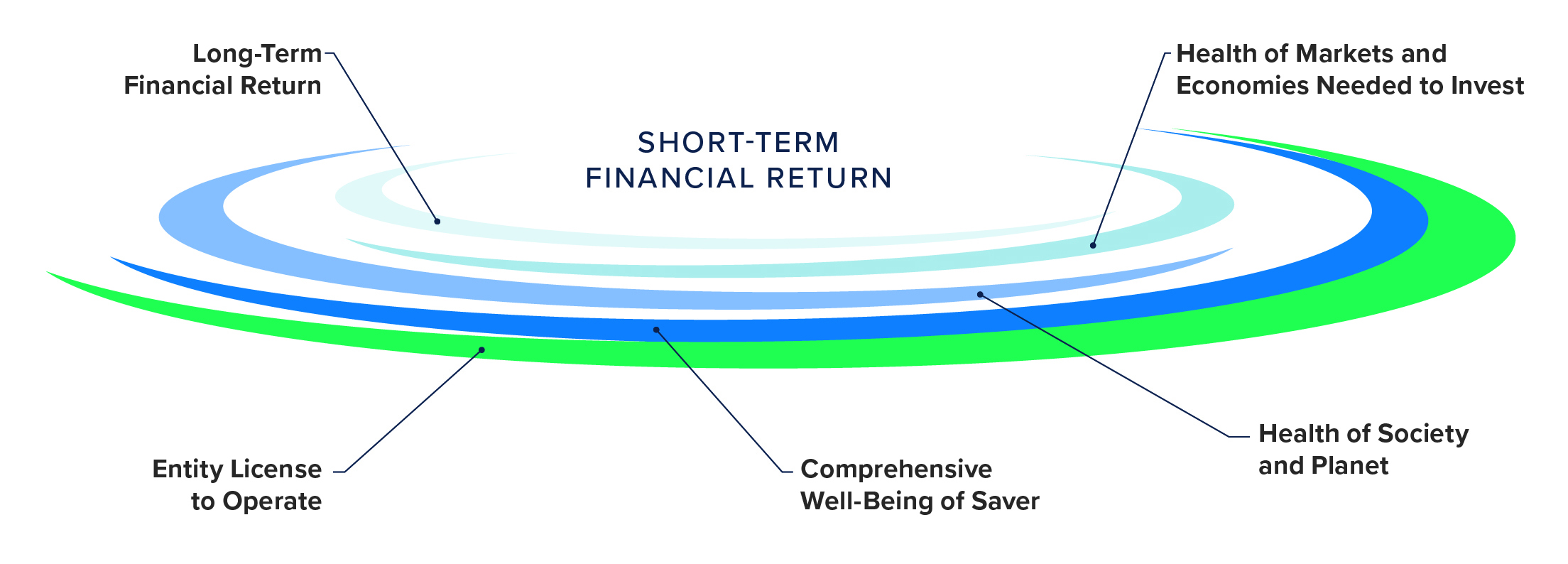

Investor responsibility can be compared to a rippling pond. Expectations come from constituents standing on the shoreline tossing stones into the pond. The way that investors navigate these “ripples” of responsibility has a tremendous effect on their long-term success:

The process for making these decisions can be more standard. Keeping an inventory of existing responsibilities and anticipating potential new ones is part of the job for long-term investment organizations. Long-term funds also must fulfill their responsibilities reliably throughout their often large and complex organizations and communicate those responsibilities to a wide range of audiences, including the general public. Ripples of Responsibility provides a crisp way for investment organizations to understand the sometimes abstract concepts of responsibility and offers a practical toolkit to help identify existing responsibilities, anticipate new ones, fulfill them, and communicate accordingly.