By Han Yik

Life expectancies have lengthened – children born today will likely live beyond 2100 – at the same time as the burden of responsibility for providing a secure retirement has shifted towards the individual saver. Furthermore, the nature of work has evolved away from the typical model of a single employer for decades to a more fluid career pattern. And workforce participation and family structures have also been transformed since most retirement legislation was designed.

Against this backdrop, our objective for this series is to develop a blueprint containing practical recommendations for both existing retirement systems as well as nascent long-term savings plans The focus will be on four key areas:

- Examining the stakeholders (government, businesses, and individuals) and risk-sharing arrangements under different schemes

- Promoting best practices to mitigate demographic disparities (i.e. gender gap; aging populations)

- Increasing retirement savings

- Increasing access to retirement plans

Life Expectancy

A key challenge for existing retirement systems has been the increase in life expectancy since many of these systems were first designed. For example, although the United Kingdom introduced the Old Age Pension Act in 1908, the most recognizable form of the state pension was enacted by the National Insurance Act of 1946, which set the retirement age at 65 for men and age 60 for women. In the United States, the Social Security Act of 1935 established the retirement age at 65, which followed the German adaptation of age 65 in 1916.

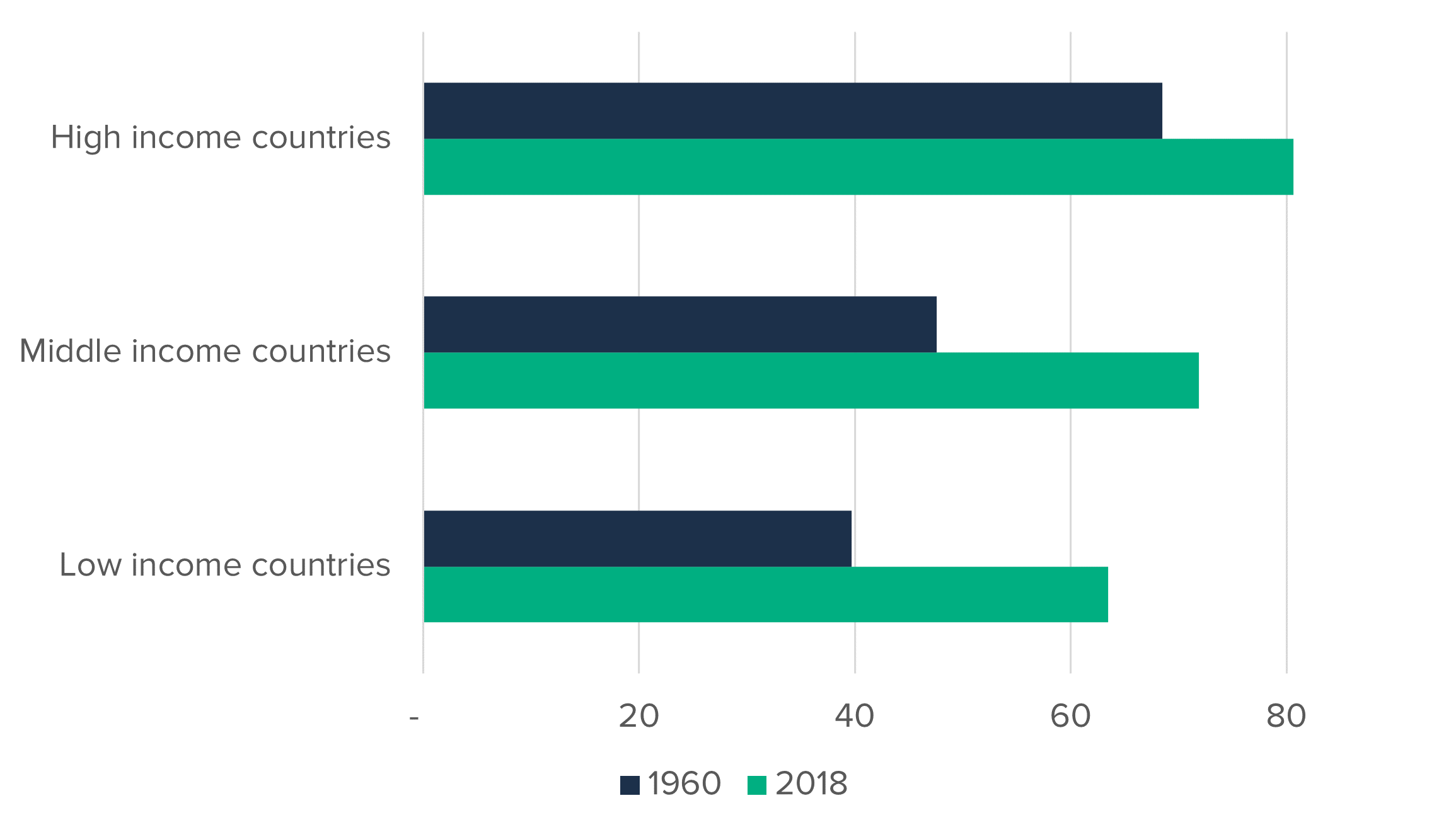

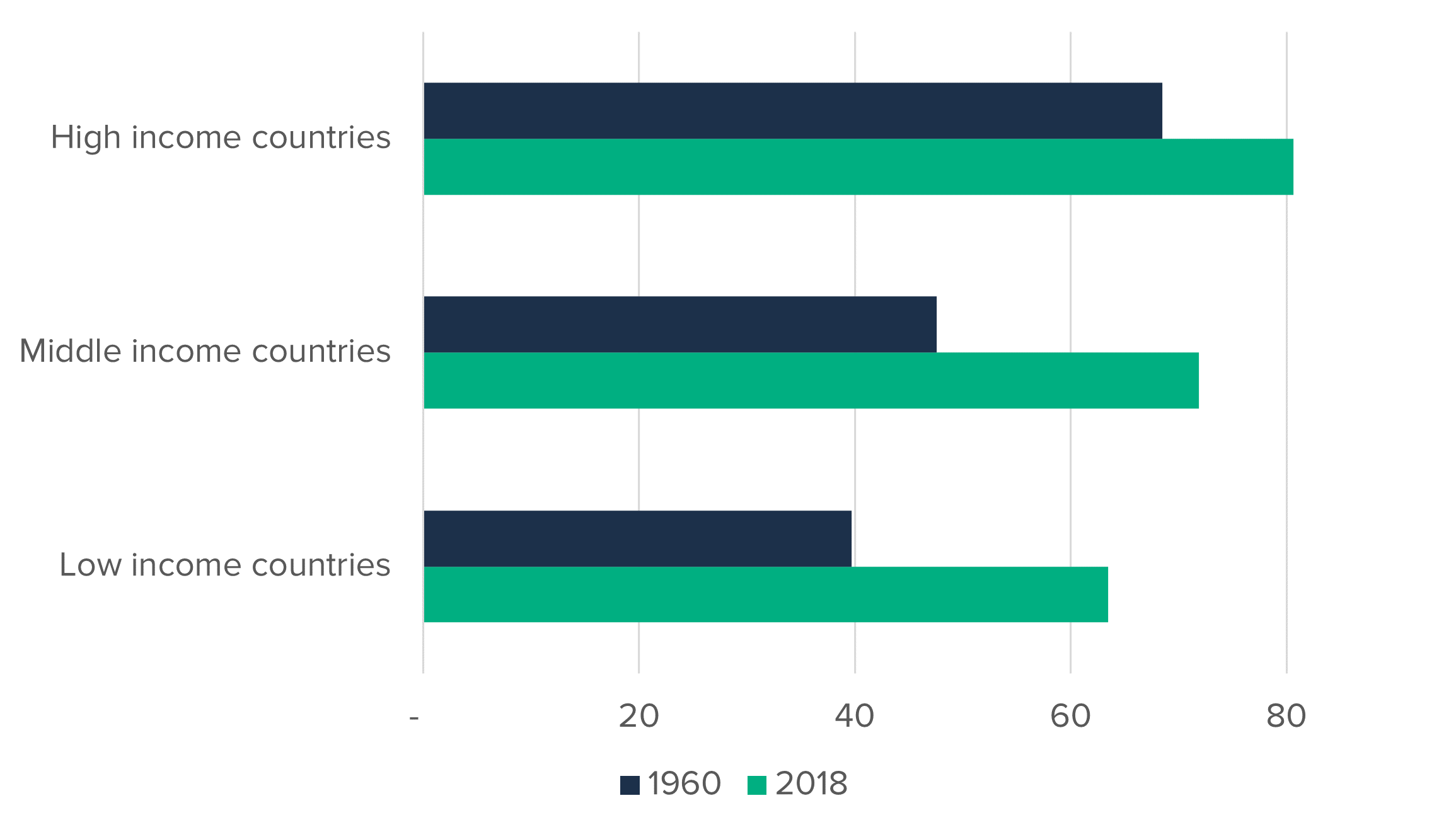

While many countries around the world with existing pension schemes still use age 65 as a retirement age, life expectancies have increased far beyond that. Looking at the World Bank database, life expectancy in 1960 for high-income countries was 68.5 years while in 2018 (the latest data available) this had increased to 80.7 years – up 12.2 years.1 In the middle-income countries (representing 75% of the world’s population), the combination of global economic growth and advances in technology, medicine and health, have led to even larger increases, leaving them only 5.4 years shy of the high-income countries.

Average Life Expectancy (in years)

Source: The World Bank Open Data

In the face of lengthening life expectancies, many countries have been building, reforming, or expanding their pension systems as their economies and standard of living improve. Despite these efforts, there is a growing retirement savings gap around the world, with insufficient capital invested to provide for a secure and dignified retirement.

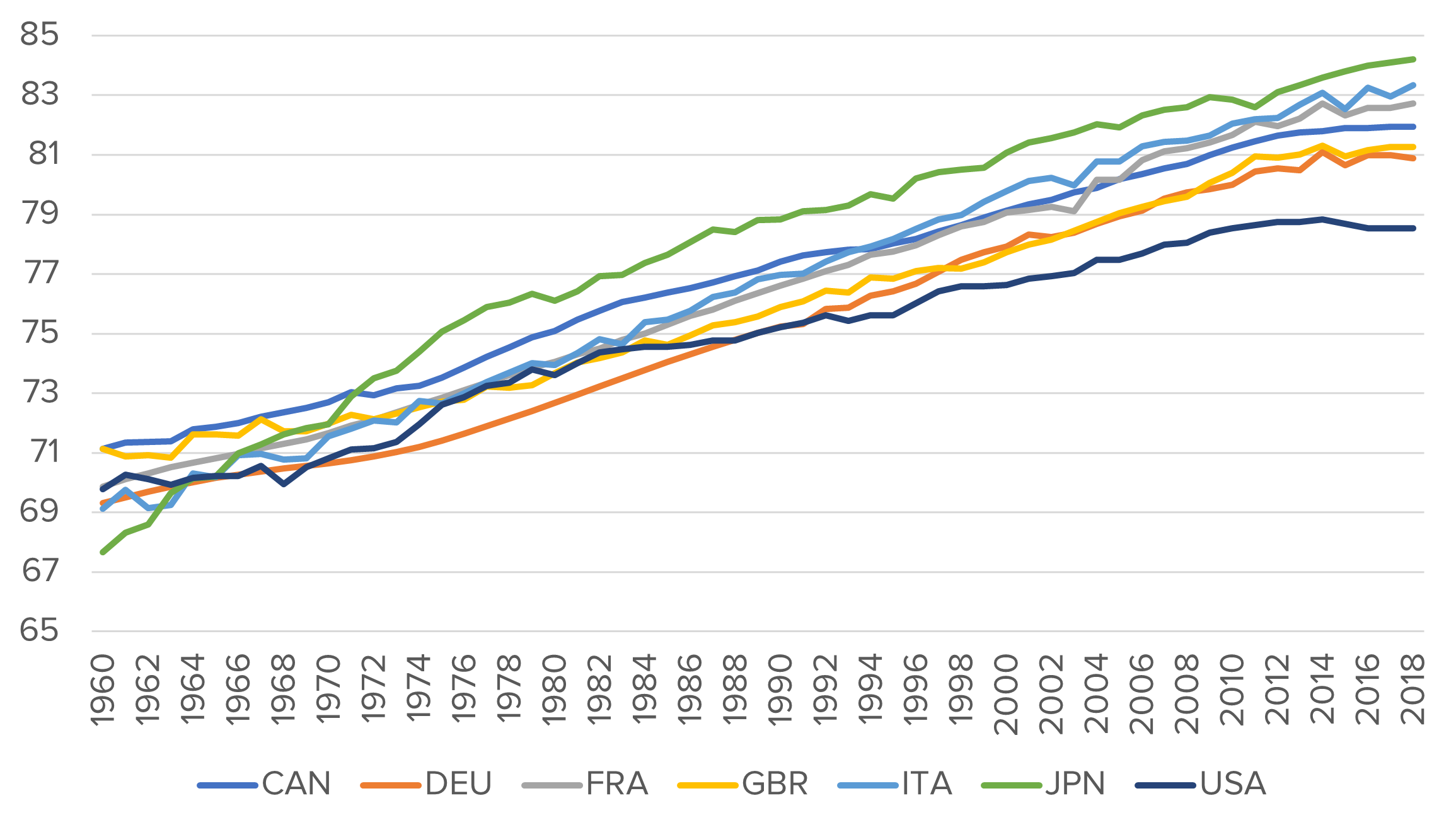

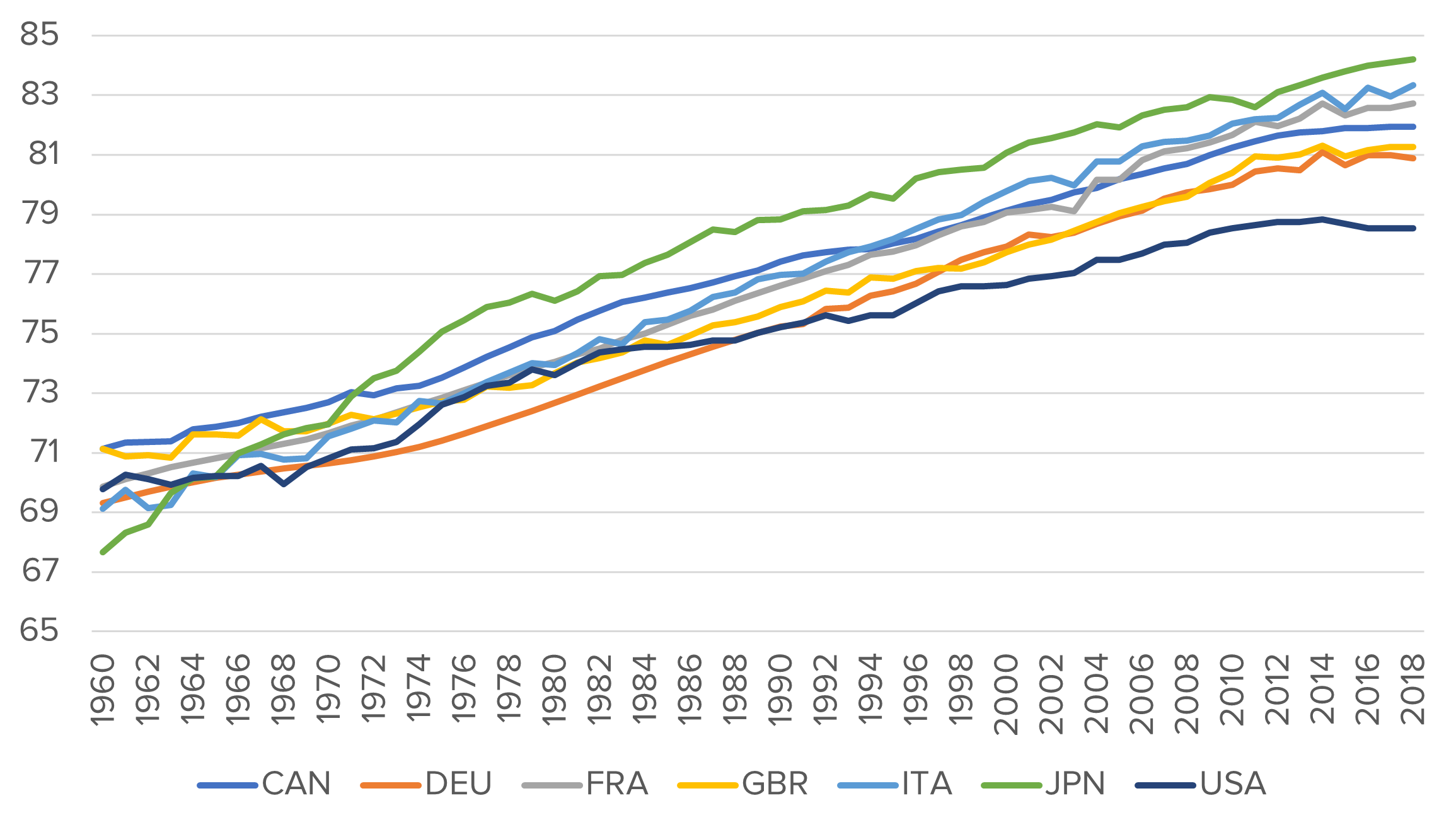

Life expectancy at birth, G7, 1960-2018

Source: The World Bank Open Data

Stakeholders and Risk Sharing

We begin with the stakeholders. Traditionally, pension systems have involved the government providing for the most basic needs (designed to prevent elderly poverty) while businesses (employers) and/or individuals (employees) pay into the next level which is designed to provide a comfortable income during retirement.

The design that dominated most of the 20th century was the defined benefit (“DB”) plan, in which the income stream in retirement is set according to a benefit formula. For a DB plan, and it is up to the plan sponsor (the government or the employer) to make the contributions to the plan and bear the investment risk of managing the assets in order to be able to deliver the promised (defined) benefits. In the case of employer-provided DB plans, the government often provides incentives in the form of tax savings to encourage employer sponsorship. Assets in a DB plan are pooled and professionally managed by the plan sponsor in support of achieving the targeted defined benefit obligations. If the plan is appropriately funded, individuals participating in a DB plan bear little to no responsibility or risk in the provision of their pension benefits (other than meeting the minimum service requirements to the employer providing the plan in question). One key factor to note is that the accrual pattern for individuals was much steeper the longer one worked at a company, which both incentivized and mirrored working patterns of longer tenures with fewer employers.

During the last few decades, the traditional employer-sponsored DB plan largely gave way to the defined contribution (DC) plan. Instead of the defined income stream at retirement that a DB plan promises, for a DC plan it is instead the contribution amount that is defined, and in many cases that responsibility to contribute is now a shared one between employee and employer. DC savings are placed in an individual account, and the investment risk of managing the assets shifts fully to the individual, who is responsible for having a sufficient balance at retirement as well as for managing that balance during retirement.

Employees participating in DC plans must be both expert at their own occupation as well as astute investors – bearing the burden of asset allocation and investment selection – a scenario few individuals are well equipped for. Furthermore, most businesses are experts at their business – not at managing retirement plans. In many DC plans, employers have responsibility for administering the retirement plan but the individual makes the decisions. Reducing post-retirement risk on employers by transferring it to individuals through DC plans also indirectly adds risk to governments. This new government risk stems from the possibility that individuals could require greater support at the base level if they do not have an adequate DC plan balance at retirement.

In addition to shifting the burden of savings and investment risk, we are now in a period where the nature of employment has shifted from the traditional model (longer tenures with large, single employers) to the growth of the gig economy, freelancing, and the rise of the portfolio career. All of these shifts mean the employer-centric approach to retirement savings that made sense in the 20th century no longer meets the needs of the current 21st-century workforce.

Looking Ahead

In moving from defined benefit plans to defined contribution plans, many of the risks previously borne by employers and governments have been shifted onto individuals. Going forward, an ideal retirement system would rebalance the risk-sharing among the major stakeholders:

- Individuals are responsible for making contributions for their retirement savings. Employers/businesses share in this responsibility but there is no need for an employer to manage a DC plan on behalf of their employees – they simply make contributions to individual-centered plans. Governments can incentivize both parties to do so as a means of reducing stress on the base level pension.

- Investment risk is managed by professionals acting in a fiduciary capacity. People can drive cars without having to be their own mechanics – they should also be able to save for their retirement without having to manage their asset allocation and portfolio risk.

- Retirement is focused on its roots – providing income in post-working years , rather than a “cash-out” opportunity. Translating retirement savings to an adequate income stream during the retirement period is a necessity in order to provide long-term financial security.

As we continue with this series, FCLTGlobal looks to learn from our global member base so that we can collate both best practices and new ideas as we rethink what is necessary to develop the future of retirement.

1 “High-income” as defined according to The World Bank Atlas method classification system