For many large companies, executive compensation is now a point of emphasis. Attention from shareholders, the media, and the general public has caused companies to reflect on how much they are paying their leaders, and how they make those decisions.

For many large companies, executive compensation is now a point of emphasis. Attention from shareholders, the media, and the general public has caused companies to reflect on how much they are paying their leaders, and how they make those decisions.

As the conversation around executive pay grows louder, several possible solutions have arisen. The U.S. Congress now requires that companies reveal the ratio of their CEOs’ pay to that of their median employee. Some boards have begun tying CEO pay more concretely to the company’s financial performance – which has proven a difficult task. As a result, companies with poor returns often still give their executives sizable pay packages.

The economic crisis brought on by the novel coronavirus comes on the heels of a record-breaking year for executive compensation globally. A significant number of CEOs will be paid much less in 2020 than in years past, whether it be in solidarity with their employees or otherwise. But viewing the issue strictly in dollars and cents oversimplifies the issue – what lies beneath is whether or not compensation truly reflects a company’s long-term success, and whether it actually incentivizes decision-making that is in the company’s long-term interests.

Parallel to this growing spotlight, FCLTGlobal Members identified long-term CEO compensation provisions as an important lever to encourage a longer-term focus in business and investment decision-making. The issue was explored further at our 2020 Summit, where participants broadly agreed existing compensation plan design focuses executives more on the short term, but recognized it is difficult to design compensation that would create a longer-term focus. In response, FCLTGlobal will research new ways in which short-term, status-quo compensation practices can be restructured to enhance long-term value creation.

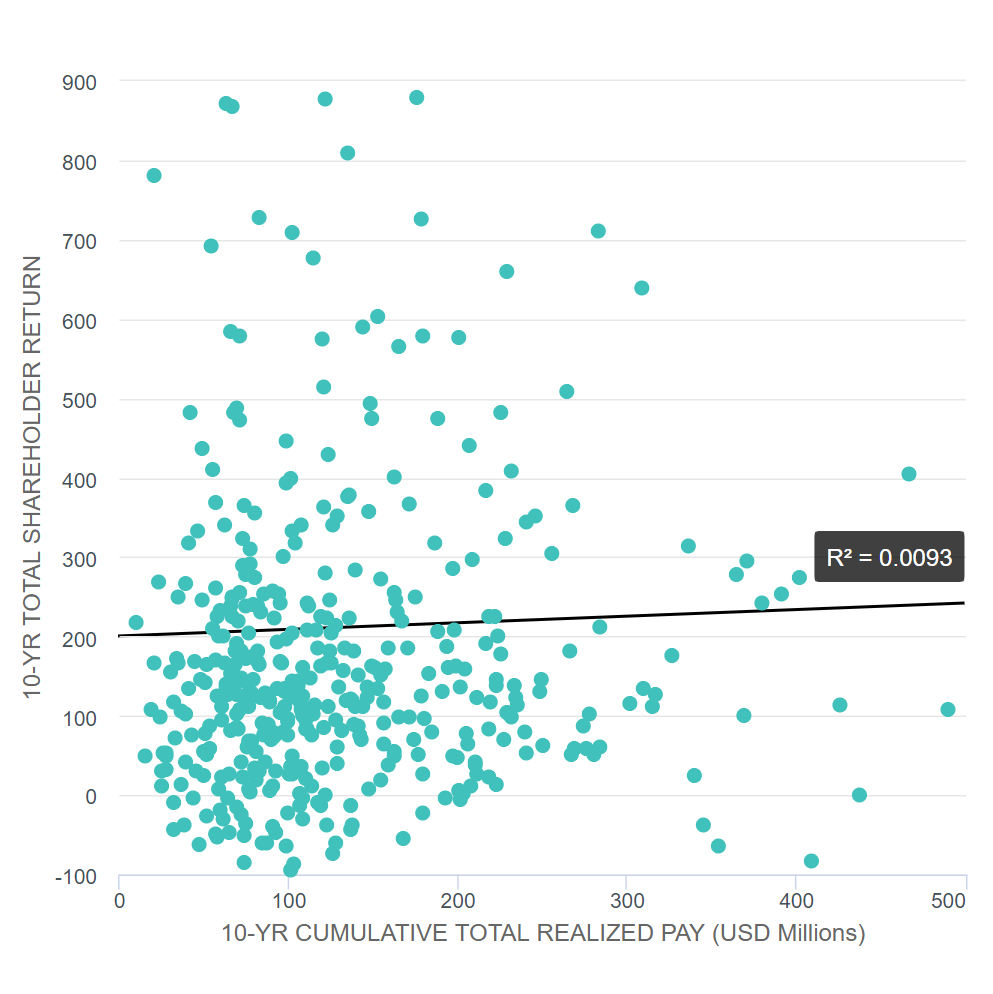

There is a growing body of work that already raises serious doubt about the extent to which current executive pay packages are associated with long-term corporate performance.

(10-year TSR as of Dec. 31, 2015 vs. 10-year cumulative total realized CEO pay as reported in 2007-2016 proxy statements, reflecting a one-year lag in reporting. Source: MSCI ESG Research)

(10-year TSR as of Dec. 31, 2015 vs. 10-year cumulative total realized CEO pay as reported in 2007-2016 proxy statements, reflecting a one-year lag in reporting. Source: MSCI ESG Research)

There are elements beyond the scope of finance that also factor into the CEO pay dilemma. Behavioral agency theory raises questions about whether compensation plans with longer durations may in fact influence executives toward shorter-term behavior because recipients discount it so significantly and feel it to be so uncertain. This form of renumeration may be viewed as “house money,” rather than management’s own compensation, potentially providing less of an incentive than originally intended. There are other common behavioral tendencies, commonly found in professional settings, that may also influence the perception of long-term compensation – these will be explored in conjunction with our future work on the topic.

Companies’ specific circumstances further muddle the current state of play, but also create the promise of longer-term pay practice.

One element of circumstance – that will be of particular focus in our future study – is the variety of rubrics investors and compensation committees must use to design and evaluate compensation plans. At this stage, we have identified at least four distinct sets of criteria currently in use. Despite varying features and components, each aims to motivate executives to maintain a more long-term approach to their business.

| Type | Definition | Reference |

|---|---|---|

| Performance- based compensation | CEO is paid based on their ability to meet pre-determined performance measures | See CPP Investments’ example on “Paying Only for Skill, a Practical Approach” |

| Ownership- based compensation | CEO is required to invest a meaningful part of his or her remuneration in company shares | See Norges, “Remuneration of the CEO: An Asset-manager Perspective” (01/2017) |

| Base/Fixed salary | CEO is paid an agreed-upon fixed salary, independent of performance | See PGGM, “Remuneration Guideline for Portfolio Companies” |

| Intrinsic pay | Significant portion of CEO remuneration is paid in non-financial rewards | See PGGM, “Remuneration Guideline for Portfolio Companies” |

Long-term companies also refer to their own strategies in order to shape the goals and objectives of their executives – FCLTGlobal’s Straight Talk for the Long Term highlights 10 elements of this approach. A notable example is Unilever; in 2017, it restructured its compensation planning in order to align with the long-term strategy. Furthermore, board directors and investors have various historical and regional experiences that inform their choices about how compensation can influence long-term executive behavior in their circumstances. We plan to use these different approaches to inform our research and arrive at new, globally relevant solutions.

FCLTGlobal expects that tailoring changes to compensation provisions can address these circumstances, incorporate insights from behavioral economics, and produce a practical, impactful, and broadly–applicable tool for designing and evaluating pay in a longer-term way.

The objective of this work is to pinpoint provisions that are useful for any organization’s compensation planning and that can be put in place independent of any regulatory change that may occur. It is our hope that investors, boards, and executives will view new provisions as balanced and capable of driving real, tangible impact.

If you have insights relevant to compensation, or any questions about our work, please contact [email protected].

In the News, Article

27 July 2020 - Rather than worrying about addressing near-term compensation shortfalls, compensation committees can use long-term incentives to keep executives focused on their business’ long-term strategy.

Metrics | Press Release

6 March 2020 - FCLTGlobal’s third Summit brings together top companies and investors

Incentive Alignment | Article

23 September 2019 - “You get what you pay for.” When it comes to executive pay, the old adage holds true. Companies’ compensation committees typically evaluate their CEOs, like any employee, based on performance benchmarks, and like every employee CEOs will work to hit the benchmarks they are measured against. Because incentives drive behavior, poorly designed incentives can precipitate poor choices. Recent studies have shown that such benchmarks, and corresponding compensation packages, are incentivizing short-term decision-making at many of today’s public companies. To dig deeper into the issue and workshop possible...