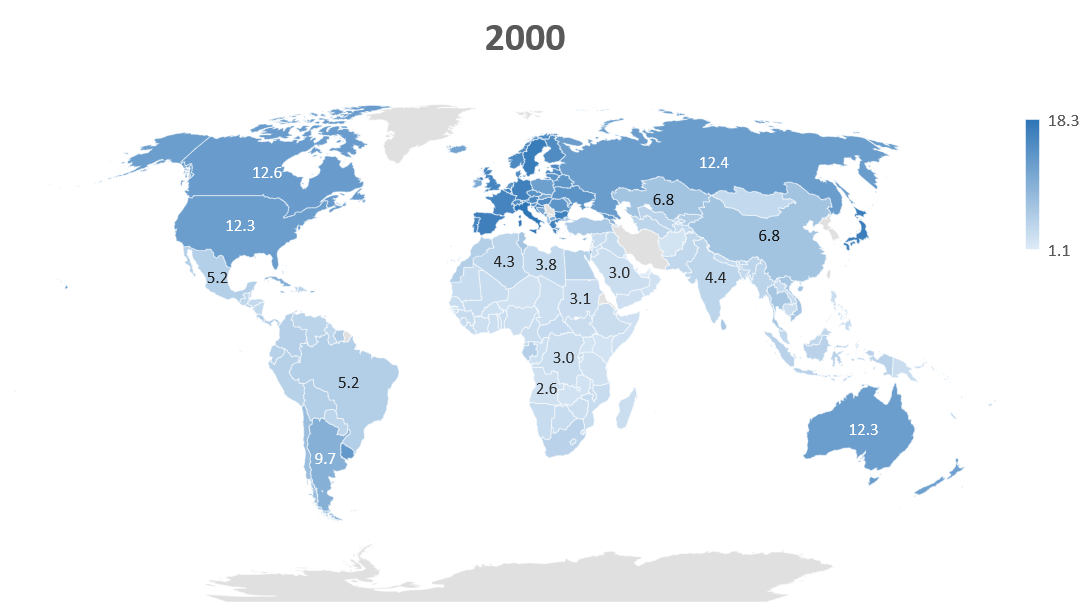

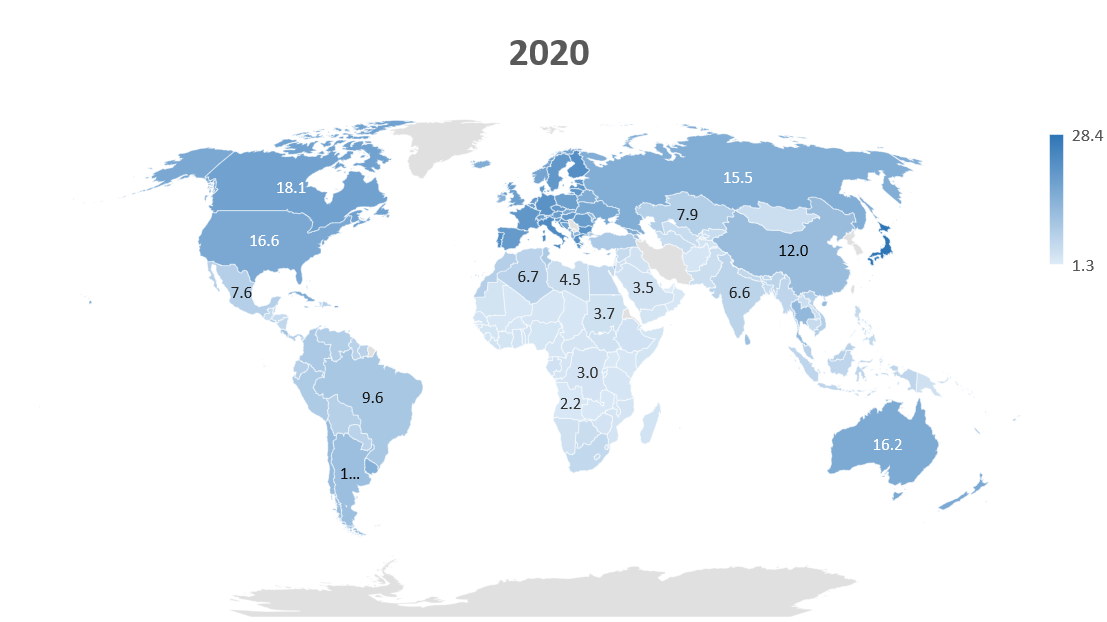

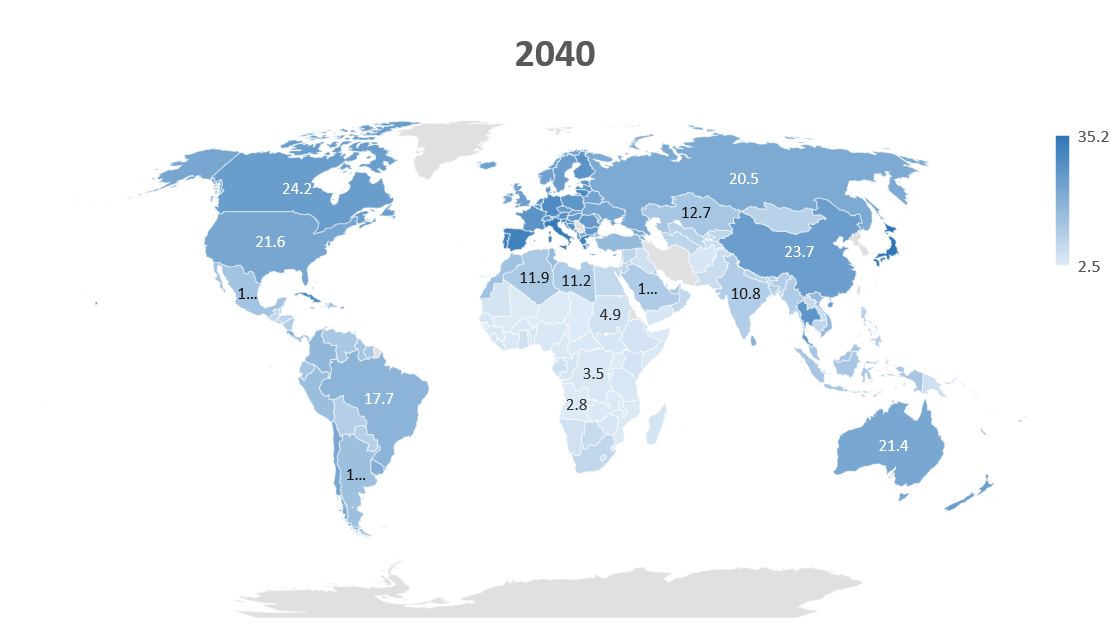

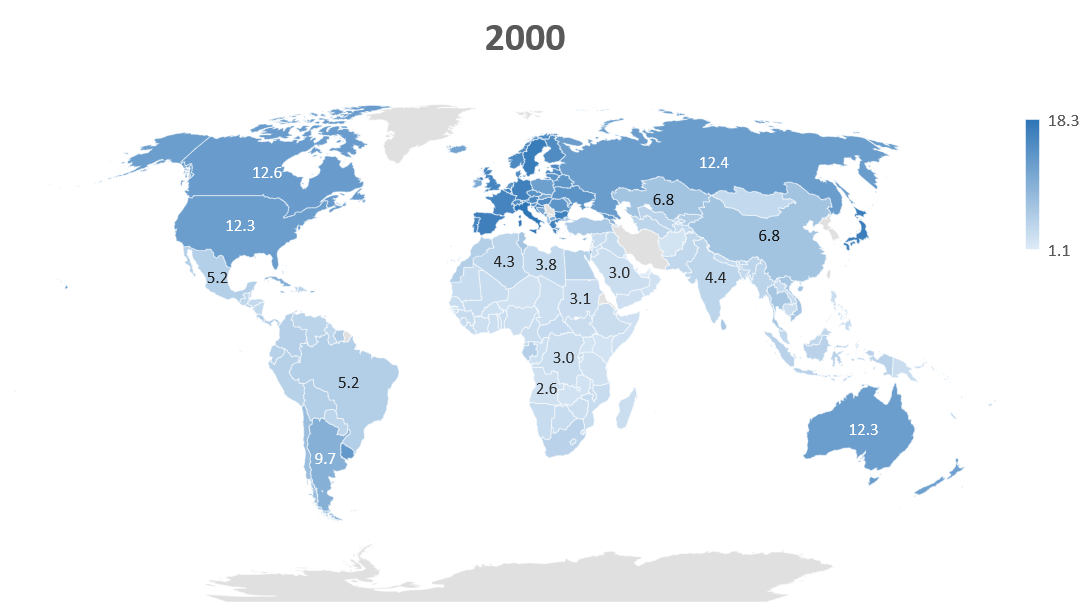

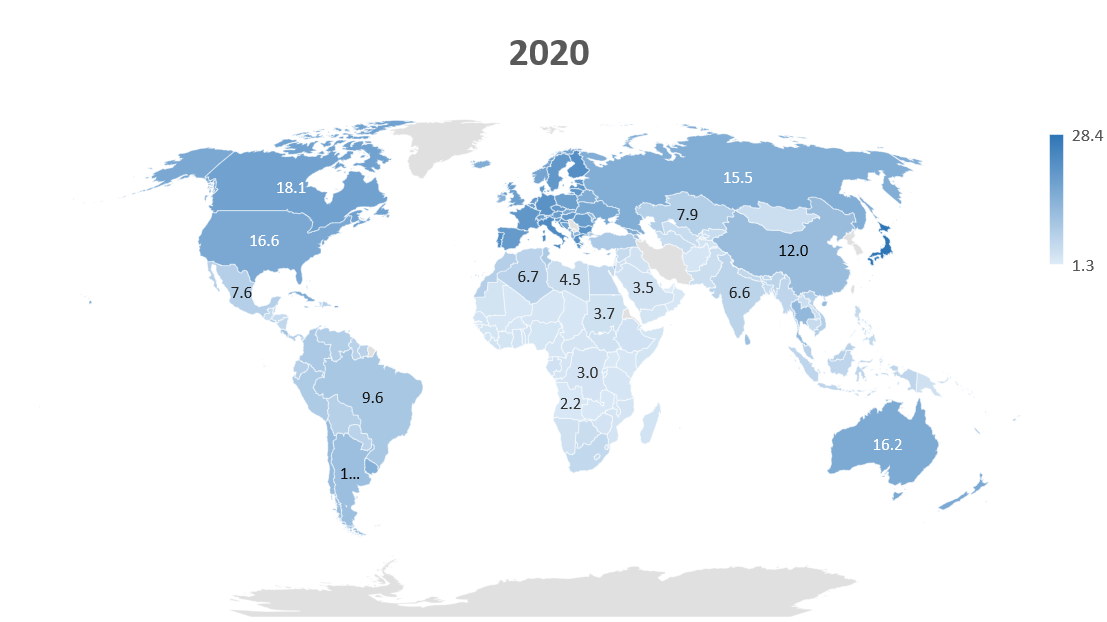

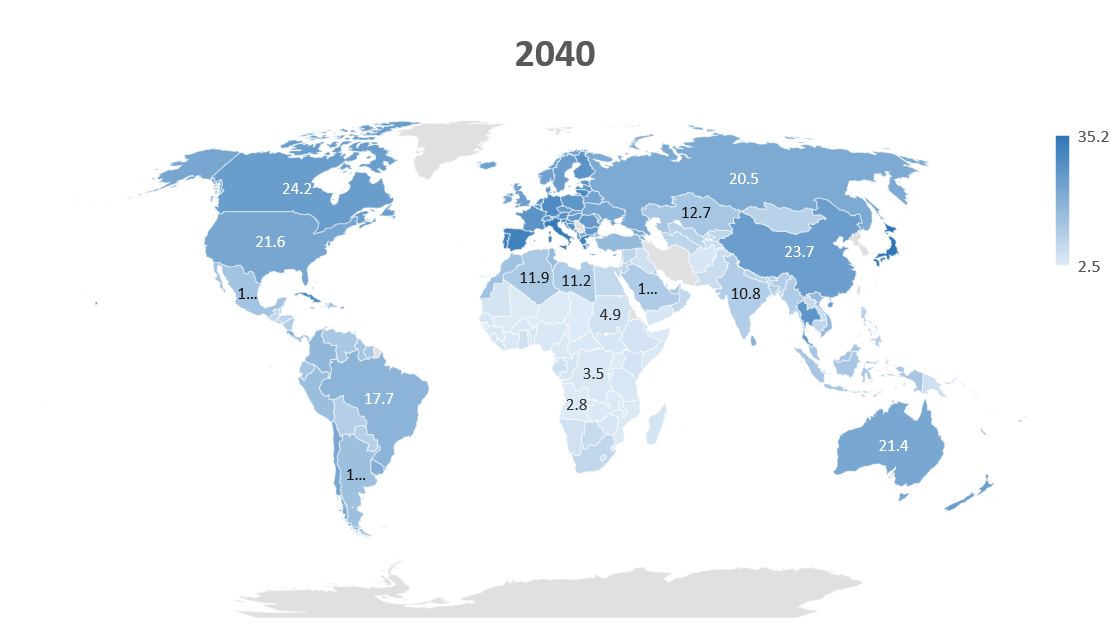

We know that increased life expectancies are placing stress on retirement systems, and of course, the problem is more acute in countries with aging populations. Much has been written about Japan grappling with a shrinking population base and increasing numbers of people moving into age 65 or older. The heatmap analysis below of elderly populations by country, using current and projected population data from the World Bank, illustrates that many European countries will be in a similar situation to Japan’s current predicament by the year 2040, with other countries such as China, the U.S., Canada, Australia and Brazil on a similar trajectory.

Percentage of Population Age 65 and Older:

Source: The World Bank

Fully funded defined benefit (DB) plans have the advantage of the employer being both responsible for administering the plan and accountable for ultimately providing a comfortable retirement to its retirees. Today, many DB plans are not fully funded, requiring current workers to fund benefits that are paid to current retirees – essentially a Ponzi scheme. The combination of an aging population with underfunded or discontinued DB plans means that a new solution is required for future generations of retirees.

The last few decades saw a movement in employer-sponsored pension plans away from the defined benefit (DB) model towards the defined contribution (DC) model, shifting the risk of shortfall onto individuals. The employer-sponsored DC model has the disadvantage that the employer is responsible for the plan, but the individual is ultimately accountable for providing an appropriate retirement income stream.

However, one clear advantage of the shift was the notion of individual accounts – where each worker funds their own future retirement, rather than that of current retirees. In an aging population scenario, funding for the future becomes crucial in the security and sustainability of a retirement system, breaking the “Ponzi scheme” of each generation in effect funding the retirement of the preceding generation.

An individual account system has three key advantages – accountability, security, and sustainability:

Creating a path to a successful retirement requires re-envisioning the individual account system. In the United States, for example, individual accounts (typically 401(k) or 403(b) accounts) are tied to the employer as a legacy of employer-provided pension plans. These plans are discretionary, although employers who choose to have them enjoy tax benefits but also face the responsibility for the administration of these plans. One consequence for this is that individuals working for smaller companies or working in a part-time/gig economy capacity may not have access to these plans.

In Australia, individual accounts are implemented through their superannuation system. Under this system, employers are required to make contributions to an employee’s superannuation account, where the administration is done through approved superannuation funds. The individual has the opportunity in this system to choose their preferred superannuation provider, based on performance, fees, or other factors of importance to the individual.

While rollovers and consolidation are possible in both the American and Australian systems, employees may accrue multiple account balances through their working career, leading to administrative burden and less clarity in terms of the ultimate retirement outcome.

A simpler solution would be to have accounts tied to the individual themselves, as a lifetime account, in which individuals, employers, and in some cases even governments, can each make contributions. This idea is already being suggested in some areas – in the U.S., most recently, Virginia lawmakers proposed the creation of a state-sponsored retirement savings program for private-sector employees, making it the 13th state with to implement such a system.

Investment management and administration could follow the Australian model, in which approved and regulated funds are utilized, very similar to the 529 college savings model in the U.S. The advantages of this approach are threefold:

- Individuals have responsibility, accountability, and choice over their own retirement plans

- Employers do not have the burden or liability of administering retirement plans

- These plans could reflect the evolving nature of the 21st century workforce, accommodating gig work, part-time employment, or gaps in traditional employment.

In countries with existing mandatory contributions, this could continue with little change, while in countries without mandatory contributions, both individuals and employers could be given tax incentives to contribute to their accounts. Lifetime savings accounts could incentivize companies to make retirement account contributions for part-time or contract work too.

In short, an individual lifetime savings account system would create accountability, provide a more secure benefit, and would be sustainable no matter the change in future demographic mix. As we continue with this series, we will explore possible solutions this system can provide for the gender pension gap. If you have feedback or insights on this work, please contact us at [email protected].