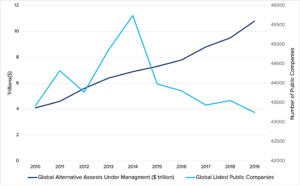

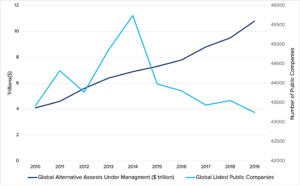

In the decade preceding the global pandemic, the public markets seemed to have lost their luster. The number of publicly listed companies in the U.S. dropped by close to 27% from 2010 to 2020. Over the same period, there was a significant shift in global capital allocations to the private markets. Global assets under management in alternative investments saw over 200% growth from $4.1 trillion in 2010 to a staggering $13.3 trillion in 2021.

The Growth in Alternatives and the Decline of Public Companies

Source: World Bank & Preqin

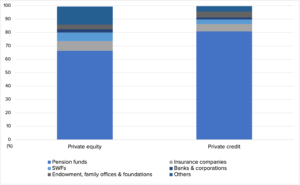

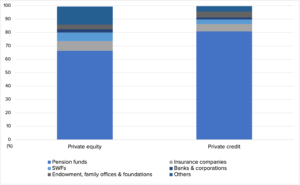

Institutional investors have deployed a significant amount of capital to the private markets, at the expense of public markets. Pension funds are the largest investors in the private markets, and many of them have explicit annual return targets to lower the gap between assets and unfunded liabilities. In an age of low interest rates, fixed income has been insufficient at generating returns, which has propelled many pension funds to search for yield in the private markets.

Pension Funds are the Key Investors in Private Markets

Source: BIS

The sizeable amount of capital in private markets – propelled by low interest rates – has dramatically lowered borrowing costs for companies financed by debt. Furthermore, many companies are staying private for longer periods of time due to the absence of quarterly guidance pressure, burdensome disclosure requirements, and run-ins with activists, all of which they would encounter in the public markets.

Low interest rates – one of the key mechanisms driving the growth of private markets – is poised to reverse course as central banks respond to the burgeoning inflationary pressure afflicting the global economy. The elevation of interest rates could temper the rapid pace of capital reaching the private markets by increasing the costs of borrowing, thereby diluting the returns for private equity and venture capital firms, lowering the valuations for private portfolio companies, and adding uncertainty to the private credit market.

The risks to private markets in an elevated rate environment present an opportunity for long-term-oriented investors to reconsider the utility and downstream benefits of public markets. Public Markets for the Long Term: How Successful Listed Companies Thrive highlights the fact that although private capital investments have grown tremendously over recent years, the public markets are a crucial driver of widespread wealth creation and capital stability for high-performing companies.

Unlike the private markets, which are primarily limited to only qualified institutional investors, the public markets provide an opportunity for individual savers to participate in long-term value creation.

While the public markets are not immune to the uncertainty associated with elevated interest rates, the size of public equity markets (over $40 trillion in the US and $100 trillion globally) offers a robust funding source for companies. Academic research suggests low-interest rates are a contributing factor to firms delaying their IPOs. As rates increase, that trend is likely to reverse, making public markets relatively more attractive – and making investing in newer growth companies more accessible to a wider community of savers better able to participate in that growth potential.

The private markets have been an effective funding source for companies and have allowed institutional investors to diversify their portfolios in a low-interest rate environment. As monetary policy begins to tighten the allure of private markets will likely dissipate. Our work has demonstrated that the deep and liquid nature of the public markets will remain a robust funding source for companies, a key generator of widespread wealth for savers, and a long-term value creator for the global economy.