Recent, real-world cases illustrate how external expectations can shape and alter those responsibilities. It is apparent in GPIF’s decision to suspend its equity lending program, in CDPQ’s allocation of $4B to the Quebecois market in response to COVID-19, in the New Zealand Super Fund’s engagement with social media firms that broadcast the Christchurch massacre, and in so many other instances.

Expectations placed on investors are ever-changing, can emerge from any of the institution’s many relationships, and extend beyond settled matters of law, regulation, and contracts. Some – but not all – of these external expectations become responsibilities. Investors, when faced with potential responsibilities, need a process for deciding to accept a responsibility, defer it to the future, deflect the potential responsibility, or take a leadership role in driving action against it. Specifically, in the context of pension management, one integral element of this process-building is determining how to engage with individual pension members on these decisions.

On 10 November, FCLTGlobal led a “Workshop on Navigating Responsibilities of Long-term Investors” at the International Centre for Pension Management’s (ICPM) Virtual Fall Discussion Forum to explore questions about investors’ evolving responsibilities. These include:

- What are some of the new or emerging responsibilities for large pension plans in their capacity as asset owners investing the retirement savings of workers?

- Who are the key influencers in advocating for new responsibilities?

- Are there challenging trade-offs in accepting these responsibilities? Can a responsibility be eliminated once accepted?

Approximately forty leaders from long-term pension funds considered answers to these questions in the joint FCLTGlobal-ICPM session and produced a draft table of their own individual responsibilities, the influencers to whom these responsibilities are owed, and the trade-offs required to fulfill them. Sarah Keohane Williamson, CEO of FCLTGlobal, and Dr. Rob Bauer, ICPM Executive Director, moderated the discussion.

“Responsibility is a task of navigating – not solving – ever-changing external expectations,” remarked Williamson. “These expectations can originate from nearly any source in society, yet the resulting responsibilities have a standard structure, and investors can prepare internally for emerging responsibilities.”

Potential Responsibilities

Several types of responsibility are common among the pension funds that participated in this session. Nearly all face expectations that they will lead in the global response to climate change and that they will uphold the reputations of the institutions that sponsor them. European pensions also commonly are responsible for soliciting and integrating the preferences of beneficiaries in how they invest, for instance with respect to sustainability. Fewer pension funds have a responsibility to contribute to economic stability or growth in their home region, but many are responsible for doing no harm to the economies in which they invest.

In the words of one participant, “every now and then we get questions from our sponsors to invest in our local economy. Our country has infrastructure needs, whether it is energy related or something else, we get asked ‘Why don’t you invest more in our country?’”

Other responsibilities, as reported by the funds in the workshop, vary widely and reflect the unique mission of each fund. These include, but are not limited to:

- Aligning investments with the UN’s Sustainable Development Goals

- Participating, in a commercially-viable way, in government-backed infrastructure projects

- Minimizing contributions required of pension sponsors

Such an array of responsibilities is expected, and appropriate, and no single, consistent set of “long-term” responsibilities exists. Rather, long-term behavior is fulfilling the fund’s individual responsibilities so that trustee directors, executive leaders, and staff can maintain a focus on their long-term strategy, rather than “responding to the issue of the moment” as one participant put it. Including a risk perspective in this process may complement it and make it easier because, in the view of a participant, “risk reveals responsibilities more reliably.”

Influencers

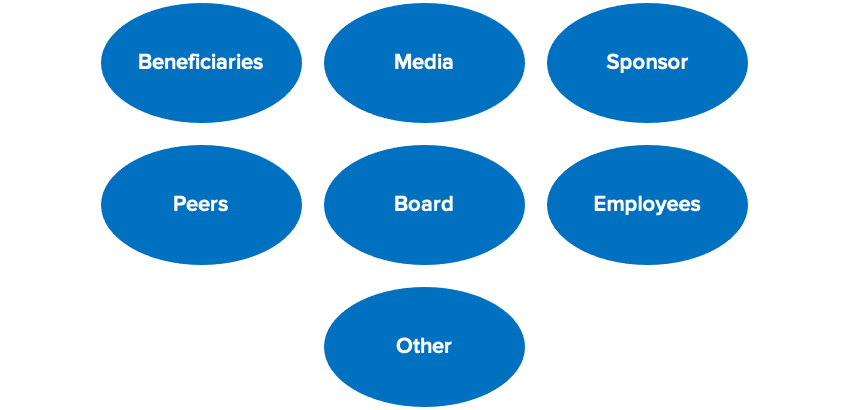

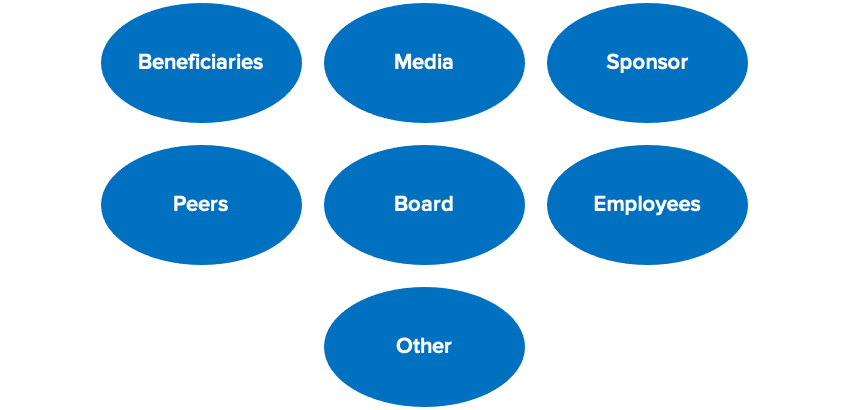

Anyone can have expectations for an investment organization, but only some of these expectations will result in a responsibility for the investor. Pension leaders in the FCLTGlobal-ICPM working session discussed who has been influential in determining their organization’s responsibilities.

Who has been influential in determining your organizations responsibilities?

All of these influencers are important to the pension funds in the room. “The most common influencers are our beneficiaries and sponsors, but regulators can also play a large role,” said one participant.

In some cases, the pension funds follow the lead of their beneficiaries – including to the point of categorizing them as decision-makers, not just influencers.

“Our beneficiaries don’t want us to ruin the world when we make our money,” a participant commented. “We want to ensure our values and morals are not at odds with our investments.” This speaks to the urgency to have a commonly-defined set of metrics for non-traditional considerations, including ESG and other impacts that unfold over longer time frames in financial terms.

In other cases, the fund boards lead. “The whole way that we’re set up is using behavioral economics to help beneficiaries focus,” another fund in the conversation said. And in other cases, the role of the peers is critical. “What are our peers doing is always a question that is asked,” one participant noted. Investors need to navigate expectations from these influencers who see responsibilities for their funds – a type of discussion that could be had within ICPM’s convenings of trustee directors.

Trade-offs

When long-term investors fulfill their responsibilities, they preserve their strategic focus and the stability of their leadership. When they do not, they risk distraction and turmoil. Managing responsibilities well requires making difficult tradeoffs.

“The time horizon you choose matters when thinking about trade-offs,” remarked one participant. Another added that “reputational risk is significant when we discuss emerging responsibilities – do these responsibilities diminish or enhance our reputation?” Again, the existence of a common set of non-traditional metrics would defray this risk.

Every investor in the working session reported having more than one responsibility, and investors know how hard it is to optimize for multiple issues. Several participants discussed how important it was to consider their responsibilities in terms of long-term returns. By making decisions to take on a responsibility – such as divesting from tobacco or coal – in the context of a long-term investment decision made it clear that the optimization function was for long-term return.

Participants recognize that they may make a short-term sacrifice for a long-term benefit, even if that long-term benefit is difficult to quantify today because “so many ESG initiatives are long-tailed, and that presents a critical mis-match because returns are reported quarterly or annually and that is insufficient metric for an ESG agenda”.

Others pointed out that they are willing to sacrifice return based on key principles that they have adopted. When asked whether a responsibility could be eliminated once accepted, the rationale for the decision was critical: “You have to be able to change your mind, if the tradeoff is based on a financial decision. It’s a bit different if the tradeoff is based on an ethical decision.”

Conclusion

Pension investors appreciated this opportunity to explore their responsibilities, the influencers that champion those responsibilities, and the trade-offs associated with fulfilling them. Others can do the same by filling out the worksheet below.

Click image to download worksheet

Williamson concluded the conversation by observing that, “Investors’ process of deciding to accept, defer, deflect, or drive a potential responsibility is critical. We have learned that responsibilities are individual to each investment organization, but it appears that long-term investors face similar challenges in making these decisions. Clarifying and operationalizing this process more widely is a promising area of research about how to focus capital on the long term.”

FCLTGlobal facilitated this important session with ICPM to advance development of a practical roadmap for investors to evaluate and operationalize emerging responsibilities. We welcome your input into FCLTGlobal’s broader, ongoing project on investors’ rights and responsibilities. For questions or suggestions, please contact Research Director Matt Leatherman at [email protected].

Download Report

Download Report