Recent regulatory shifts and financial uncertainty due to COVID-19 has changed how companies are spending their money, including on share buybacks.

Recent regulatory shifts and financial uncertainty due to COVID-19 has changed how companies are spending their money, including on share buybacks.

By Allen He

Major US announcements on buybacks have once again fixed investors’ attention on an often contentious issue. The SEC recently proposed that corporates provide information on buybacks (no later than one day after a trade is executed), while the latest version of the Build Back Better Act bill (BBBA) includes a 1% tax on corporate share buybacks.

While there is much discussion over the merits and regulation of share buybacks as a practice, the reality on the ground is that they were far less prevalent in 2020.

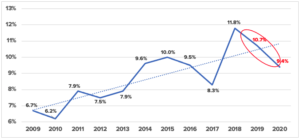

Pros and cons aside, the latest data from FCLTCompass shows that total buybacks worldwide decreased by nearly $300 billion, down from a peak of $1.054 trillion in 2019 to $758 billion in 2020. In addition, as shown below, buybacks as a percentage of total corporate spending decreased by 1.3%, its second lowest level since 2013.

Buybacks as a Percentage of Total Corporate Spending

But which companies, and in which geographic regions and which sectors, is this trend most prominent? A deeper look at the data helps answer this question.

By sector

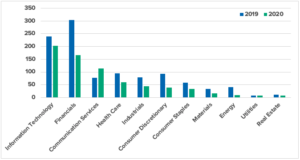

Interestingly, nearly 50% of the $300 billion decrease in buyback activity can be attributed to the financials sector alone, where regulations were put in place to stop buybacks during the pandemic. Consequently, money spent on buybacks in this sector dropped by 45% year-on-year, from $303 billion in 2019 to $166 billion in 2020. In comparison, while the IT sector also experienced a drop in buybacks, the 15% decrease was far less pronounced. Other sectors with significant changes include energy (-75%) and consumer discretionary (-57%), albeit off a lower total amount of money spent.

Buybacks by GICS Sector: 2019 vs. 2020 ($B USD)

By Country

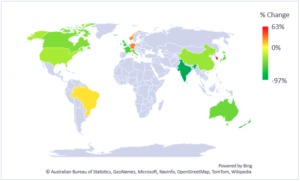

On a country-by-country basis, American companies continue to dominate the buyback landscape. While the US did have the largest decrease in absolute terms (down 26%), buybacks were down globally overall in 12 of the 17 countries studied in FCLTCompass. India and the United Kingdom experienced the largest decreases, at 97% and 61% respectively, while buyback activity in South Korea and Germany increased by 63% and 30% respectively (albeit off a lower 2019 value).1

Change in share repurchases: 2020 vs. 2019 (%)

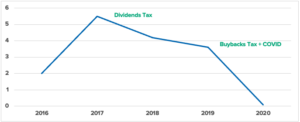

The 97% decrease in buybacks among Indian companies makes for a particularly interesting case study. As highlighted in The Dangers of Buybacks: Mitigating Common Pitfalls, in 2017, the Indian government introduced a tax on dividends, leading Indian companies to flock towards buybacks as a more tax-efficient means to return capital to shareholders. As a result, buybacks in India increased by 150% that year, compared to 29% for dividends. The government fixed this loophole in 2019 by levying the same tax on buybacks. The new tax, combined with the impacts of the pandemic, resulted in the 97% decrease we see between 2019 and 2020 (compared to a 58% decrease in dividends).2

Amount spent on buybacks: Indian Companies ($B USD)

Put into the perspective of the US BBBA bill, a 1% tax on buybacks is likely far too low to deter buyback activity. As seen in India, a 20% tax to curb buybacks can be effective, but at 1%, many companies will still view the flexibility that a buyback provides to be well worth the cost.

As regulatory restrictions that were set at the outset of the pandemic begin to lift, early signs indicate buyback spending is reverting to the pre-pandemic levels of 2019. Corporate CEOs are already claiming “that their cup runneth over” in excess cash, making buybacks a sensible vehicle to return that excess capital.

As we move ahead into 2022, buyback trends worldwide will continue to shift on a sector and geographic basis. What portion of capital corporates allocate to buybacks moving forward will be telling, particularly as we see increased investments to longer-term R&D, capital expenditures, and other new areas. How the trends continue could very well indicate whether this was the start of a trend, or just a one-year, government induced phenomenon.

1. Note: while the tax went into effect the Q3 2019, companies who had announced buyback plans earlier in the year were allowed to complete them without penalty, perhaps explaining why the drop off wasn’t immediate in 2019.

2. Minimum of $1B in buybacks, so countries like China and Singapore which normally do very little buybacks were excluded.

Investor-Corporate Engagement | Report

6 October 2020 - Returning capital to shareholders is an important and legitimate goal of many corporations. Buybacks are often an effective way to distribute capital, but care must be taken to mitigate downfalls related to personal gain and enrichment, poor timing, and excess leverage.

Investor-Corporate Engagement | Toolkit

6 October 2020 - In the right circumstances, buybacks can further long-term goals; new tools and guidelines could help evaluate buybacks on their long-term merits.

Article

16 June 2021 - By Allen He, CFA As the global economy rebounds, companies are preparing to launch a record wave of buybacks. Buybacks have become a global phenomenon over the past 20 years, with many companies viewing them as an attractive alternative to dividends in returning capital to shareholders. They are flexible, recycle excess cash to the economy, and provide tax advantages in certain jurisdictions. While buybacks can indeed be an effective way to distribute capital under certain circumstances – and can be used to signal to investors that their...