The war in Ukraine represents an immediate crisis to which businesses must respond. At the same time, its impact on the geopolitical environment and existing global order presents boards and management with a longer-term, complex challenge. Boards and management of multinational companies will continue to face greater pressures from stakeholders to pair a global strategy with a geopolitically cognizant risk management approach. Coupled with societal, regulatory, economic, and related market risks, that are emerging regularly, boards will continue to face fluid operating environments. Boards and management are expected to act in the short term, with proper consideration of the wide-ranging implications for long-term strategy and investment decisions.

By starting with corporate purpose, then taking inventory of evolving responsibilities to their various stakeholders, companies can address geopolitical risks with an understanding of how they might impact stakeholders and material business functions. From there, they can plan and adjust strategy to incorporate these responsibilities and risks. These steps can be integrated into the EY geostrategy framework, which encourages executives to undertake the management of political risk systematically—to scan the political risk landscape (take an inventory of material risk), understand the impact it has across the organization (assess and process the risk), and then act to address the risk and adjust strategy as needed. In exercising their oversight responsibilities, boards can ask whether management is successfully integrating dynamic risk assessment into the short- and long-term business strategies.

The Strategic Imperative of Addressing Political Risk

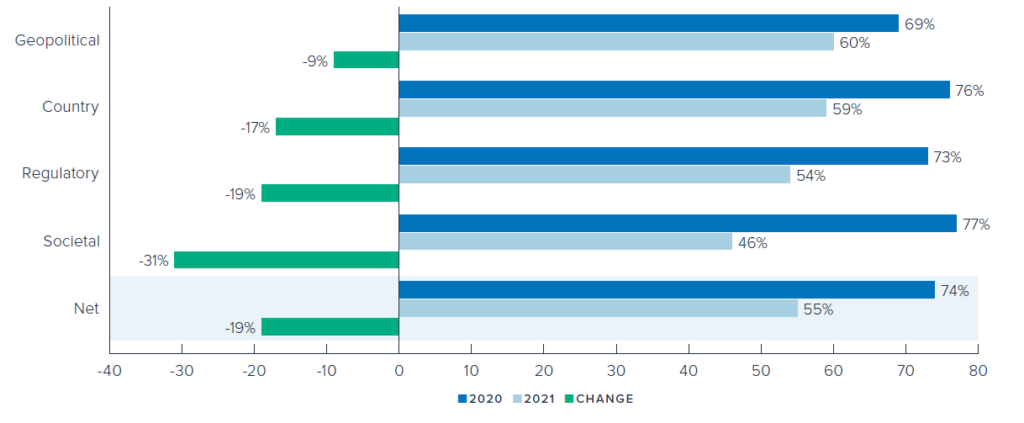

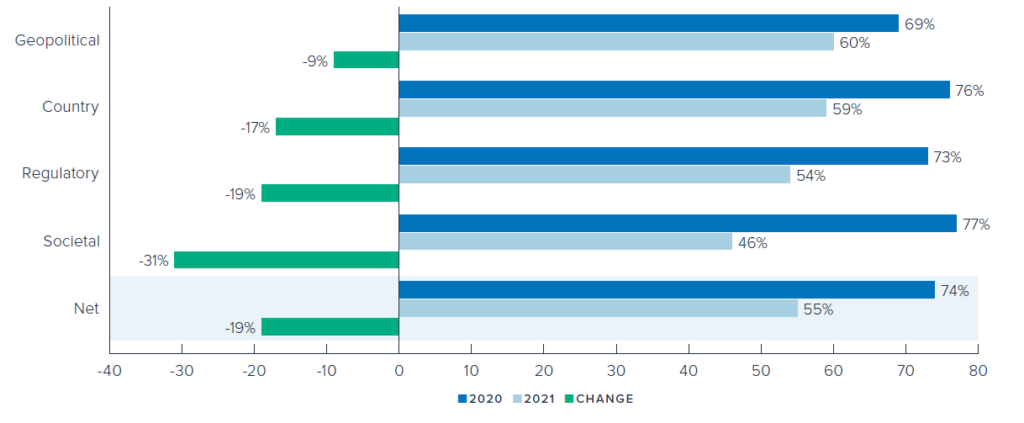

In an EY survey of 1,000+ executives conducted in 2021, 94% reported they had been impacted by unexpected political risks over the last 12 months, and 58% prioritized improving how their organization assesses political risk. Most, however, have been in reactive mode; just one in three reported proactively coordinating political risk management and only 25% of boards regularly considered political risk when making board decisions. Additionally, prior FCLTGlobal research found 67% of executives said the board needed to contribute more to their team’s strategy, but EY research shows confidence in managing political risks has plummeted (see Figure 1).

For organizations to succeed in building resilient long-term strategies, this needs to change. Over the last few years, we have seen a steady rise in the levels of political risk, fueled by great-power rivalries that have challenged assumptions about the trajectory of globalization. With the advent of the war in Ukraine, there is a heightened impetus to embark on a more sober assessment of the landscape of geopolitical risk and give increased attention to the governance of political risk management.

A Need for Frameworks

When it comes to managing multi-horizon systemic risks, frameworks embedded in a stakeholder-focused strategy can help organizations prioritize and take action. Frameworks will not save companies and their boards from the disruption of a crisis, but they are designed to help prepare for one before it hits. They are important, actionable tools to bring order into a complex environment, test assumptions, and catalyze strategic decision-making.

By starting with corporate purpose, then taking inventory of commitments to stakeholders, and anticipating how responsibilities may be evolving, companies can address dynamic risks with an understanding of how they might impact stakeholders and material business functions. From there, they can plan and adjust long-term strategy to process and fulfill expectations—to act and to create a strategy to fulfill stakeholder responsibilities, including through governance and risk management of geopolitical developments.

Figure 1: C-suite confidence in managing political risks has plummeted[1]

How confident are you in your company’s ability to manage the following types of political risk?

Figure 2: EY Geostrategy Framework

These steps can be integrated into the EY geostrategy framework (illustrative view in Figure 2). The framework encourages executives to undertake the management of political risk systematically—to scan the political risk landscape (take an inventory of material risk), understand the impact it has across the organization (assess and process the risk), and then act to address the risk and adjust strategy as needed.

Geopolitical Conversation Guide

No matter where a company sits in its maturity in political risk management, addressing disruptions involves investing time to take stock, reassess, and ask the right questions. Geopolitical events often present similar threats in terms of potential disruption to long-term strategy but come with their own idiosyncratic characteristics.

Below is an adapted version of the Risk Conversation Guide, developed to facilitate board decisions that meet both long-term objectives and short-term risks in the face of geopolitical crisis or disruption. The guiding principle is that geopolitical risk, like any other external risk, can be proactively managed. This guide is meant to help organizations evaluate how significant geopolitical risks affect their ability to operate and allow boards and management to guide more forward-leaning, coordinated strategies.

To view the full Geopolitical Risk Conversation Guide, download the full article.

[1] Source: EY Geostrategy in Practice 2021. The share of global executives highly confident about their company’s ability to manage political risks dropped from 74% to 55% between the 2020 and 2021 editions of the EY Geostrategy in Practice survey.