In combination with other uses of capital (fixed investment or capex, M&A, and return of capital to shareholders), investment in research and development (R&D) indeed contributes to the foundation for future growth. The returns to successful R&D are often significant and can be transformational for an organization and for the broader society in which it operates. This positive contribution from R&D has been well documented:

- Eberhart, Maxwell and Siddique (2002) examined U.S. firms who increased R&D expenditures by an economically significant amount between 1974 – 2001 and found significantly positive long-run abnormal operating performance and abnormal stock returns following the increase.3

- Lev, Radhakrishnan, and Ciftci (2006) evaluated performance of R&D leaders and followers and found R&D leaders earn significant excess future returns, higher future sales growth, and higher ROA while R&D followers earn the average return.4

- Su, Chen and Chang (2009) examined Taiwanese firms and found those that economically significantly increase R&D expenditures exhibit abnormal excess stock returns.5

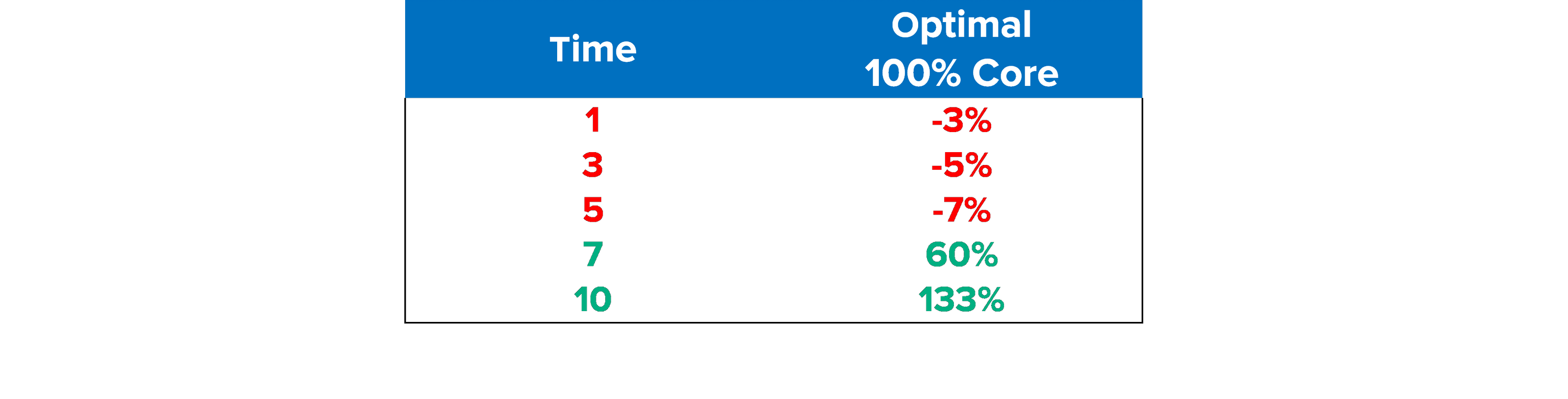

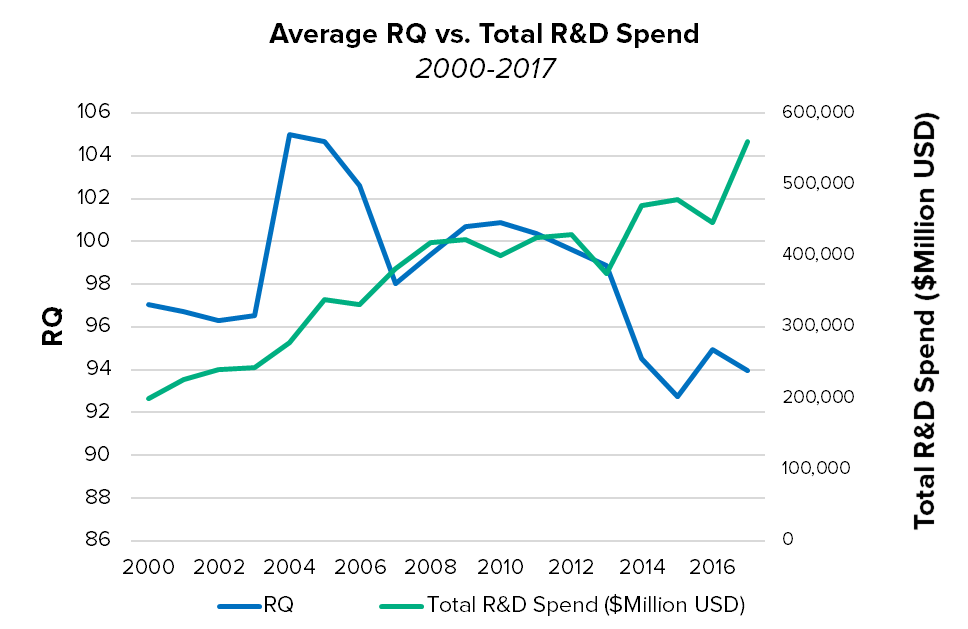

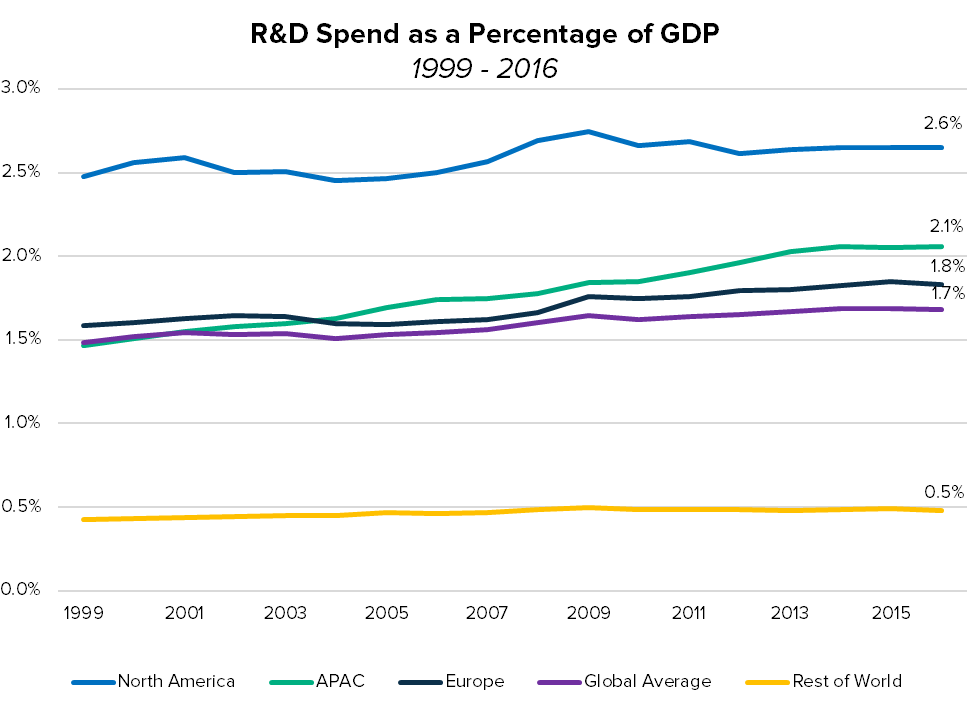

Over the past 15 years, total global R&D spending has grown – on both an absolute basis (spending is up 170% globally from 2000-2016, the most recent year for which global data is available) and as a proportion of global GDP (R&D spending accounted for 1.7% of global GDP in 2016, up from 1.5% in 2000).6

7

7

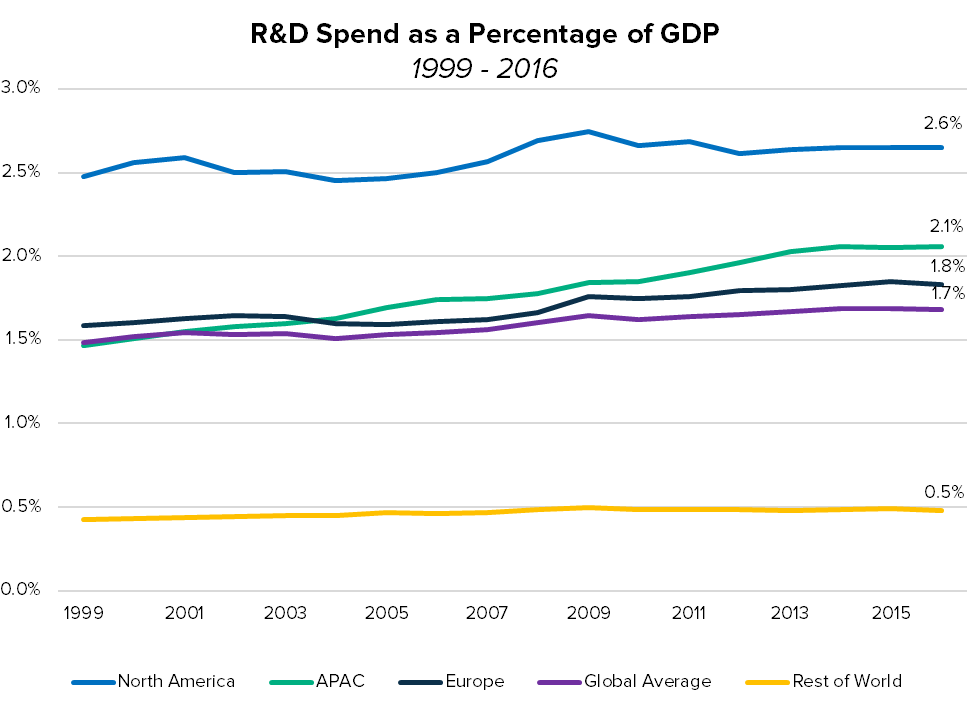

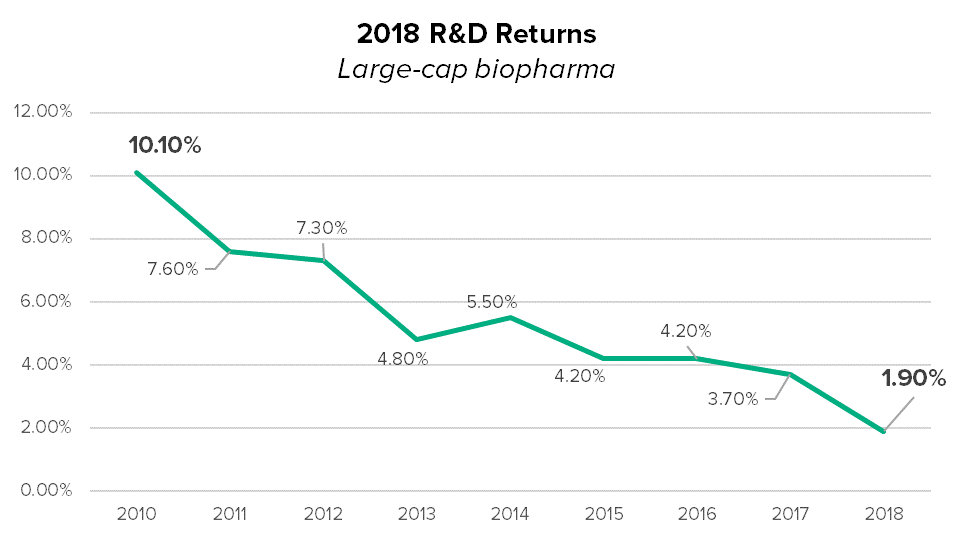

But the productivity of that additional investment has been declining – as evidenced by diminishing marginal returns to R&D. For example, Deloitte’s 2018 examination of the biopharma industry found costs to bring an asset to market had increased to record levels ($2.2 billion in 2018 vs. $1.2 billion in 2010) while returns to R&D investment have fallen to the lowest level in 9 years (1.9% return in 2018 vs. 10.1% in 2010).8

9

9

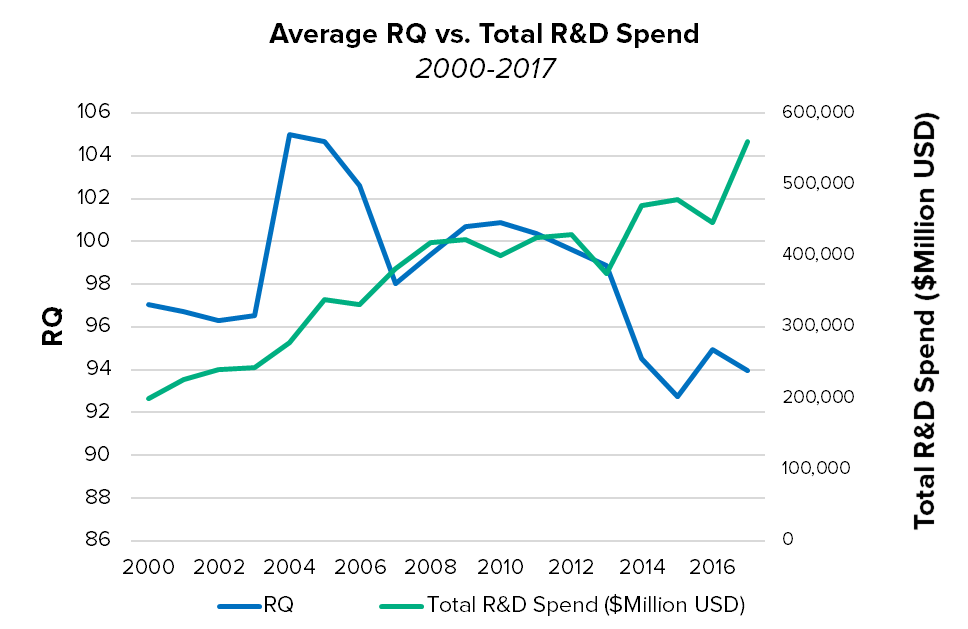

This decline in returns to R&D investment is not a phenomenon unique to biopharma. According to Washington University in St. Louis’s Olin Business School Professor Anne Marie Knott’s research, across industries the returns to additional R&D spending have been falling since well before the financial crisis:10

11

11

What’s behind this global decline in returns to R&D, and investment in innovation more broadly? In this unprecedented era of low interest rates and easy money, is there simply too much capital chasing too few opportunities?

Are the issues of today so much more difficult to solve (because we’ve picked all the ‘low-hanging fruit’ and we are tackling topics of increasing complexity) that they will naturally require more time and resources, limiting return potential?

Has corporate outsourcing of R&D to move it off-balance sheet drained the talent pool (distracting the brightest minds by the need to access to capital and equipment) while leaving companies incapable of generating truly transformational innovation?

These theories have all been offered as explanations for the decline in R&D expense productivity in both the popular press as well as the academic community.12

But emerging evidence suggests short-termism lies at the heart of this puzzle.

R&D spending, especially long-horizon R&D project spending, faces a unique set of short-term pressures relative to other types of long-term investment. Behavioral biases leading to suboptimal decision-making and greater uncertainty around forecasting future potential returns (among other things) may contribute to the tendency for long-horizon projects to be among the first places management teams cut when faced with short-term financial pressures. Prof. Gerben Bakker of the London School of Economics succinctly describes the problem of allocating capital to R&D, “The financing of R&D is made difficult by five challenges: the presence of sunk costs, real uncertainty, long and open-ended time lags between outlays and pay-offs, adverse selection, and moral hazard.”13

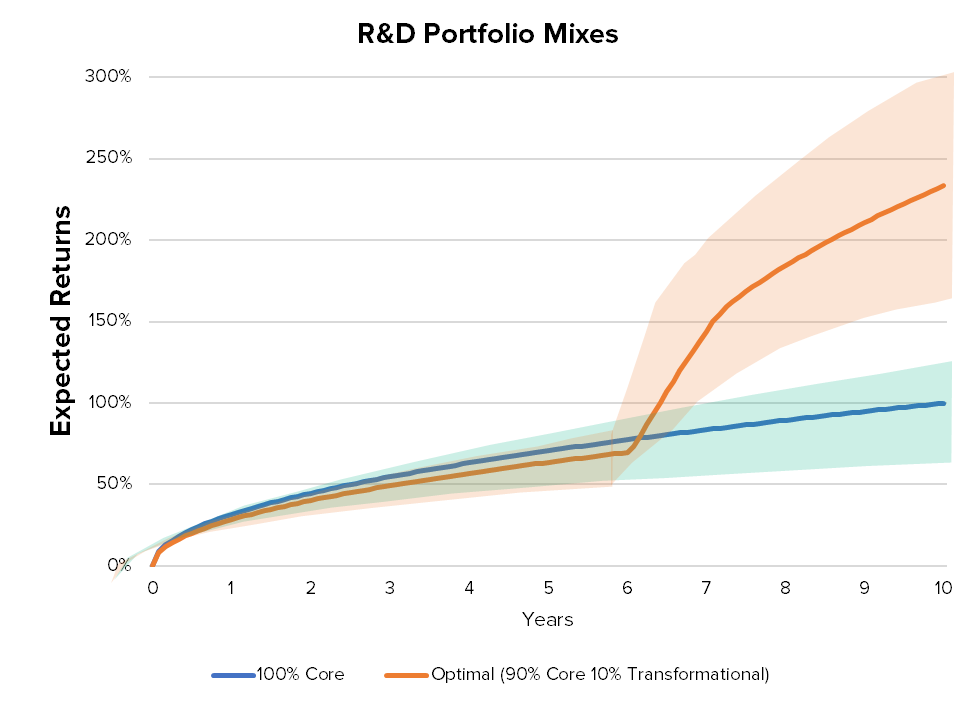

Unfortunately, it is often those same long-horizon projects that deliver the most long-term value creation potential. As Nagji and Tuff illustrated in a 2012 Harvard Business Review article,14 it is the long-horizon transformational R&D that delivers the vast majority (approximately 70%) of returns to R&D expense.

Informed by this 2012 research, preliminary work has led us to a new explanation for the persistent decline in returns to R&D over the past decade plus. This work suggests the tendency to cut long-horizon projects has left companies and investors with unbalanced innovation portfolios which favor short-term projects delivering more certain, albeit ultimately lower, incremental returns. The overweighting of short-term projects, generally a reliable near-term strategy, sacrifices significant return potential offered by long-horizon transformational innovation, and similarly transformational returns. We hypothesize that this overweighting of short-term, core and adjacent product R&D in innovation portfolios is responsible for the decline in R&D productivity – and returns to R&D more broadly.

In a series of in-depth interviews with experienced R&D managers conducted over the prior six months, we tested this hypothesis and found that anecdotal evidence confirmed our suspicions about the shrinking time horizon of R&D investment portfolios. As has been demonstrated in other academic literature, short-horizon R&D projects (with expected payoffs less than five years into the future, and often as short as 1-3 years) tend to be stickier. We suspect, based on our conversations, that they account for the vast majority of R&D spending at publicly listed companies today:

- “For years we cut long-horizon projects and instead invested a lot of resources into acquisition of late-stage drugs, opting for ‘buy’ vs. ‘build.’ None of those deals worked and now we have a hole in our drug pipeline and a question mark hanging over future revenue projections.” SVP R&D Finance, Multi-national Pharmaceutical Manufacturer

- “We don’t invest in anything with a payback period longer than three years out into the future.” Head of Investor Relations, Fortune 500 Telecomm

- “Long-term potentially transformational projects are always underfunded, and no one questions you about cutting projects like that. Managers that propose cutting projects in that category almost always get cheered.” President, Mid-Cap Industrial & Analytical Instruments Manufacturer

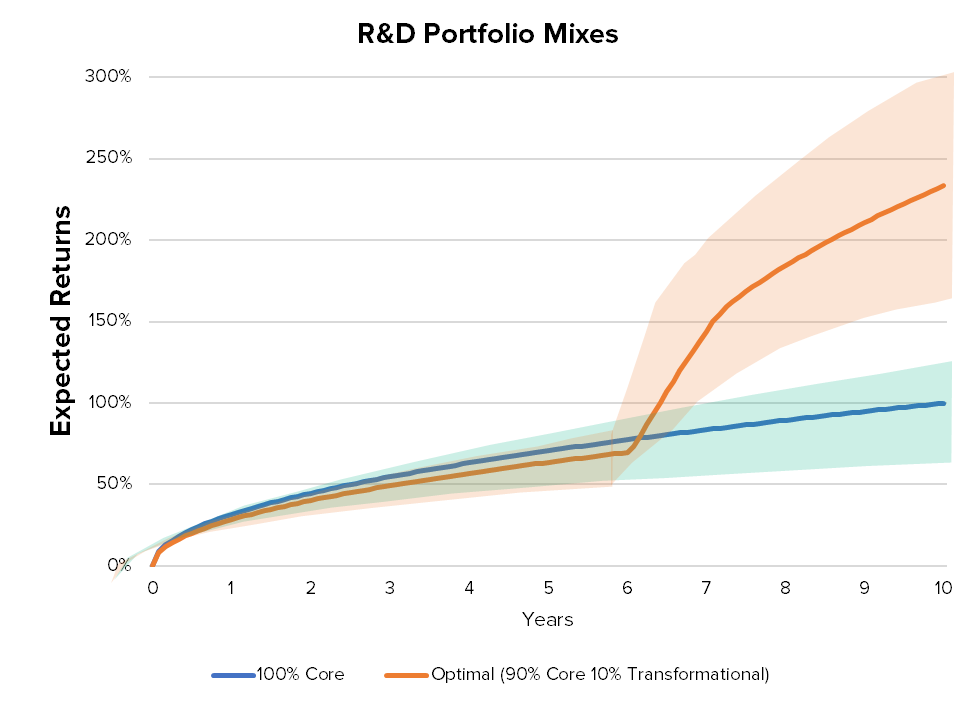

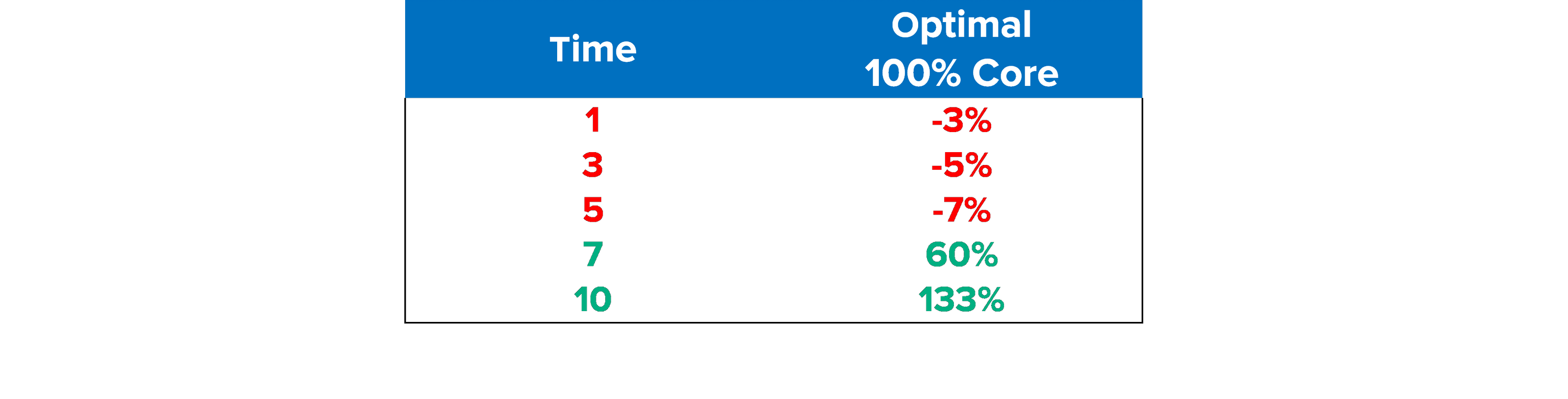

It’s not surprising that CEOs, with a median tenure of five years,15 would tend to overweight short-term projects with more certain return profiles in their R&D portfolios. Indeed, this could be a valid choice for many managers concerned primarily with near term results. As demonstrated in the figure – a management team opting to allocate 100% of their innovation capital to short-term core product innovation would deliver better performance in the first five years as compared to a peer allocating 10% of innovation capital to longer-horizon, potentially transformational projects. But that 100% allocation to short-term projects looks like a mistake for companies and investors with longer time horizons as the returns from that small allocation to potentially transformational innovation starts to materialize. In this model, we assume the average ROI of a firm’s core investment is 10% per year, while the average transformational ROI is several times that, but takes until year seven to meaningfully materialize. For example, an industrials company with a 90/10 split between core and transformational R&D would give up a little over one percent per year in returns over the first five years (as compared to a peer with a 100% core allocation) for the potential to more than double their expected returns over ten years.16, 17

Investors accustomed to thinking about their own portfolios in terms of option value likely find this chart familiar. It’s not uncommon to allocate a small portion of an investment portfolio to a handful of potentially lucrative long-horizon opportunities. This same “option-value” framework could be helpful in thinking about a company’s potential return profile from a mix of innovation investments. Managers and investors concerned with long-term performance can use this modeling to illustrate how companies can be managed with a sustainable growth mindset. Translating that mindset to their capital allocation decisions at the innovation portfolio level is key to solving one aspect of the short-termism problem we find inherent in capital markets today.

So, what can we do to encourage companies and investors to shift their R&D allocations to fund these longer-horizon projects more regularly, bringing innovation portfolios back into balance? Alternative ways to manage and evaluate R&D investments could better insulate long-term projects with good prospects, neutralizing some of the irrational biases that lead to long-term project cuts. Similarly, ways to identify loss-making projects earlier in an attempt to help companies and investors avoid “throwing good money after bad” and succumbing to so-called “long-term bias” could help remove the stigma many long-horizon projects often carry, improving the risk-reward profile of investments in this category. Other solutions could include changing the structure and management of R&D teams, identifying new methods of funding longer-term projects, and ensuring incentives are aligned with delivering returns over time (rather than front loading).

Over the course of the next several months, we plan to continue our work on this question of how to encourage funding of longer-horizon innovation by focusing on development of practical tools and other potential solutions. We welcome thoughtful feedback on our preliminary work and ideas or examples of solutions which have worked well in your experience at [email protected].

3. Note 1974 is the year the accounting treatment of R&D Expense was standardized in the U.S., resulting in comparable reporting treatment. A. Eberhart, W. Maxwell, A. Siddique, “An Examination of Long-term Abnormal Stock Returns and Operating Performance Following R&D Increases,” Journal of Finance, Vol. 59, No. 2, pp. 623-650, December 2002, http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.198.4478&rep=rep1&type=pdf

5. Where ‘economically significant increase’ was defined as was defined as a jump in R&D intensity (R&D expense/sales) from at least 1% up to at least 5%. Y.S. Su, R. Chen, C.C. Chang, “Abnormal Stock Returns and Share Repurchases Following Increases in R&D Expenditures,” Contemporary Management Research, Vol. 5, No. 3, pp. 259-272, September 2009, https://pdfs.semanticscholar.org/16a4/78c47c08e0ac6dd9d44fde63ae9a9f0fb592.pdf.

7. Global spending has gone up by 170% from 2000 to 2016 on an absolute dollars spent basis and also increased as a percentage of GDP – UNESCO’s UIS (UNESCO Institute for Statistics) Database http://data.uis.unesco.org/

10. FCLTGlobal analysis of FactSet data, U.S. listed companies, 2000-2017, using the methodology described for calculating the RQ™ Research Quotient in M.J. Cooper, A.M. Knott, and W. Yang, “RQ Innovative Efficiency and Firm Value,” last revised May 2019, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2631655.

11. FCLTGlobal analysis of FactSet data, U.S. listed companies, 2000-2017 using the methodology described for calculating the RQ™ Research Quotient in M.J. Cooper, A.M. Knott, and W. Yang, “RQ Innovative Efficiency and Firm Value,” last revised 20 May 2019, https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2631655.

12. See for example: A.M. Knott, “Is R&D Getting Harder, or are Companies just Getting Worse at it?” Harvard Business Review, March 2017, https://hbr.org/2017/03/is-rd-getting-harder-or-are-companies-just-getting-worse-at-it. H. Anderson, “Why are the R&D labs so bad?” Network World from IDG, March 2004, https://www.networkworld.com/article/2330813/why-are-the-r-d-labs-so-bad-.html. Jones, Charles I. and John C. Williams. “Too Much Of A Good Thing? The Economics of Investment In R&D,” Journal of Economic Growth, 2000, v5(1,Mar), 65-85. https://www.nber.org/papers/w7283.pdf

15. As calculated by FCLTGlobal using data from Bloomberg for the MSCI ACWI constituents year ending 2017.

16. On the other extreme, while a firm that engages in 100% transformational R&D may end up with higher expected returns in 10 years, the trade-off is zero revenue for the formative years (10% in revenue each year), along with the chance that the transformative R&D projects may fail. Giving up years of steady revenue for a chance to win the lottery will not sit well with the board either – making the optimal allocation a true balancing act, and one that is likely to differ depending on firms’ industry, age and market position. For more, see Nagji and Tuff’s 2012 paper.

17. Of note, the figure shows firms’ revenue generated from the inception of their R&D projects – firms may already have projects much further along in their pipeline. Revenues from year zero could reflect the profile of a start-up, while revenues from years 7-8 could be that of an Amazon-like firm, with the transformational pipeline paying off.

7

7 9

9 11

11