While the overall gaps decreased between the three segments last year, such a trend could be a signal of increased short-term pressures. For example, high household consumption (especially in the United States) drove saver horizons down to their lowest point in our study period. Companies, for their part, held onto more cash and retained earnings and did not allocate more to R&D and capital expenditures, instead choosing to buy back stock – shortening time horizons as a result.

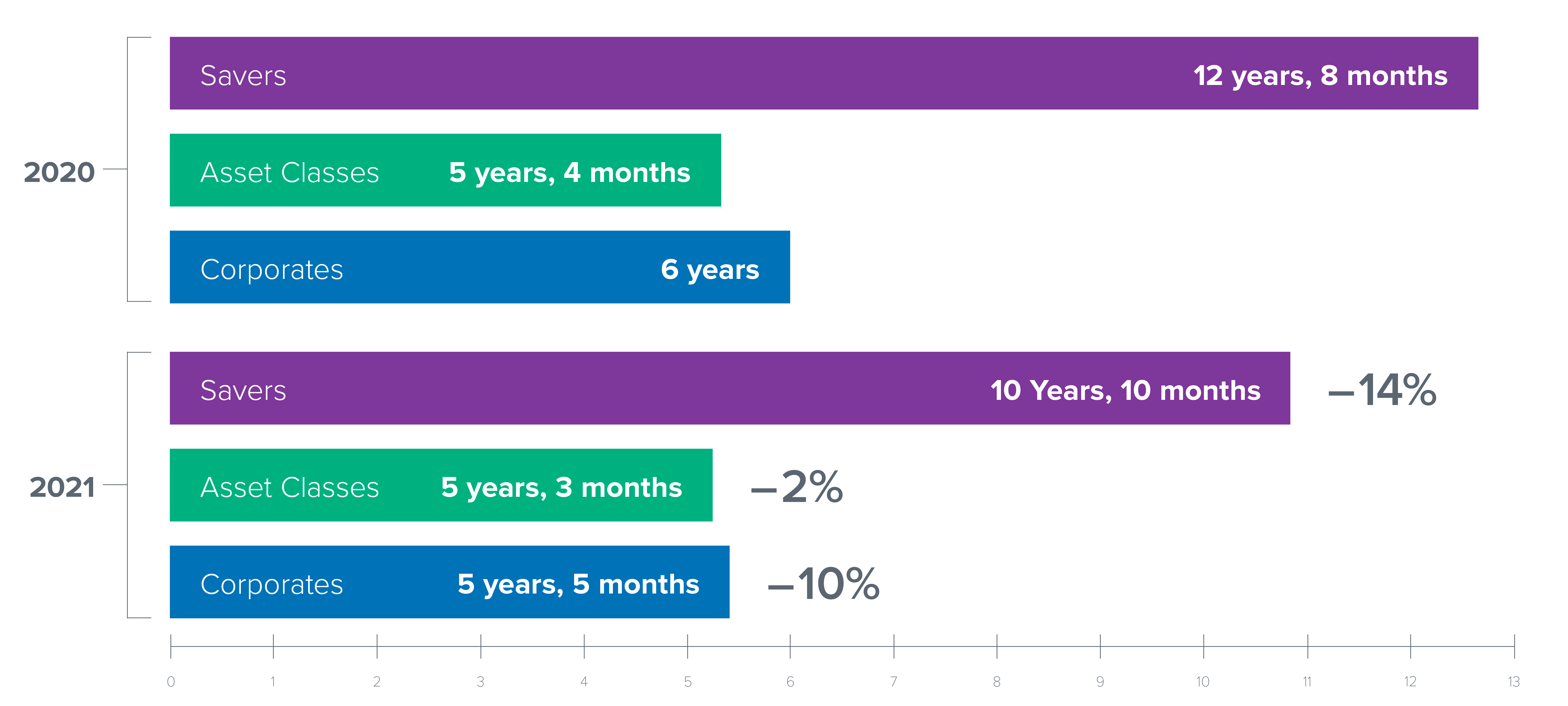

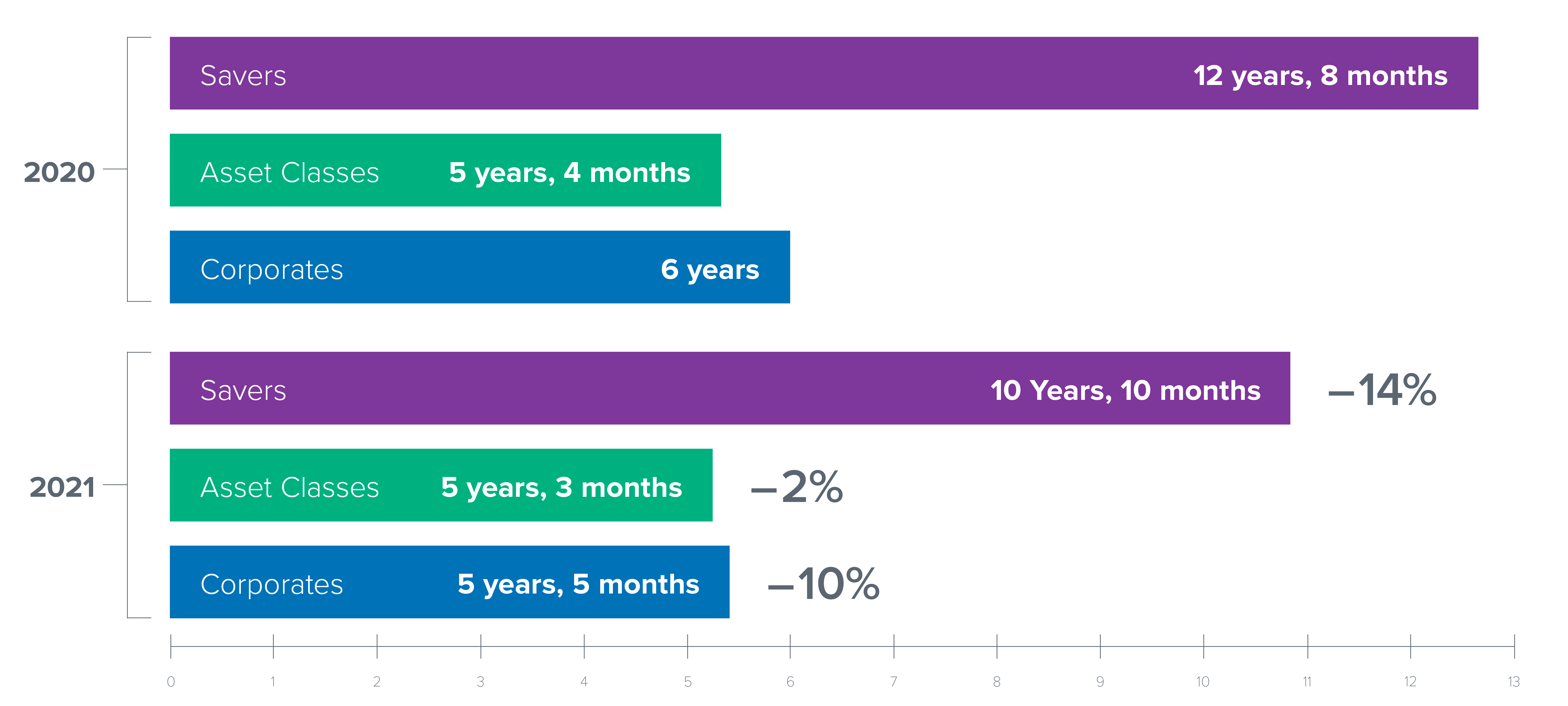

Investment horizons receded in 2021 due to global disruptions such as inflation and COVID-19 recovery efforts. The gap in investment horizons between savers and asset classes shrank by 14% (1 year 9 months). This suggests that markets, and each group in the market, became more short-term in a trend that may indicate a growing sense of caution post-pandemic:

Investors increased allocations to illiquid assets to increase return, leading to comparatively longer time horizons. Due to a high correlation between equities and fixed income, institutional investors looked to generate returns in other ways – mostly in real assets and private equity. Even in the face of increasing corporate and saver short-termism, equity investors recovered, while fixed income became shorter-term, resulting in the 2% decrease overall. Institutional investors are increasingly allocating to real assets (e.g. private equity, venture capital, real estate, infrastructure). While the former trend looks likely to reverse given the markets in 2022, the latter is a trend that will likely persist.

Post-pandemic, companies are faced with the dilemma of saving for resilience or maintaining balance sheet efficiency. Many companies made shorter-term decisions such as:

- Holding significant cash (20% of all capital in 2021 was kept as retained earnings)

- Choosing to return capital via buybacks (+2%, $1.3B overall)

- Under-allocating to R&D (-1%) and CapEx (-6%).

- How these companies are positioning themselves to mitigate long-term risks such as climate change or economic downturns is an open issue.

Preliminary 2022 data reflects continued geopolitical instability. It is too early to determine the impact geopolitical events could have on investment time horizons, but periods of significant stress and volatility often foreshadow cautious investment behaviors and shortening time horizons.

To learn more about this project and view all the data of our recent update, visit our interactive dashboard via the link below.