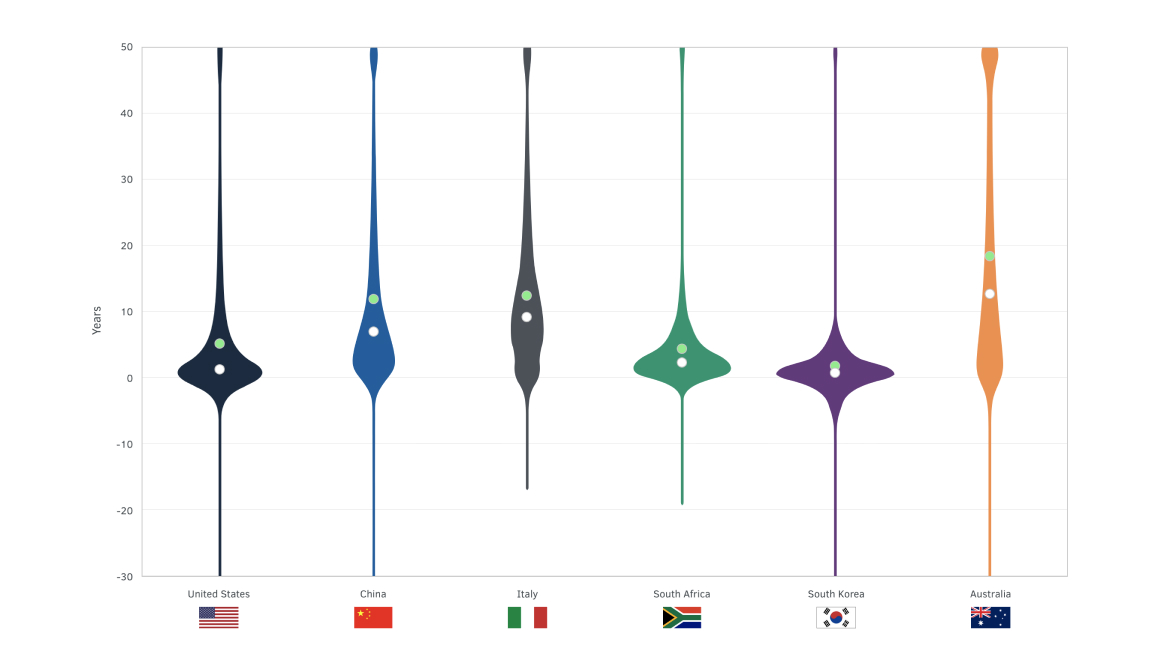

A long-term approach to investment decision-making delivers superior value over time. FCLTCompass measures the investment horizons of the global investment value chain, how households are saving and allocating their money, and how long they can live off those savings. Calculating these metrics provides a holistic understanding of the long- or short-term orientation of global capital markets and how that orientation impacts the financial futures of millions of people worldwide.