New study shows that certain characteristics of company’s board of directors correlates with long-term value creation

New study shows that certain characteristics of company’s board of directors correlates with long-term value creation

Building a long-term culture requires a clear and active commitment from a company’s leadership, as they have the unique stature to establish long-term strategies and support long-term initiatives throughout the organization.

Long-term Habits of a Highly Effective Corporate Board, FCLTGlobal’s latest research on how corporate board’s impact company performance, identifies several established practices boards can employ in order to develop and eventually realize a farsighted strategic plan. These include: spending more time on strategy (regulatory and compliance-related tasks often consume significant board attention); holding company stock through and beyond their board tenure (studies have confirmed that director stock ownership is positively related to firm operating performance); and more direct communication with shareholders (77% of directors agree that direct engagement impacts proxy voting).

But there’s a follow-up question. If the long-term success of a company relies on long-term thinking on the part of its board, what effect does the board’s actual makeup and diversity, or lack thereof, have on a company’s prospects for creating value over the long term?

There have been several studies to date that explore the connection between diversity and productivity, and the evidence is compelling. Using a multi-dimensional measure of diversity combining ethnicity, age, gender, education, financial expertise, and prior board experience, Bernile, Bhagwat and Yonker (2017) found that greater board diversity correlates with lower stock price volatility, more consistent investment in R&D projects over time, and better performance overall. In a separate study, Carter, Simkins and Simpson (2003) examined the relationship between board diversity and firm value for Fortune 1000 firms, and after controlling for size, industry, and other corporate governance measures they found significant positive relationships between a company’s value and the contingent of women or minorities on a company’s board.

FCLTGlobal’s own research has confirmed this assessment. When looking at MSCI ACWI firms between 2010 and 2017 through a lens of both age and gender diversity, we found that the most diverse boards added 3.3% to return on invested capital (ROIC) as compared to their least diverse peers. With regard to gender diversity in particular, our analysis found that companies with the most gender diverse boards outperformed the least diverse in terms of ROIC by 2.6%.

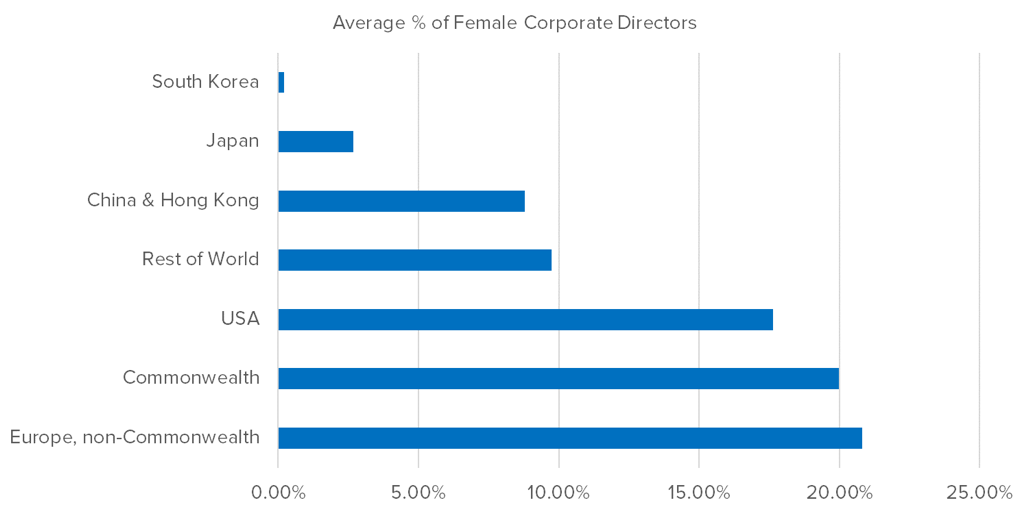

Despite the empirical evidence, greater gender diversity on boards has not yet become a global norm and the average percentage of female directors per board varies greatly across developed economies.

It is important to note that several areas included in this study have regulations in place that require a certain degree of gender diversity on corporate boards: France, Austria, Norway and Italy have minimum requirements for female directors. Commonwealth countries, including New Zealand and select Canadian provinces, have installed similar guidelines. In the U.S., California recently set quotas for female members on the boards of publicly traded companies headquartered in the state.

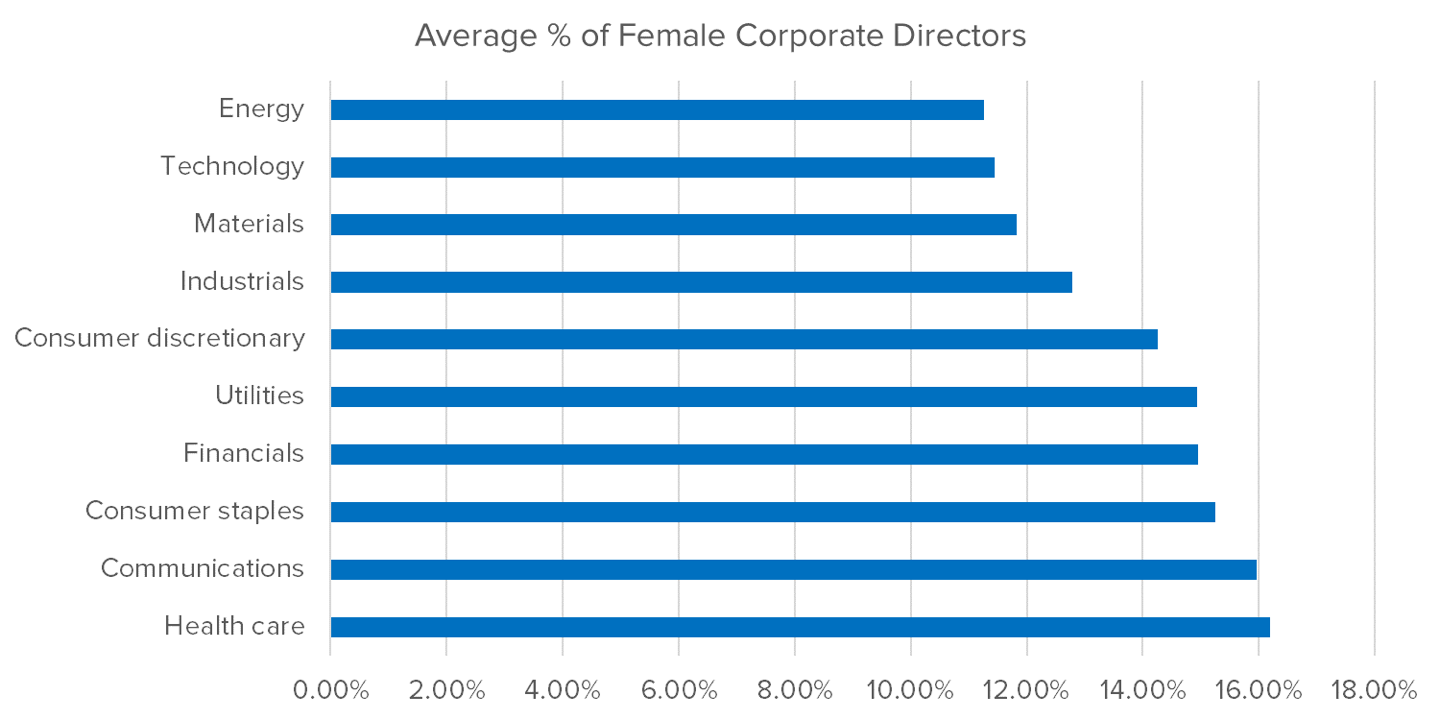

Across industries, the disparity is far less pronounced:

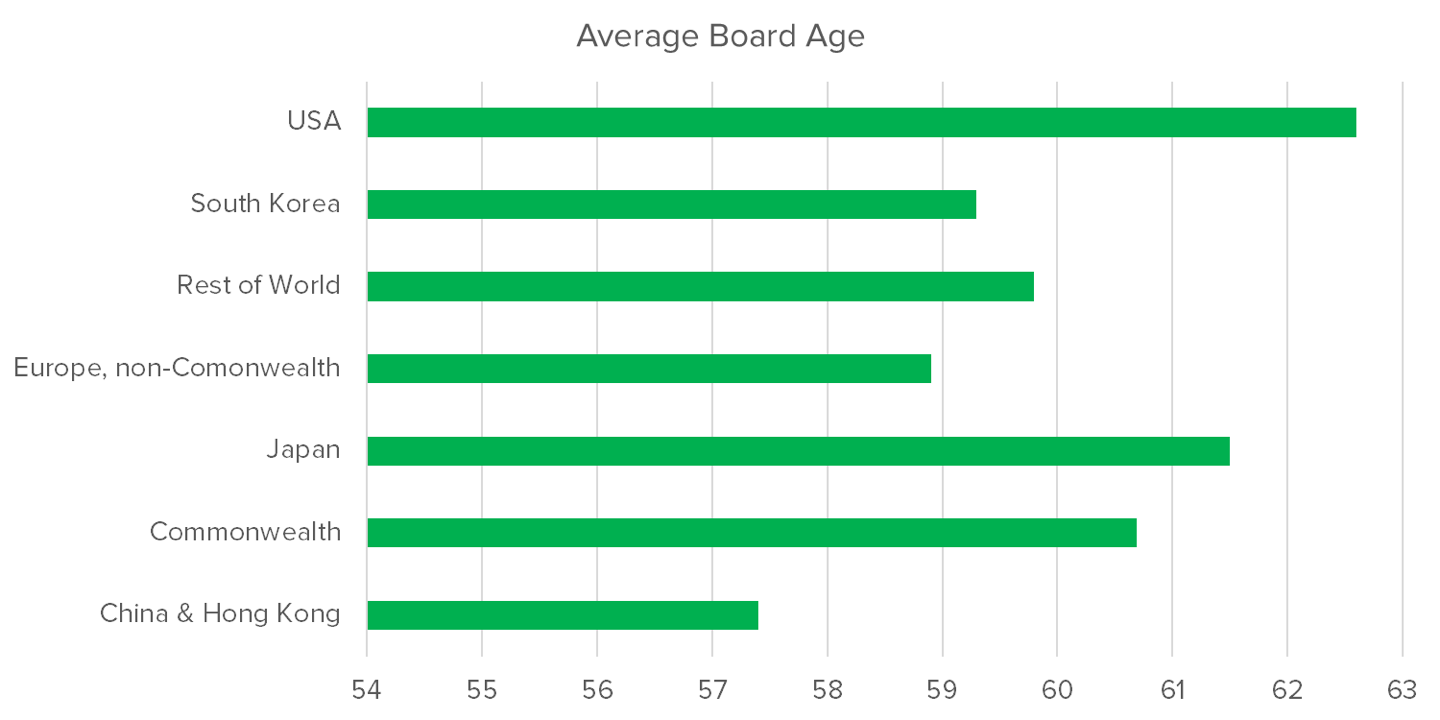

Similar trends were found when looking at age diversity among corporate directors. Anecdotal evidence suggests a correlation between adding younger directors and company outperformance, and FCLTGlobal’s own data analysis bore this out. Taking the same sample of MSCI ACWI companies between 2010 and 2017, a regression analysis has revealed a correlation between a lower average age of a company’s board and greater ROIC. The same analysis also drew connections to markers of long-term value creation – companies with younger boards tend to allocate more funding to both capital expenditures and fixed assets.

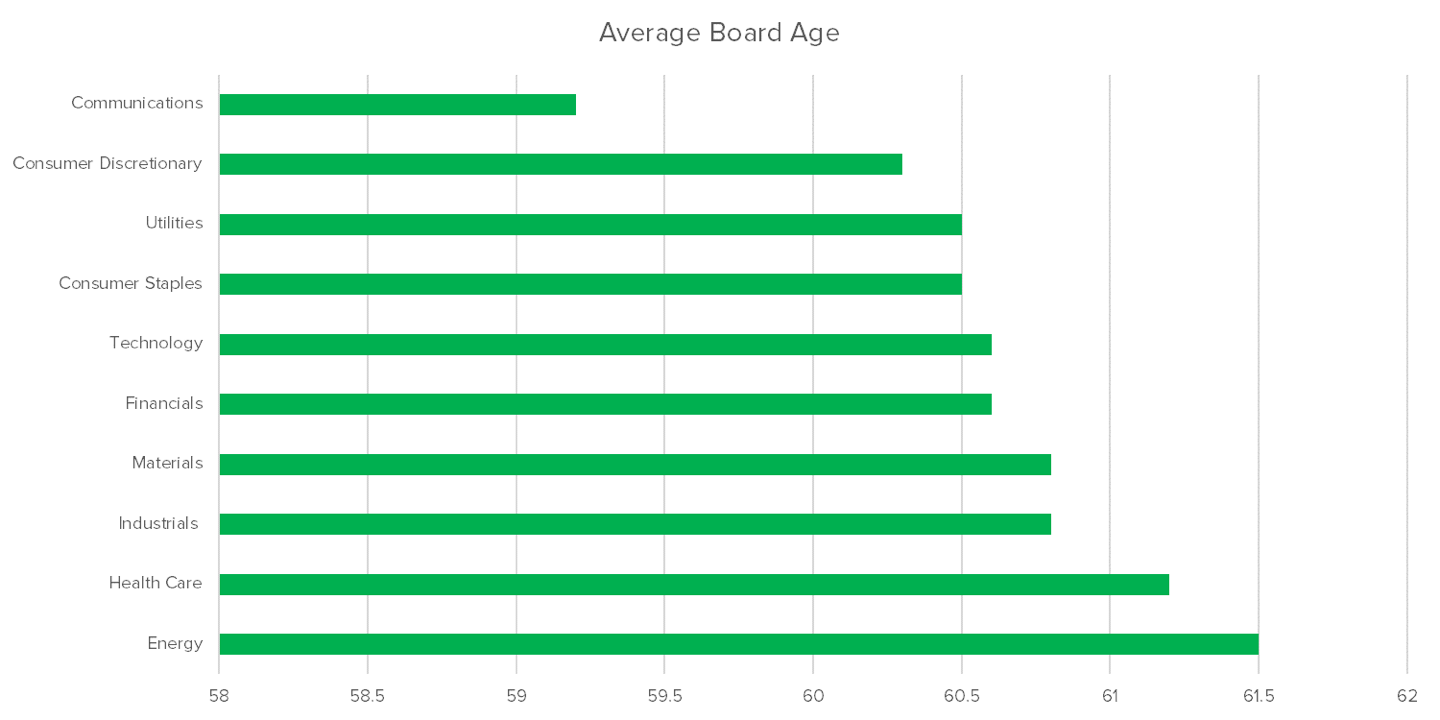

Again, it appears that despite evidence to the contrary, the wider business community has yet to adopt this outlook when filling board seats. The average age for directors at the companies included in our study was just above 60, and only 2% of boards had an average age below 50. We do not see the same global and sector disparities in director age that we encountered when examining director gender, with a range of 5.2 years regionally and 2 years across industry:

It should be noted that age is heavily correlated with tenure in our study, but limiting mechanisms are gaining popularity in an effort to stem boardroom entrenchment and encourage more frequent turnover. In theory, this would also in effect lower average board age.

Corporate boards’ unique position allows them to shape corporate ethos from the top down. And creating a diverse board ensures a variety of perspectives among board members that can unearth new approaches and opportunities for the business, and instill a longer-term outlook and culture.

Do you have experiences as a member of, or working with, a highly diverse boards of directors? Have you identified direct ties between board decision-making and company performance? Please feel free to share with us by contacting our Research staff. To learn more about the impact of long-term corporate boards, read our recent whitepaper, Long-term Habits of a Highly Effective Corporate Board.