Boards and executives of long-term funds, such as pension plans, sovereign wealth funds, and endowments need to manage their portfolios to meet their long-term purpose, which may be decades or more into the future.

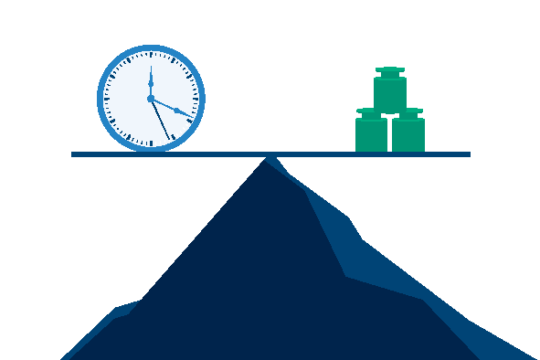

Yet no fund has the luxury of looking only to that long-term time horizon. Each must also meet expectations in the near term in order to continue in its role and with its investment strategy. This challenge of meeting both long-term obligations and short-term expectations means that even the longest-term investor must manage across multiple time horizons. This necessity is often at odds with most risk processes, which have been developed to address short-term risks or to target long-term return—but not both.

FCLTGlobal, with input from its members, which include many of the world’s leading asset owners and investors, has raised this challenge as central to their ability to take advantage of their long time horizons. Too often, funds carefully set up long-term investment strategies, with a focus on meeting their ultimate purpose, only to shift to a short-term strategy in response to stressful market conditions.