Global companies recognize the many advantages to creating a long-term plan which sets out a clear forward-looking perspective on growth, risk and capital allocation for investors. Such plans provide a holistic view of economic drivers and strategic goals, help ensure that all stakeholders have a firm grasp of company strategy and enhance shareholder belief in long-term opportunities, in the face of short-term pressures.

One example is FCLTGlobal member GlaxoSmithKline plc (GSK), a science-led global healthcare company headquartered in Brentford, UK. Established in 2000 by a merger of Glaxo Wellcome and SmithKline Beecham, today GSK generates upwards of £30 billion in annual revenues and employs over 98,000 people worldwide. The company has three global business segments that research, develop and manufacture pharmaceutical medicines, vaccines, and consumer healthcare products.

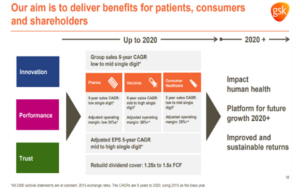

In March 2017, Emma Walmsley, GSK’s newly-appointed CEO, set out a new plan guided by three priorities to deliver sustainable long-term growth – “Innovation, Performance, and Trust”. All three businesses are aligned to these long-term priorities, and work to one capital allocation framework (pictured left) and one set of KPIs.

Taking a disciplined approach to executing her strategy matters to Walmsley, who told Fortune in June: “The way I define the [CEO] job is, firstly, in setting strategy for the company, and then leading the allocation of capital to that strategy—because until you put the money where you say your strategy is, it’s not your strategy.”

Before launching her strategy, Walmsley spent time gathering feedback from many GSK employees and a range of external stakeholders, including investors, on the company’s strengths and areas of opportunity. An updated approach to investor engagement was one of the outputs of this extensive listening program.

With full support from the Board and the management team, Walmsley’s strategy was introduced in its full detail at GSK’s Capital Markets Day in July 2017. Since then, the company has updated shareholders on both an annual basis with investor events and R&D updates, and on an interim basis during quarterly reporting periods. Walmsley also discussed GSK’s long-term roadmap at CECP’s 2018 CEO Investor Forum.

GSK’s roadmap begins by laying out the core drivers of its business. Chief among the company’s priority activities are executing new product launches, driving sales of existing treatments, investing rigorously in scientific research including in-house R&D and strategic business development, and distributing returns via dividends. All of these activities are positioned in the context of the longer term plan. This roadmap is valuable for investors, giving them a framework to understand where the company is headed, and what it will take to get there successfully. It also helps ensure employees can connect changes in their immediate business units to a broader picture.

GSK translates trust into strategy by emphasizing that running their business in the right way, putting patients’ and consumers’ interests first and seeking to make a positive impact to society, is vital to their long-term success. They have set out a prioritized approach here which focuses on three areas: “using their science to address unmet health needs, particularly for the world’s most vulnerable populations; making their products affordable and available, with responsible and sustainable pricing and access strategies; and being a modern employer for their global workforce.”

Well-structured roadmaps like GSK’s set out multi-year KPIs and a tangible set of actions that allow investors to track progress toward them. They include targets that the company can provide expectations for, and over which they have a reasonable degree of control.

GSK has laid out aggressive yet realistic targets for each of its groups – Pharmaceuticals, Vaccines, and Consumer Healthcare – across Innovation, Performance and Trust, carrying the company through 2020 and beyond.

Mel Foster-Hawes, VP Investor Relations commented on the challenge with setting such targets – “When sharing long-term information companies need to balance the benefits of disclosure with the risks of sharing competitive insight. At GSK we manage that tension by signaling key inflection points in the business and sharing detail around those, to build credibility for the strategy.”

A long-term roadmap should convey a company’s strategic objectives and inform investors on how the leadership plans to achieve those objectives. Whether this includes numerical KPIs, focal points for specific business units, or directional shifts across the organization, sharing tangible forward-looking information with shareholders can help inspire committed investment behavior. In the case of GSK, since unveiling their roadmap the company has seen new longer-term oriented investors take an interest in the business for the first time – proof positive that their approach is resonating with the company’s target audiences.

Building on our research on long-term corporate-investor relations, FCLTGlobal will publish a whitepaper later this year that continues to explore the dynamic between corporations and their investors and shares how strategic roadmaps can make this touchpoint more transparent. Visit our Research section to learn more about our work on long-term plans and strengthening the investor-corporate dialogue.

Consumer Healthcare Update, London UK. 27 Mar. 2018. https://www.gsk.com/media/4780/consumer-healthcare-update-analyst-call-slides.pdf

Annual JP Morgan Healthcare Conference, San Francisco USA. 9 Jan. 2018. https://www.gsk.com/media/4561/2018-jpm-emma-walmsley-presentation.pdf

Consumer Healthcare investor event, New Jersey USA. 21 Sept. 2018. https://www.gsk.com/media/5106/consumer-healthcare-investor-event-slides-sept-2018.pdf

Investor Event, London UK. 26 Jul. 2017. https://www.gsk.com/media/3882/simon-dingemans-q2-and-financial-outlook.pdf