Developing a committed shareholder base is crucial to long-term success. Companies with a longer-term-oriented shareholder base can rely on their long-term shareholders to insulate them from short-term pressures.

Bunge, a leading agribusiness and food company, transformed the composition of its shareholder base between 2018-2023 through a combination of long-term-oriented strategies, including wholesale changes to its operating model, risk management philosophy, and commitments to sustainability. Overlaid with increased transparency in messaging and communications, Bunge was able to develop its long-term strategy while addressing investor concerns.

Towards the second half of the 2010s, Bunge experienced a period of financial turbulence due to unfavorable market dynamics as well as company-specific decisions. By late 2018, the company was under acute stress which led to board and leadership turnover. When new CEO Greg Heckman took the helm in early 2019, the shareholder base had eroded. Short-term, transient investors represented close to a fifth of Bunge’s underlying shareholder base. Moreover, there was substantial turnover among its top shareholders.

Fig. 1a and 1b

Bunge was able to completely transform its shareholder base in a few years (Figure 1b): today, short-term investors now only represent 7% of the shareholder base while long-term oriented investors now make up 52% (Figure 2), with indexed investors making up nearly one-third of its shareholders after its inclusion in the S&P 500 in early 2023.

Fig. 2

|

Investment Horizon |

2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|

Long term |

42% | 49% | 50% | 59% | 53% | 52% |

|

Index |

24% | 26% | 23% | 24% | 25% | 32% |

| Short term | 19% | 12% | 12% | 9% | 11% |

7% |

| Other | 15% | 13% | 14% | 8% | 11% |

8% |

How was Bunge able to achieve this transformation?

While companies cannot pick the shareholders they want, there is evidence to suggest that companies can influence the composition of the shareholder base by combining focused, long-term strategies, with transparent, robust, and timely investor engagement. Companies that issue quarterly guidance and provide investors with information on near-term earnings targets are more likely to attract short-term investors, whereas companies that articulate a long-term strategy – outlining clear operational, sustainability, and risk management frameworks – can build a base of long-term oriented investors.

Centralizing Core Operations and Risk Management

When Heckman took the reins as CEO in 2019, he took a number of steps to change the company’s approach in key areas. First, he went on a listening tour, receiving constructive feedback from employees and top shareholders. Bunge updated its decision-making in three ways:

- Focusing on wholesale firm growth: Bunge shifted away from its old regional model where each region had the autonomy to maximize its performance for the region, rather than Bunge as a whole.

- Divesting non-core businesses: Bunge reassessed and focused on streamlining its core operations, proceeding to divest over $1 billion in non-core businesses.

- Adopting a new risk management philosophy: Bunge aligned risk management with the underlying earnings power of the assets, taking into account the current market environment.

By adopting a global, long-term-focused operating model aligning key segments of the value chain, Bunge was able to more effectively create value and communicate its organizational values and corporate purposes to its shareholders.

Sustainability

Another topic highlighted by investors was sustainability. Much of Bunge’s core business is tied to agricultural commodities, and demonstrating commitment to sustainability was important to investors.

Bunge had set some of its initial sustainability goals, such as a pledge to end deforestation in its supply chains in 2025, as early as 2015. In addition, since 2019, Bunge has also committed to approved science-based targets (SBTi) for scopes 1, 2, and 3 carbon reductions by 2030.

After setting initial sustainability goals, firms then must also back up their talk with action. Substantial progress has been made on both deforestation and carbon reduction goals since Bunge’s initial commitments, and the company expects to meet both goals. Then Heckman went a step further – integrating sustainability into Bunge’s new operating model and strategy, as well as elevating the chief sustainability officer role into a direct report.

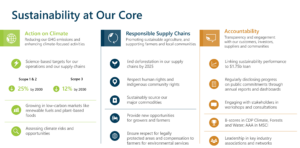

Figure 3 below illustrates how Bunge publicly communicates key sustainability metrics to its shareholders: action on climate, responsible supply chains, and accountability to its stakeholders.

Fig. 3

Communication

In addition to long-term operational, risk management, and sustainability frameworks, the last key ingredient is communication – via transparent investor engagement. Instead of seeking to appease all shareholders, Bunge’s engagement strategy has been twofold:

- To focus on speaking with, understanding, and addressing the primary concerns of its long-term shareholders (and responding to these concerns appropriately),

- To actively promote its long-term strategy through tailored communication, treating the growth and cultivation of a long-term shareholder base as a key component of its core business strategy.

While companies cannot pick and choose who their exact shareholders are, Bunge’s evolution over the past few years has demonstrated that long-term shareholders will inevitably be drawn to value-creation strategies that are aligned with their investment horizons. The company that does not communicate its strategy holds no more sway than the company that does not have one. Companies can attract the committed long-term shareholders they desire by exemplifying and endorsing long-term behavior themselves.