From the push to reduce carbon emissions, to the regulation of environmental, social and governance (ESG) issues, to gender parity on corporate boards, investors are increasingly factoring climate change and other sustainability risks into their decision-making. Against that background, MSCI ESG Research launched the 10 ESG Questions Project, which explores challenges that could affect the investment landscape over the coming decade.

The 10 questions are:

- Who will lead the race to cut carbon?

- What if antibiotics stop working?

- What if public companies stay privately controlled?

- What if we can’t balance people and planet?

- What if ESG risks transcend politics?

- What if gender parity is out of reach for corporate boards?

- Who will regulate ESG?

- What if we cut down all the forests?

- What if ESG disclosures become standardized?

- Who cares about the UN Sustainable Development Goals?

The project draws on MSCI ESG Ratings and metrics along with datasets covering climate change and other sustainability controversies for nearly 14,000 listed companies to illustrate how ESG considerations can help investors build better portfolios.

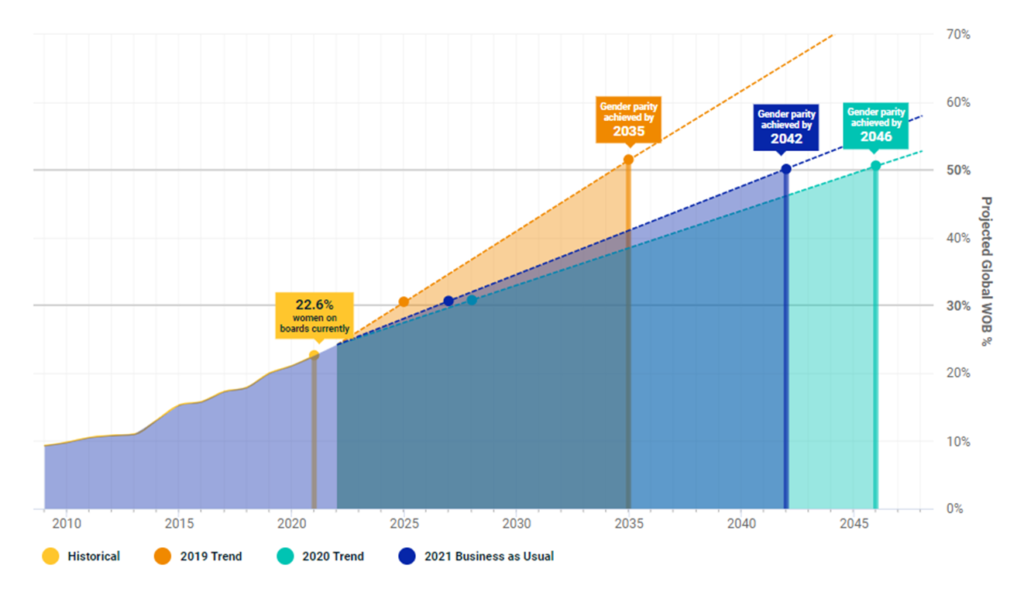

To determine whether gender parity is out of reach for the boards of listed companies, for example, researchers modeled when such boards might comprise equal numbers of women and men, based on three different scenarios.

When corporate boards could reach gender parity[i]

If the rate of increase in recent years continues (“business as usual”), it could be 2042 before there are equal numbers of men and women on corporate boards. Achieving the goal sooner would require an increase in the number of board seats that open each year and/or the appointment of women to a higher percentage of the seats that become available. Our research has found that companies with a critical mass of women on their board have been more likely to manage talent effectively, to innovate, to emit less carbon, and to outperform peers with less diverse boards.

The 10 ESG Questions Project highlights the value of ESG and climate data in analyzing the potential long-term resilience of companies to financially relevant environmental, social and governance risks and other macroeconomic trends.

We continue to update the findings, which inform the questions that MSCI researchers will examine as the decade unfolds.

[i] Source: MSCI ESG Research, November 2021. Universe: MSCI ACWI Index. Business as usual 2021 assumes a constant annual increase of 1.3% in the number of female directors, based on the average rate of increase in the number of women directors in the period 2018 to 2021.