Changes to SEC regulations will change the way companies disclose how they invest in their employees.

Changes to SEC regulations will change the way companies disclose how they invest in their employees.

By Ariel Babcock CFA, Allen He CFA, and Devin Weiss

Intuitively, many companies understand the importance of strategically investing in their employees. Past academic research has found employees contribute materially to the long-term value creation of a corporation. For instance, the “100 Best Companies to Work in America” had significantly higher stock returns than industry averages. Higher firm investment in intangible assets is associated with higher revenue, and strong relationships have been demonstrated between employee satisfaction, productivity, and loyalty to the consumer base.

Given the links between employee support and firm performance, investors have cast increasing importance on companies’ disclosures of human capital metrics. In the U.S., the Securities and Exchange Commission has begun to regulate the matter. With the modernization of Regulation S-K, the SEC has signaled to companies the importance of keeping track and disclosing vital human capital metrics. This move has the potential to shake up the disclosure landscape amongst public companies in the U.S., and it is the first time in thirty years that these requirements have undergone significant changes.

Despite the growing momentum around human capital metrics, disclosure coverage has remained sparse. Prior research has identified six metrics specific to the measurement of human capital that institutional investors need to make informed investment decisions. And while companies have shown meaningful improvement in this area over the past several years, the current disclosure rate among members of the MSCI ACWI remains low, with none of the six metrics topping 50%:

Average disclosure rates by human capital metric 1

| Metric | Disclosure rate (2019) | Disclosure rate (2021) |

|---|---|---|

| Personnel turnover | 37% | 45% |

| Leadership diversity | 38% | 49% |

| Gender pay gap | 5% | 12% |

| Employee health and safety | 28% | 32% |

| Employee training | 33% | 42% |

| Monetary losses from legal proceedings | N/A | N/A |

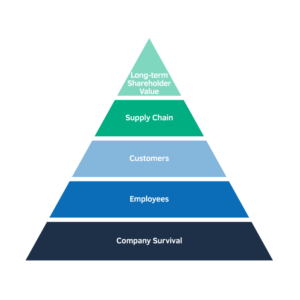

“Human capital” encapsulates the idea that employees, and all stakeholders, bring their own important contributions to a company, and the company prioritizes meeting their needs in return. Successful long-term companies consider the needs of various groups of stakeholders both internal and external to the organization. Still, our model (below) places employees at the center of the pyramid, emphasizing the integral role they play.

A Hierarchy of Stakeholder Needs

Especially in times of crisis, forward-looking companies have demonstrated that they take the responsibility of doing right by their employees seriously – in a survey of FCLTGlobal’s members administered at the onset of the pandemic—89% of organizations indicated that their top priority was the health and safety of their employees.

Especially in times of crisis, forward-looking companies have demonstrated that they take the responsibility of doing right by their employees seriously – in a survey of FCLTGlobal’s members administered at the onset of the pandemic—89% of organizations indicated that their top priority was the health and safety of their employees.

The past year and a half amid the pandemic saw organizations across the global investment value chain work diligently to maintain the health and wellbeing of their employees. As this trend continues with the SEC’s revisions to Regulation S-K, human capital metrics will remain as a leading indicator of superior long-term performance.

1. Refinitiv analysis of MSCI ACWI data. Note that monetary losses from legal proceedings is not yet a well-defined field on Refinitiv or other similar data platforms.

Policy and Geopolitics, Metrics | Article

25 October 2019 - The U.S. Securities and Exchange Commission has proposed amendments to corporate disclosures to include tangible measures human capital objectives.

Metrics | Article

3 January 2020 - A new step towards integrating long-term metrics in investing.

Stakeholder Capitalism | Article

21 April 2020 - Amid unforeseen circumstances, how do companies prioritize their stakeholders?