Upcoming work follows 2018 report “Balancing Act: Managing Risk Across Multiple Time Horizons”

Upcoming work follows 2018 report “Balancing Act: Managing Risk Across Multiple Time Horizons”

By Matthew Leatherman and Allen He

Boards and executives of long-term funds, such as pension plans, sovereign wealth funds, and endowments, have a challenging problem. They need to manage those portfolios to meet their long-term purpose, which may be decades or more into the future. Yet no fund has the luxury of looking only to that long-term time horizon. Each must also meet expectations in the near term in order to continue in its role and with its investment strategy.

Currently, investors tend to treat risk management as tradecraft – expert, but repetitive – and neglect the critical thinking required to tailor their risk management to their organization’s purpose. As a result, nearly all of these critical decisions are made by defaults encoded into statistical formulas. The problem is many of these formulas default to a short-term frame.

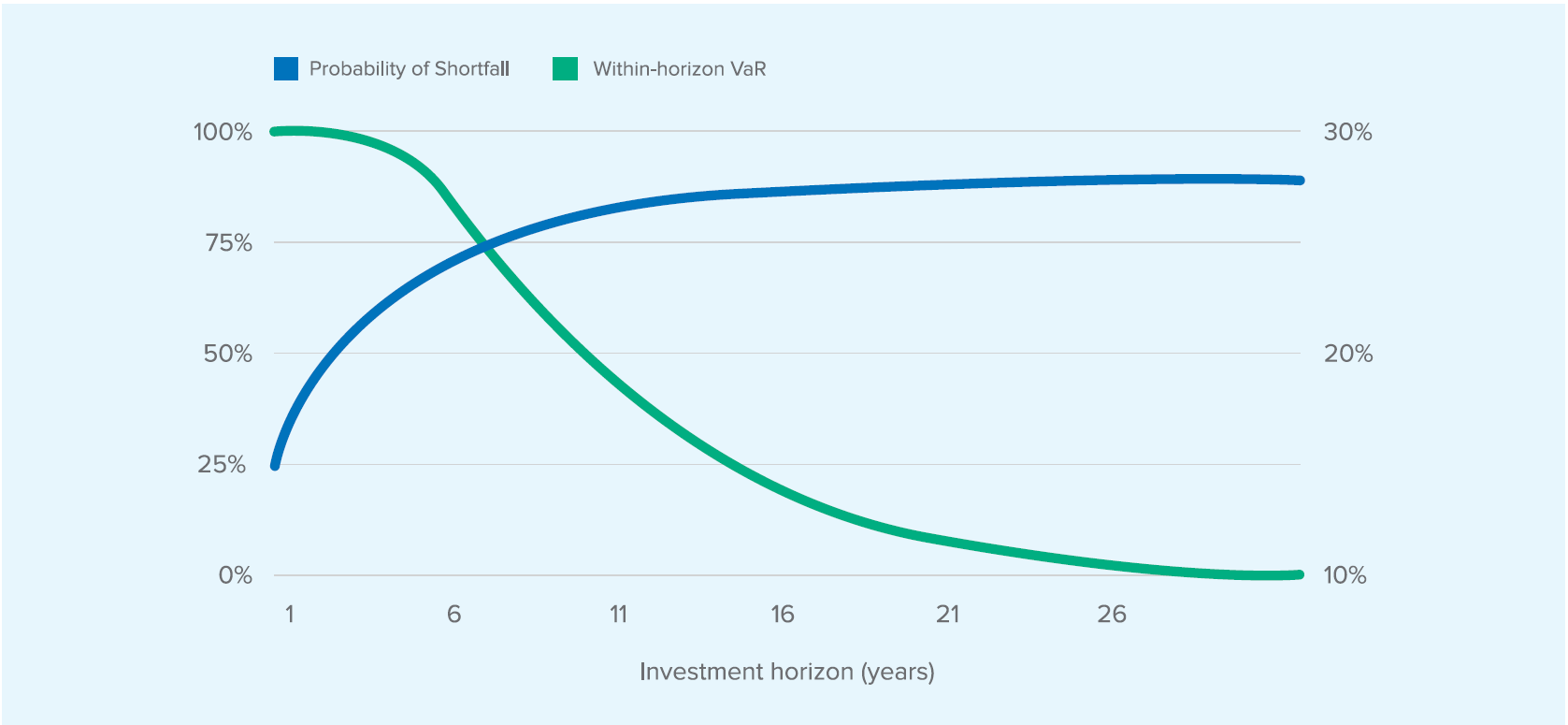

There are common short-term assumptions around annualized monthly volatility (GIPS), within-horizon risk, the normal distribution, and Value-at-Risk (VaR), all of which make sense in general, but may be less accurate for long-term investors. These defaults can each be summarized through the following flight-path metaphors:

In addition, there is a growing body of work that already challenges the status quo, urging risk professionals not to take the default assumptions for granted.

Trade-off of shortfall and potential drawdown

Since our initial work on risk, we have found that there are some potential hurdles to implementation. Simply spreading the word about default inputs is not enough: the framing must shift so that long-term investors are inspired to make change. Such hurdles include:

Through the second phase of our risk research, FCLTGlobal hopes to learn from members why implementation is not happening, what is needed to increase it, as well as to draft a list of hypothetical tools to change behavior. Preliminary tools being considered include, but are not limited to, real-life case studies of portfolio changes, introductory educational videos, fill-in-the-blank templates, and a primer document comparing and contrasting default vs. alternative risk measurements.

If you have any thoughts relevant to the adoption or implementation of long-term risk measurements, or questions about our work, please contact [email protected].

Risk and Resilience | Article

25 January 2021 - In a decade-long low interest rate environment, riskier asset classes have seen accelerated asset gathering as savers chase yield.

Risk and Resilience | Report

21 December 2018 - Boards and executives of long-term funds, such as pension plans, sovereign wealth funds, and endowments, have a challenging problem. They need to manage those portfolios to meet their long-term purpose, which may be decades or more into the future. Yet no fund has the luxury of looking only to that long-term time horizon. Each must also meet expectations in the near term in order to continue in its role and with its investment strategy.

Risk and Resilience | Article

7 April 2020 - Events of the past century tell us that markets almost always recover in the long run. This does not mean that investors should ignore short-term circumstances, nor does it mean they should abandon well-crafted plans for the future. Recent research and anecdotes from global investors confirm that flexibility is key for institutional investors, whose objective is to manage risks and return in portfolios across multiple time horizons. Even those plans with decades-long liabilities must confront the concerns of the moment. Outlining the purpose, goals and parameters...