Few companies take too many moonshots. Most R&D portfolios take too few.

Few companies take too many moonshots. Most R&D portfolios take too few.

By Allen He

As noted in Funding the Future: Investing in Long-Horizon Innovation, it can sometimes be shrewd for investors to consider their portfolio companies’ research and development (R&D) pipelines as a series of options. Doing so can provide an alternative way of valuing a company and may help reveal a differentiated view of a company’s potential upside from R&D investment.

R&D pipelines share several similarities with call options, chief among them their value pertaining to volatility and time to maturity. A chronic problem discussed in Funding the Future is that management teams believe investors only recognize current successes while neglecting future potential, often by assigning heavy discounts to uncertain future projects and cash flows. This has resulted in R&D portfolios falling out of balance. Management prioritizes sure-handed, short-term projects over long-horizon moonshots to deliver the most immediate value, even though long-term transformational projects bring in the majority of a firm’s profits in the long run.

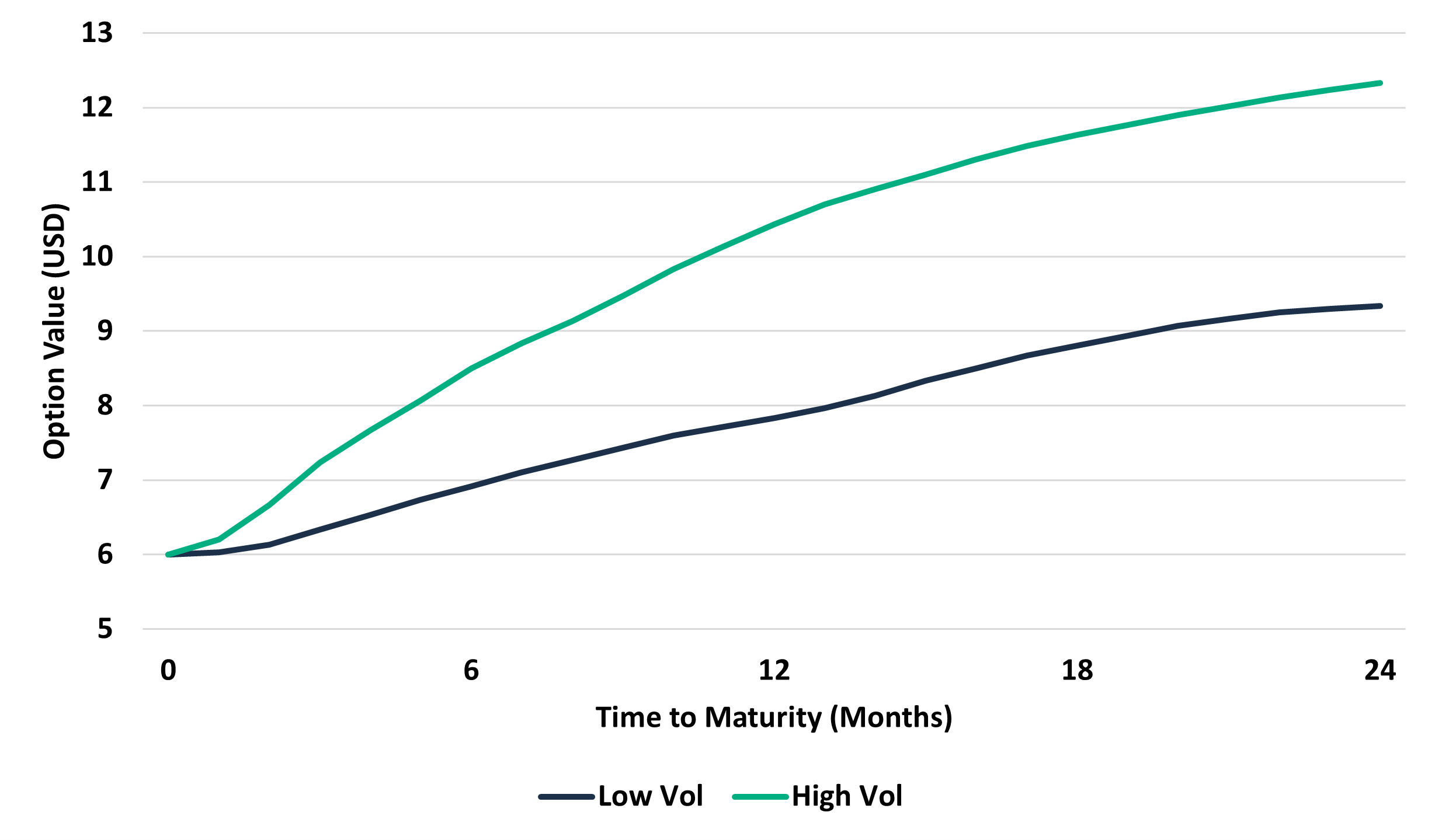

If instead, investors look at their portfolios through an option-pricing lens, the payoff of long-horizon transformational R&D projects becomes clearer. According to the Black-Scholes formula, the price of a call option is a function of (among other things) time and volatility. If we think of the time spent to bring a product to market as an option’s time to maturity, then all else equal, longer-horizon (transformational) projects should be valued higher compared to their shorter-term counterparts. The greater the time to maturity, the greater the potential value of a call option.

Option value as a function of time and volatility

Likewise, another point that may be counter-intuitive to an investor is that greater volatility can mean greater value. Black-Scholes again tells us that the greater the volatility, the greater the price of an option. Oftentimes, volatility is viewed only as risk on the downside, a manifestation of “what could go wrong”. However, the downside is only half of a distribution: we commonly forget the upside that high-risk, high-reward projects can have. While there may be substantial risk betting on one project, when we consider a company’s R&D portfolio as exposure to a series of options/projects, then much of the risk gets diversified away. There is a far greater chance that at least one of the many high-risk, high-reward projects in the R&D pipeline of a company or portfolio of companies will be successful. As seen in our previous case study1, long-horizon R&D projects often have asymmetric returns: one large payoff can often make up for the losses of several unsuccessful bets.2

It is worth noting, however, that above all, companies and investors need to find a balance between short-term projects with a high probability of success and long-term moonshots with high payoff potential. Dedicating all of your resources to moonshots is like buying a series of long-dated, out-of-the-money calls: taking on many bets with long-term potential, but little to show for in the short and medium-term. On the other hand, investing only in short-term projects is like buying a series of in-the-money calls that are about to expire: lower risk, higher probability of payoff, but limited upside in value. While the optimal balance differs by industry, jurisdiction, and market size (among other things), it is worth noting from our research that very few companies take too many moonshots – the majority of R&D portfolios take too few.

By adopting an options-based mindset, investors can take a more balanced approach to evaluating their portfolios. Rather than seeking immediate returns, investors taking this approach could engage with companies and encourage them to dedicate more of their R&D portfolios to longer-horizon projects. Doing so could lead to more companies taking a similar mindset, shifting corporate investment behavior. Instead of pointing the finger at each other, investors and companies both stand to gain from working together. More balanced corporate R&D portfolios can yield better long-term returns3 and stimulate economic growth in society.

For an interactive look at how risk/return tradeoffs can differ with allocations over time, visit FCLTGlobal’s R&D Scenario Engine page.

As always, if you have insights, information, or further data relevant to this study, please contact FCLTGlobal’s research staff by emailing research@fcltglobal.org.

1. Case Study: Funding Long-horizon Innovation at Baillie Gifford, FCLTGlobal, October 2020, https://www.fcltglobal.org/resource/case-study-funding-long-horizon-innovation-at-baillie-gifford/.

2. See Bessembinder, Hendrik. “Do stocks outperform Treasury bills?.” Journal of financial economics 129, no. 3 (2018): 440-457.https://www.sciencedirect.com/science/article/abs/pii/S0304405X18301521.

3. See Bessembinder, Hendrik. “Extreme Stock Market Performers, Part III: What are their Observable Characteristics?.” July, 2020. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3657611.