Globally, companies have increasingly favored buybacks over the past two decades, so much so that they have nearly surpassed dividends as the most utilized means for companies to return capital to their shareholders.

Globally, companies have increasingly favored buybacks over the past two decades, so much so that they have nearly surpassed dividends as the most utilized means for companies to return capital to their shareholders.

By Allen He

However, the acceptance of buybacks has not been unanimous. Academics, practitioners, and politicians have criticized their use, taking issue with their potential contribution to income inequality, underinvestment in innovation, and use by executives for personal gain. Buybacks and their implications for the long-term strength of the economy remain controversial while not yet fully understood.

Cash-rich industries, and specific companies, tend to invest proportionately more in buybacks. In 2007, household names such as Exxon and Intel were at the top of the list – more recently, Apple and financial institutions like Bank of America, Wells Fargo, JP Morgan, and Citigroup dominated the market.

As with the economy at large, can implications be equally severe for the companies themselves in the long run? To answer this question, FCLTGlobal explored share buyback behavior with regard to public companies with negative book equity.

The research made it evident that very few corporations have negative book equity to begin with. Prior to 2015, less than 1% of all companies in the MSCI ACWI had negative book equity. As of 2019, only 34 out of 3050 companies in the MSCI ACWI executed a buyback while having negative book equity. Looking at companies who have repeatedly done this for more than three years, the number drops to 23.

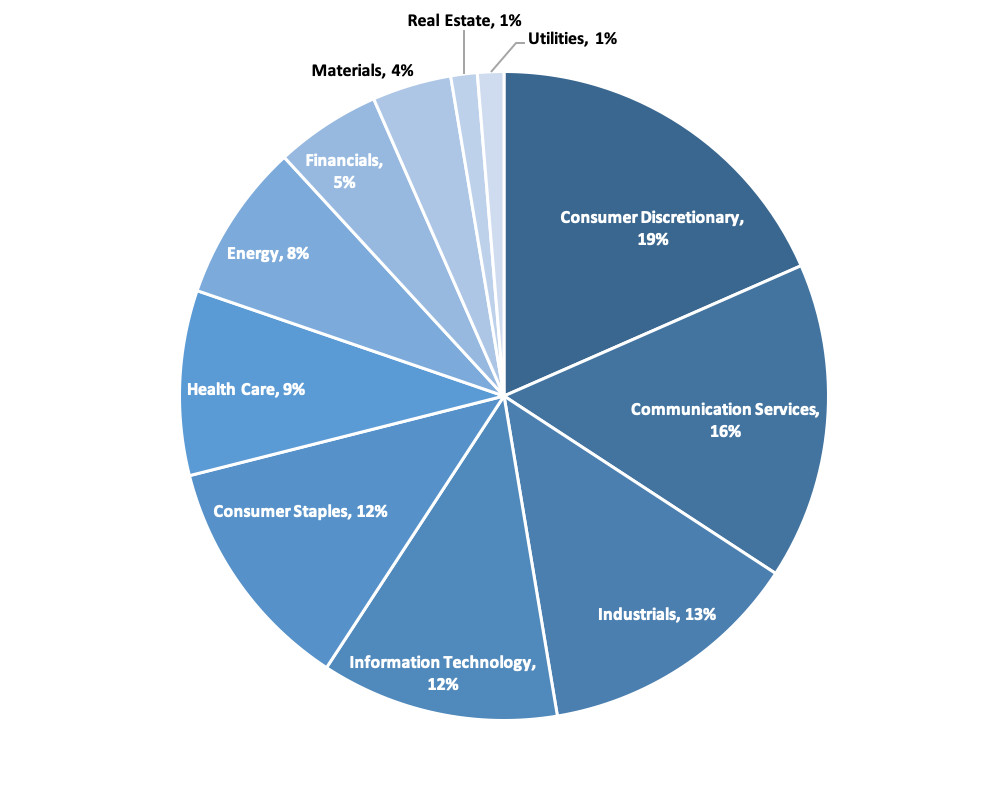

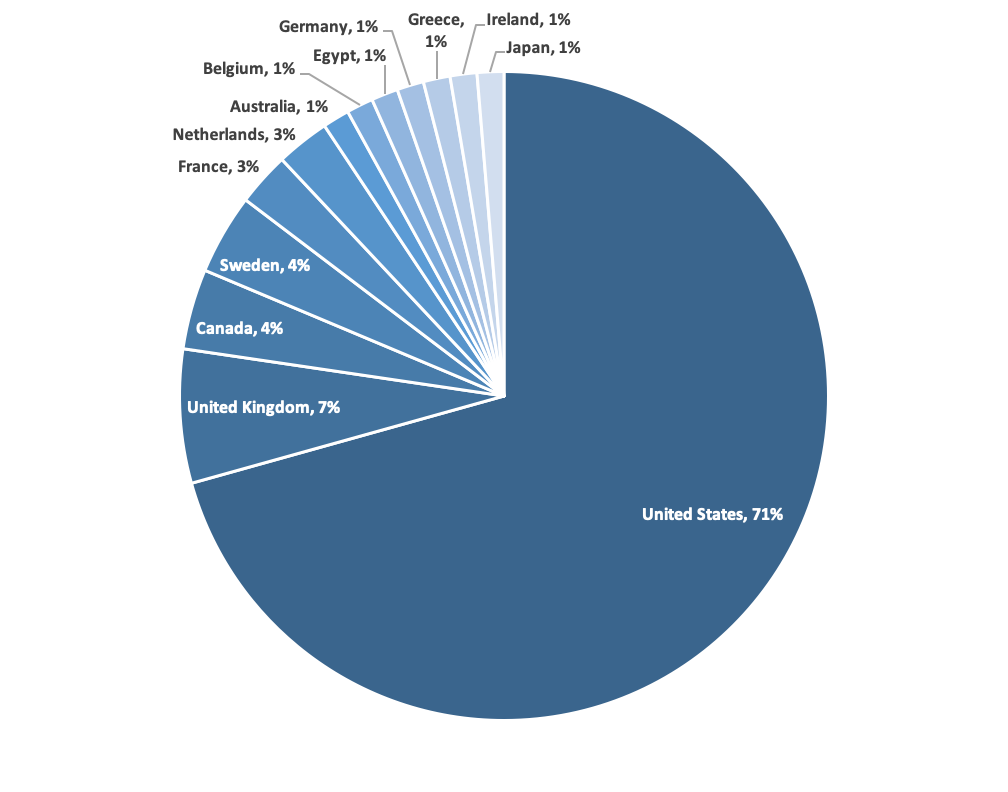

Among companies that satisfied both criteria, several trends emerged. First, there are specific industry sectors that have a tendency for buybacks and negative book equity, namely the communication services, consumer discretionary, IT, industrial sectors. Second, more than 70 percent of the companies that executed a buyback while having negative equity are based in the United States.

Percentage of buybacks by companies with negative equity, by sector (2009-2018)

Percentage of buybacks by companies with negative equity, by country (2009-2018)

Is negative equity a death blow for companies? Unlikely. Though it may be too soon to state definitively, early results indicate that executing a buyback while having negative book equity does not pose a substantial threat to companies’ standing. A significant amount of companies, including notables such as Home Depot or McDonald’s, have found success employing this method. This does not, however, discredit the amount of risk companies with negative equity face. Data and evidence show that a greater proportion of these companies are subject to acquisitions, downgrades, and bankruptcies and are left with weak financials, with American Airlines, DirecTV, and Rolls-Royce being prime examples.

While this behavior’s prevalence has risen in the past 10 years, there are still too few examples of sustained use to determine with certainty what implications they have for companies’ long-term prospects. Early results show that companies repurchasing stock with negative equity do not underperform their peers, but it remains to be seen how these companies perform over the long run. Our previous research has shown that while companies with weak financials perform at similar levels to their peers in a bull market, long-term companies with strong financials rebound much faster after a recession. Whatever the case, FCLTGlobal will be sure to closely monitor the long-term results of this trend.

As always, if you have insights, information, or further data relevant to this study, please contact FCLTGlobal’s research staff by emailing [email protected].